Exit as a Service (EaaS) offers entrepreneurs a flexible and strategic alternative to traditional acquisitions by providing tailored pathways for business exits without the immediate pressure of full company buyouts. This innovative approach leverages expert advisory, financial engineering, and market positioning to maximize valuation and optimize timing for founders. Explore how EaaS can transform your entrepreneurial exit strategy and unlock new growth opportunities.

Why it is important

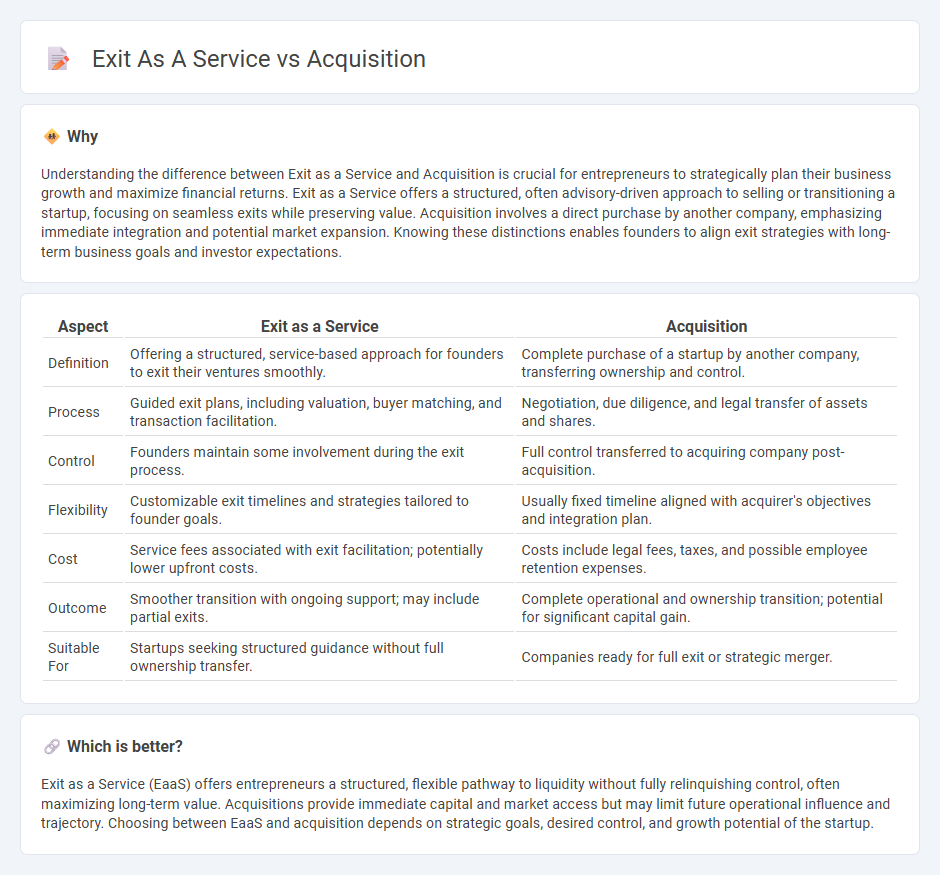

Understanding the difference between Exit as a Service and Acquisition is crucial for entrepreneurs to strategically plan their business growth and maximize financial returns. Exit as a Service offers a structured, often advisory-driven approach to selling or transitioning a startup, focusing on seamless exits while preserving value. Acquisition involves a direct purchase by another company, emphasizing immediate integration and potential market expansion. Knowing these distinctions enables founders to align exit strategies with long-term business goals and investor expectations.

Comparison Table

| Aspect | Exit as a Service | Acquisition |

|---|---|---|

| Definition | Offering a structured, service-based approach for founders to exit their ventures smoothly. | Complete purchase of a startup by another company, transferring ownership and control. |

| Process | Guided exit plans, including valuation, buyer matching, and transaction facilitation. | Negotiation, due diligence, and legal transfer of assets and shares. |

| Control | Founders maintain some involvement during the exit process. | Full control transferred to acquiring company post-acquisition. |

| Flexibility | Customizable exit timelines and strategies tailored to founder goals. | Usually fixed timeline aligned with acquirer's objectives and integration plan. |

| Cost | Service fees associated with exit facilitation; potentially lower upfront costs. | Costs include legal fees, taxes, and possible employee retention expenses. |

| Outcome | Smoother transition with ongoing support; may include partial exits. | Complete operational and ownership transition; potential for significant capital gain. |

| Suitable For | Startups seeking structured guidance without full ownership transfer. | Companies ready for full exit or strategic merger. |

Which is better?

Exit as a Service (EaaS) offers entrepreneurs a structured, flexible pathway to liquidity without fully relinquishing control, often maximizing long-term value. Acquisitions provide immediate capital and market access but may limit future operational influence and trajectory. Choosing between EaaS and acquisition depends on strategic goals, desired control, and growth potential of the startup.

Connection

Exit as a Service (EaaS) and acquisitions are closely connected through the streamlined process EaaS provides for startups aiming to sell their business. EaaS platforms facilitate strategic preparation, valuation, and negotiation, making acquisitions more efficient and transparent. This service enhances the likelihood of successful exits by aligning startup goals with buyer expectations in acquisition transactions.

Key Terms

Mergers and Acquisitions (M&A)

Acquisition as a service streamlines the buying process, leveraging strategic valuation, due diligence, and integration planning to optimize mergers and acquisitions (M&A) outcomes. Exit as a service prioritizes maximizing shareholder value through tailored exit strategies, including IPO readiness, buyouts, or asset sales, ensuring a profitable and seamless transition. Explore our in-depth analysis to understand how these approaches can transform your M&A strategy.

Earn-Out Agreements

Earn-Out Agreements play a critical role in both acquisition and exit as a service strategies, serving as a performance-based mechanism that aligns buyer and seller interests by tying future payments to specific financial milestones. In acquisitions, Earn-Outs mitigate risks by ensuring the acquired company's value meets expectations post-transaction, while in exit as a service frameworks, they offer flexibility for entrepreneurs to maximize returns over time. Discover how mastering Earn-Out Agreements can optimize deal outcomes and secure long-term value through expert negotiation and structuring.

Strategic Buyout

Strategic buyout as a service involves acquiring companies to integrate and enhance core business capabilities, driving long-term growth and competitive advantage. Unlike exit as a service, which focuses on facilitating ownership transfer for financial returns, strategic buyouts prioritize synergy creation and market expansion. Discover how strategic buyouts reshape acquisition strategies for sustained business success.

Source and External Links

Acquisition - Definition, Pros, Cons, vs Merger - An acquisition is a corporate transaction where one company purchases a portion or all of another company's shares or assets, allowing the acquiring company to control the acquired entity while both survive as separate legal entities.

What Is an Acquisition? Definition, Types, and Examples - Forage - A business acquisition occurs when one company buys most or all shares in another to control its assets and operations, with common types including horizontal acquisitions where companies with similar products or services consolidate.

Merge and acquire businesses | U.S. Small Business Administration - Unlike mergers, acquisitions do not create a new company but fully absorb the purchased company, which may lead to liquidation, and require a valuation and sales agreement process.

dowidth.com

dowidth.com