Pitch deck design focuses on visually engaging presentations that highlight key business opportunities, team strengths, and market potential to quickly capture investor interest. Investment memorandums provide a comprehensive and detailed analysis, including financial projections, risk assessments, and legal considerations to support informed investment decisions. Explore how tailoring each document to its purpose can significantly boost funding success rates.

Why it is important

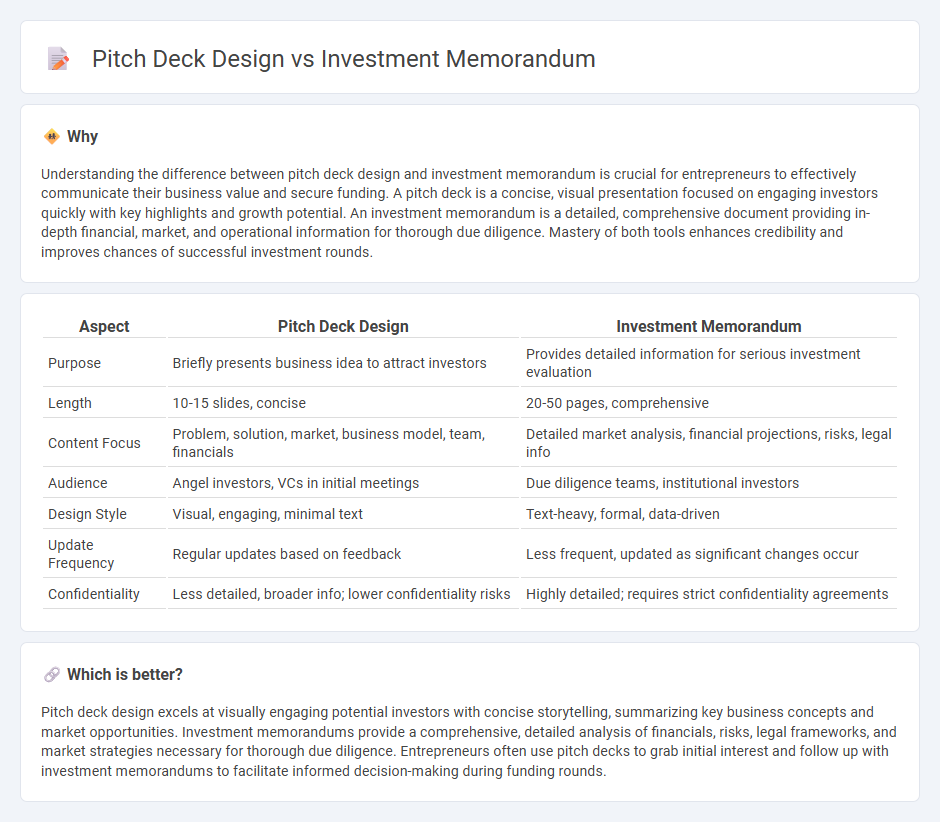

Understanding the difference between pitch deck design and investment memorandum is crucial for entrepreneurs to effectively communicate their business value and secure funding. A pitch deck is a concise, visual presentation focused on engaging investors quickly with key highlights and growth potential. An investment memorandum is a detailed, comprehensive document providing in-depth financial, market, and operational information for thorough due diligence. Mastery of both tools enhances credibility and improves chances of successful investment rounds.

Comparison Table

| Aspect | Pitch Deck Design | Investment Memorandum |

|---|---|---|

| Purpose | Briefly presents business idea to attract investors | Provides detailed information for serious investment evaluation |

| Length | 10-15 slides, concise | 20-50 pages, comprehensive |

| Content Focus | Problem, solution, market, business model, team, financials | Detailed market analysis, financial projections, risks, legal info |

| Audience | Angel investors, VCs in initial meetings | Due diligence teams, institutional investors |

| Design Style | Visual, engaging, minimal text | Text-heavy, formal, data-driven |

| Update Frequency | Regular updates based on feedback | Less frequent, updated as significant changes occur |

| Confidentiality | Less detailed, broader info; lower confidentiality risks | Highly detailed; requires strict confidentiality agreements |

Which is better?

Pitch deck design excels at visually engaging potential investors with concise storytelling, summarizing key business concepts and market opportunities. Investment memorandums provide a comprehensive, detailed analysis of financials, risks, legal frameworks, and market strategies necessary for thorough due diligence. Entrepreneurs often use pitch decks to grab initial interest and follow up with investment memorandums to facilitate informed decision-making during funding rounds.

Connection

Pitch deck design and investment memorandum are both critical tools in the fundraising process for entrepreneurs, serving to communicate the business vision and financial potential to investors. A well-crafted pitch deck provides a concise, visually engaging overview, while the investment memorandum delivers detailed information, including market analysis, financial projections, and risk assessments. Together, they complement each other by balancing brevity with depth, enhancing the clarity and persuasiveness of the investment proposition.

Key Terms

**Investment Memorandum:**

An Investment Memorandum offers a comprehensive and detailed overview of a company's business model, financial projections, market analysis, and risk factors tailored for potential investors seeking in-depth information. It emphasizes legal disclosures, extensive data, and strategic planning to facilitate well-informed investment decisions. Explore how crafting a precise Investment Memorandum can significantly enhance your fund-raising success.

Detailed Financial Projections

Investment memorandums present detailed financial projections with in-depth analysis, including multi-year income statements, balance sheets, and cash flow forecasts, critical for thorough due diligence. Pitch decks use simplified, visually engaging financial slides to highlight key metrics like revenue growth, EBITDA, and funding needs, aiming to capture investor interest quickly. Explore how mastering these formats can enhance your fundraising strategy and secure investor confidence.

Risk Analysis

Investment memorandums provide a comprehensive risk analysis including market, financial, and operational risks with detailed data and mitigation strategies to build investor confidence. Pitch deck designs highlight key risk factors concisely, using visuals and simplified language to capture attention during brief presentations. Explore effective techniques to balance depth and clarity in risk communication for successful fundraising.

Source and External Links

What Is an Investor Memorandum? (Plus What's Included) - Indeed - An investor memorandum, or offering memorandum, is a detailed document prepared by an investment banker to attract investors by explaining a business's financial health, market niche, risks, and capital needs during private offerings.

Investment Memo: How to write your investment memo - Carta - An investment memo comprehensively evaluates an investment opportunity, including an executive summary, market opportunity, business overview, financials, competition, risks, valuation, and exit strategies, to help investors make informed decisions.

Investment Memorandum: What You Need to Know - An investment memorandum provides essential disclosure to prospective investors about an investment opportunity, ensuring legal compliance, investor protection, detailed business information, and serving as both a marketing and legal protection tool.

dowidth.com

dowidth.com