Alternative funding platforms, such as crowdfunding and peer-to-peer lending, provide entrepreneurs with access to capital without relinquishing equity or control, contrasting with venture capital's equity-driven investments and stringent terms. These platforms often offer faster funding cycles and broader investor engagement, appealing to startups seeking flexibility and community validation. Explore the advantages and challenges of alternative funding versus venture capital to find the best fit for your entrepreneurial venture.

Why it is important

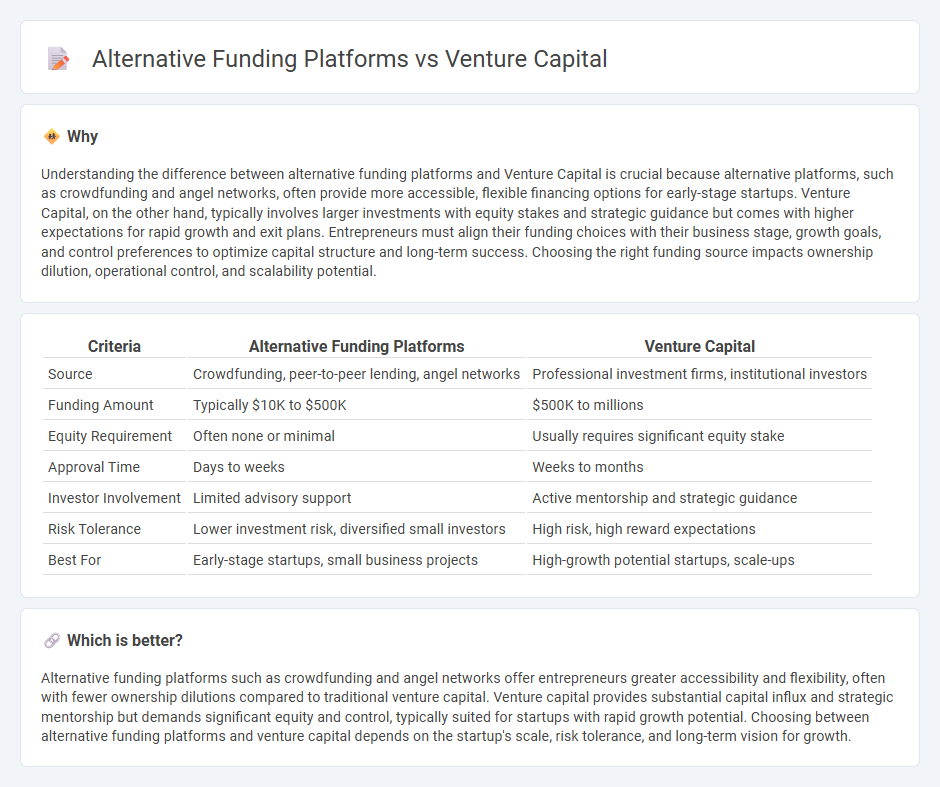

Understanding the difference between alternative funding platforms and Venture Capital is crucial because alternative platforms, such as crowdfunding and angel networks, often provide more accessible, flexible financing options for early-stage startups. Venture Capital, on the other hand, typically involves larger investments with equity stakes and strategic guidance but comes with higher expectations for rapid growth and exit plans. Entrepreneurs must align their funding choices with their business stage, growth goals, and control preferences to optimize capital structure and long-term success. Choosing the right funding source impacts ownership dilution, operational control, and scalability potential.

Comparison Table

| Criteria | Alternative Funding Platforms | Venture Capital |

|---|---|---|

| Source | Crowdfunding, peer-to-peer lending, angel networks | Professional investment firms, institutional investors |

| Funding Amount | Typically $10K to $500K | $500K to millions |

| Equity Requirement | Often none or minimal | Usually requires significant equity stake |

| Approval Time | Days to weeks | Weeks to months |

| Investor Involvement | Limited advisory support | Active mentorship and strategic guidance |

| Risk Tolerance | Lower investment risk, diversified small investors | High risk, high reward expectations |

| Best For | Early-stage startups, small business projects | High-growth potential startups, scale-ups |

Which is better?

Alternative funding platforms such as crowdfunding and angel networks offer entrepreneurs greater accessibility and flexibility, often with fewer ownership dilutions compared to traditional venture capital. Venture capital provides substantial capital influx and strategic mentorship but demands significant equity and control, typically suited for startups with rapid growth potential. Choosing between alternative funding platforms and venture capital depends on the startup's scale, risk tolerance, and long-term vision for growth.

Connection

Alternative funding platforms and venture capital create a dynamic ecosystem where both entities complement each other in nurturing startups and innovative ventures. Crowdfunding sites and angel networks often serve as preliminary testing grounds for concepts, providing critical validation and early-stage capital that enhance a startup's appeal to venture capitalists. This interconnection accelerates business growth by bridging initial resource gaps and scaling opportunities, driving economic development and innovation across industries.

Key Terms

Equity Investment

Venture capital involves professional investors providing significant equity funding to startups with high growth potential in exchange for ownership stakes, often leading to strategic guidance and extensive networking opportunities. Alternative funding platforms, such as crowdfunding or angel networks, offer diverse equity investment options that may involve smaller contributions from multiple investors, providing startups with more flexible and accessible capital sources. Explore the advantages and differences of these equity investment methods to determine the best funding strategy for your business growth.

Crowdfunding

Venture capital offers substantial financial backing and strategic support from experienced investors, typically seeking high-growth startups with scalable business models. Crowdfunding platforms provide an alternative funding approach by allowing entrepreneurs to raise smaller amounts of capital from a large number of individual backers, facilitating community engagement and market validation. Explore how crowdfunding compares with venture capital to find the best funding strategy for your venture.

Angel Investors

Angel investors provide early-stage startups with essential capital, often bridging the gap before venture capital funding becomes available. Unlike venture capital firms, angels typically invest their own money and offer personalized mentorship, accelerating startup growth through hands-on support. Discover how angel investors can uniquely propel your business by exploring their distinct advantages in startup financing.

Source and External Links

What is Venture Capital? - Venture capital is funding that supports innovative startups and high-growth companies by investing equity in exchange for strategic partnership and long-term growth, often taking years to mature and involving experienced guidance from investors.

What is Venture Capital? | J.P. Morgan - Venture capital finances startups with novel technologies and innovations, providing not only capital but also industry advice, networking, and commercialization support, with funding mainly coming from institutional investors expecting high returns despite risks.

What is venture capital? - Venture capital is private equity for early-stage companies involving minority equity stakes with high risk and long-term horizons, where a few successful investments yield outsized returns that compensate for losses elsewhere and help drive innovation and job growth.

dowidth.com

dowidth.com