Bootstrappers focus on building businesses using personal resources and sustainable growth strategies, emphasizing independence and long-term value creation. Startup accelerators provide structured programs with mentorship, funding, and networking opportunities designed to rapidly scale early-stage companies. Explore how each path offers unique advantages and challenges for aspiring entrepreneurs seeking growth and investment.

Why it is important

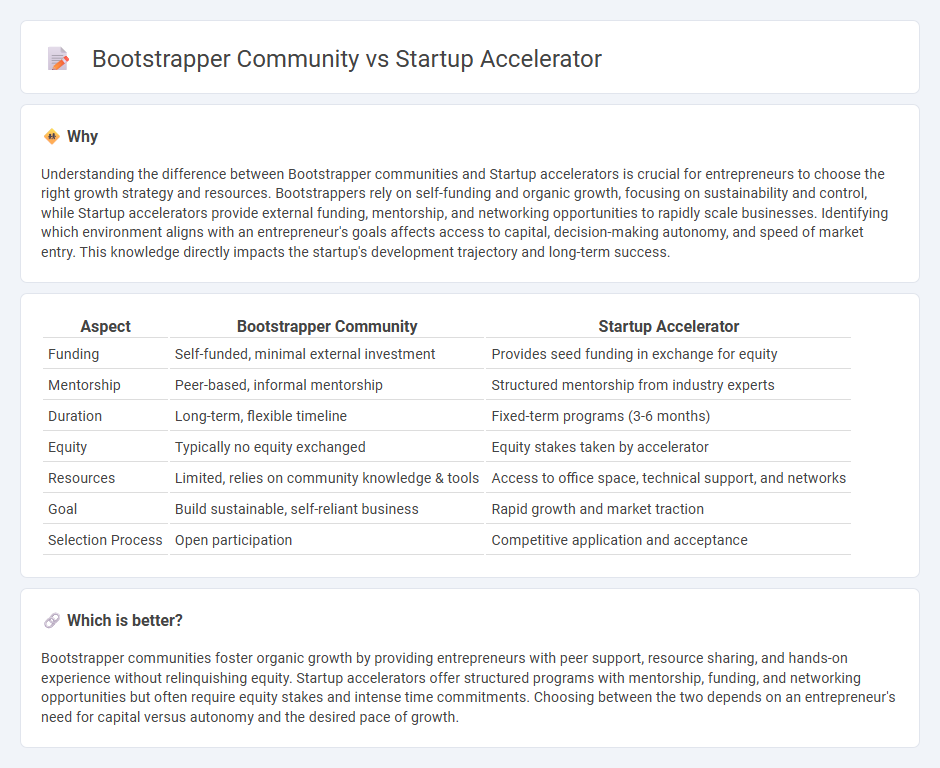

Understanding the difference between Bootstrapper communities and Startup accelerators is crucial for entrepreneurs to choose the right growth strategy and resources. Bootstrappers rely on self-funding and organic growth, focusing on sustainability and control, while Startup accelerators provide external funding, mentorship, and networking opportunities to rapidly scale businesses. Identifying which environment aligns with an entrepreneur's goals affects access to capital, decision-making autonomy, and speed of market entry. This knowledge directly impacts the startup's development trajectory and long-term success.

Comparison Table

| Aspect | Bootstrapper Community | Startup Accelerator |

|---|---|---|

| Funding | Self-funded, minimal external investment | Provides seed funding in exchange for equity |

| Mentorship | Peer-based, informal mentorship | Structured mentorship from industry experts |

| Duration | Long-term, flexible timeline | Fixed-term programs (3-6 months) |

| Equity | Typically no equity exchanged | Equity stakes taken by accelerator |

| Resources | Limited, relies on community knowledge & tools | Access to office space, technical support, and networks |

| Goal | Build sustainable, self-reliant business | Rapid growth and market traction |

| Selection Process | Open participation | Competitive application and acceptance |

Which is better?

Bootstrapper communities foster organic growth by providing entrepreneurs with peer support, resource sharing, and hands-on experience without relinquishing equity. Startup accelerators offer structured programs with mentorship, funding, and networking opportunities but often require equity stakes and intense time commitments. Choosing between the two depends on an entrepreneur's need for capital versus autonomy and the desired pace of growth.

Connection

The bootstrapper community and startup accelerators both focus on nurturing early-stage entrepreneurs by providing essential resources, mentorship, and networking opportunities that accelerate business growth. Bootstrappers rely on self-funding and lean operations to validate their ideas, while startup accelerators offer structured programs, access to investors, and strategic guidance to scale quickly. Together, they create a complementary ecosystem that supports innovation, resource efficiency, and market readiness in the entrepreneurial journey.

Key Terms

Seed Funding

Startup accelerators provide structured programs supporting early-stage companies with mentorship, networking opportunities, and access to seed funding often ranging from $50,000 to $150,000 in exchange for equity. Bootstrapper communities emphasize self-funding strategies, resource sharing, and organic growth without external investment, promoting financial independence and equity retention. Discover detailed comparisons and strategies to determine the best path for your startup's seed funding needs.

Equity

Startup accelerators typically require equity stakes ranging from 5% to 10% in exchange for seed funding, mentorship, and access to networks, which can significantly impact founders' ownership percentages. Bootstrapper communities emphasize self-funding and resource sharing without relinquishing equity, enabling founders to maintain full control but often limiting access to external capital. Explore the detailed equity implications and strategic benefits of each model to determine the best pathway for your startup's growth.

Self-funding

Self-funding empowers bootstrappers to maintain full ownership and control of their ventures, leveraging personal savings and revenue reinvestment for sustainable growth without external equity dilution. Startup accelerators often provide seed funding, mentorship, and networking opportunities but require equity stakes, potentially impacting founder autonomy and long-term financial outcomes. Explore the strengths and trade-offs of each funding approach to determine the best path for your startup's success.

Source and External Links

32 Best Startup Accelerators 2025 - Startup accelerators are fixed-term programs aimed at rapidly growing startups, with top examples like Y Combinator and Microsoft Accelerator offering funding, mentorship, and resources tailored to their sectors and stages.

Best Startup Accelerators & Programs in 2025 - StartupBlink - Accelerators are cohort-based programs providing early-stage startups with mentorship, networking, and funding in exchange for equity, designed to help them navigate ecosystems and scale efficiently.

Startup accelerator - Wikipedia - Startup accelerators offer competitive, cohort-based programs typically lasting 3 months, providing seed investment, intensive mentorship, and culminating in demo days, with funding often exchanged for equity.

dowidth.com

dowidth.com