Exit planning focuses on maximizing the value and smooth transition of a business for owners looking to sell or retire, emphasizing timelines, valuation, and succession. Growth strategy involves expanding market share, increasing revenue, and scaling operations to enhance long-term business viability and competitive advantage. Explore detailed insights on balancing exit planning and growth strategy to optimize entrepreneurial success.

Why it is important

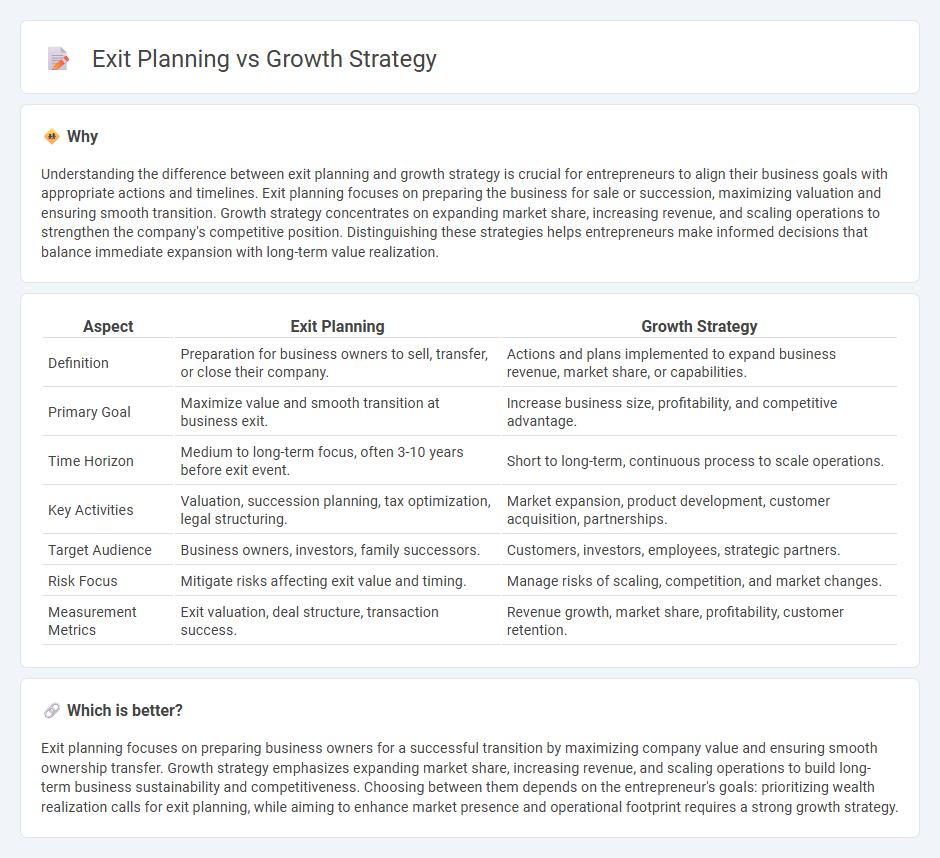

Understanding the difference between exit planning and growth strategy is crucial for entrepreneurs to align their business goals with appropriate actions and timelines. Exit planning focuses on preparing the business for sale or succession, maximizing valuation and ensuring smooth transition. Growth strategy concentrates on expanding market share, increasing revenue, and scaling operations to strengthen the company's competitive position. Distinguishing these strategies helps entrepreneurs make informed decisions that balance immediate expansion with long-term value realization.

Comparison Table

| Aspect | Exit Planning | Growth Strategy |

|---|---|---|

| Definition | Preparation for business owners to sell, transfer, or close their company. | Actions and plans implemented to expand business revenue, market share, or capabilities. |

| Primary Goal | Maximize value and smooth transition at business exit. | Increase business size, profitability, and competitive advantage. |

| Time Horizon | Medium to long-term focus, often 3-10 years before exit event. | Short to long-term, continuous process to scale operations. |

| Key Activities | Valuation, succession planning, tax optimization, legal structuring. | Market expansion, product development, customer acquisition, partnerships. |

| Target Audience | Business owners, investors, family successors. | Customers, investors, employees, strategic partners. |

| Risk Focus | Mitigate risks affecting exit value and timing. | Manage risks of scaling, competition, and market changes. |

| Measurement Metrics | Exit valuation, deal structure, transaction success. | Revenue growth, market share, profitability, customer retention. |

Which is better?

Exit planning focuses on preparing business owners for a successful transition by maximizing company value and ensuring smooth ownership transfer. Growth strategy emphasizes expanding market share, increasing revenue, and scaling operations to build long-term business sustainability and competitiveness. Choosing between them depends on the entrepreneur's goals: prioritizing wealth realization calls for exit planning, while aiming to enhance market presence and operational footprint requires a strong growth strategy.

Connection

Exit planning and growth strategy are intrinsically connected as effective growth strategies enhance business valuation and operational scalability, which directly influence successful exit opportunities. A well-structured growth approach prepares the company for attractive acquisitions, mergers, or public offerings by maximizing revenue streams and market positioning. Strategic alignment between growth initiatives and exit objectives ensures that the business evolves with clear milestones, facilitating smoother transitions and optimized financial returns for entrepreneurs.

Key Terms

Scalability

Growth strategy centers on scaling operations, increasing market reach, and optimizing resources to enhance long-term business value. Exit planning prioritizes scalability to ensure the company is attractive to potential buyers or investors, highlighting sustainable revenue growth and operational efficiency. Discover more about how scalability impacts both growth strategies and exit planning to maximize business success.

Valuation

Growth strategy enhances company valuation by increasing revenue, market share, and operational efficiency, attracting investors and buyers. Exit planning focuses on maximizing valuation through careful timing, legal structuring, and financial optimization to secure the best deal. Explore detailed tactics to boost your company's valuation effectively during growth and exit phases.

Acquisition

Growth strategy emphasizes scaling business operations, increasing market share, and expanding revenue streams through strategic acquisitions. Exit planning focuses on preparing the business for a successful sale or merger, maximizing valuation, and ensuring smooth ownership transition. Explore effective acquisition approaches to balance growth ambitions with exit readiness.

Source and External Links

Company Growth Strategy: 7 Key Steps for Business Growth - A growth strategy is a focused plan to expand a business by increasing revenue, customer base, products, or locations, often tailored to the company's industry and target market.

What Is a Growth Strategy? (With Tips and Examples) | Indeed.com - Growth strategies include market expansion, segmentation, and penetration to increase sales, profits, and customer reach through targeted actions like entering new markets or adjusting pricing.

Business Growth Strategies For The Modern Marketplace - Quantive - Key avenues for business growth include expanding product lines, exploring new markets, adopting new technologies, and forming strategic partnerships to boost market share and revenue.

dowidth.com

dowidth.com