Entrepreneurship in embedded finance integrates financial services directly into non-financial platforms, streamlining user experience and driving innovation through seamless payments, lending, and insurance solutions. Financial APIs act as the technological backbone, enabling businesses to securely connect with banks, payment gateways, and financial data providers to customize their offerings. Explore how leveraging embedded finance and APIs can transform your entrepreneurial ventures with enhanced financial accessibility and operational efficiency.

Why it is important

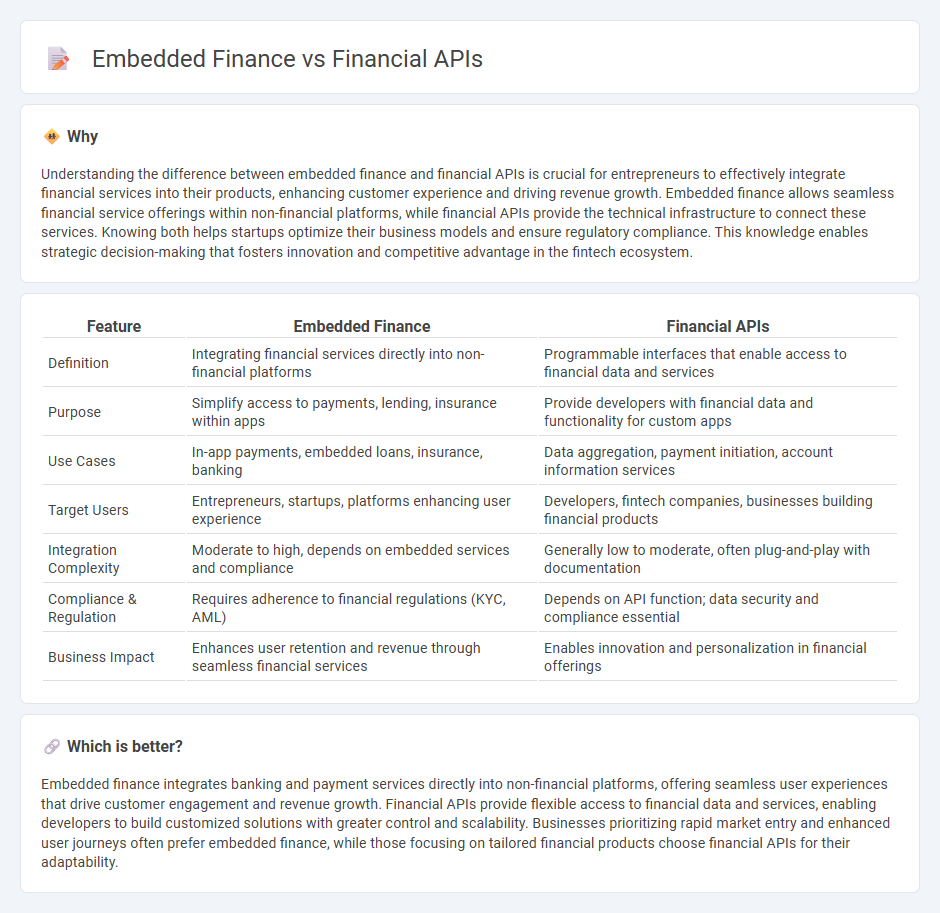

Understanding the difference between embedded finance and financial APIs is crucial for entrepreneurs to effectively integrate financial services into their products, enhancing customer experience and driving revenue growth. Embedded finance allows seamless financial service offerings within non-financial platforms, while financial APIs provide the technical infrastructure to connect these services. Knowing both helps startups optimize their business models and ensure regulatory compliance. This knowledge enables strategic decision-making that fosters innovation and competitive advantage in the fintech ecosystem.

Comparison Table

| Feature | Embedded Finance | Financial APIs |

|---|---|---|

| Definition | Integrating financial services directly into non-financial platforms | Programmable interfaces that enable access to financial data and services |

| Purpose | Simplify access to payments, lending, insurance within apps | Provide developers with financial data and functionality for custom apps |

| Use Cases | In-app payments, embedded loans, insurance, banking | Data aggregation, payment initiation, account information services |

| Target Users | Entrepreneurs, startups, platforms enhancing user experience | Developers, fintech companies, businesses building financial products |

| Integration Complexity | Moderate to high, depends on embedded services and compliance | Generally low to moderate, often plug-and-play with documentation |

| Compliance & Regulation | Requires adherence to financial regulations (KYC, AML) | Depends on API function; data security and compliance essential |

| Business Impact | Enhances user retention and revenue through seamless financial services | Enables innovation and personalization in financial offerings |

Which is better?

Embedded finance integrates banking and payment services directly into non-financial platforms, offering seamless user experiences that drive customer engagement and revenue growth. Financial APIs provide flexible access to financial data and services, enabling developers to build customized solutions with greater control and scalability. Businesses prioritizing rapid market entry and enhanced user journeys often prefer embedded finance, while those focusing on tailored financial products choose financial APIs for their adaptability.

Connection

Embedded finance integrates financial services directly into non-financial platforms through financial APIs, enabling seamless transactions within entrepreneurial ecosystems. These APIs facilitate real-time data exchange, payment processing, and credit underwriting, streamlining operations for startups and small businesses. Entrepreneurs leverage embedded finance to enhance customer experiences, reduce friction in financial activities, and accelerate business growth.

Key Terms

Payment Gateway

Payment gateways serve as crucial financial APIs enabling businesses to process transactions securely across various platforms. Embedded finance integrates these APIs seamlessly within non-financial apps, enhancing user experience by streamlining payments and financial services. Explore how these innovations transform payment solutions for deeper insights.

Banking-as-a-Service (BaaS)

Financial APIs empower developers to seamlessly integrate banking functionalities such as payments, account management, and identity verification into their applications. Embedded finance leverages Banking-as-a-Service (BaaS) platforms to embed full banking services within non-financial products, enhancing customer experience and streamlining financial operations. Explore how BaaS transforms traditional banking frameworks and drives innovation in embedded finance solutions.

Revenue Streams

Financial APIs enable businesses to integrate third-party financial services, generating revenue through transaction fees, subscription models, and data monetization. Embedded finance seamlessly incorporates financial products like payments, lending, or insurance into non-financial platforms, driving revenue by enhancing user engagement and increasing cross-selling opportunities. Explore detailed insights on how financial APIs and embedded finance shape distinct but complementary revenue streams.

Source and External Links

What are financial APIs? Here's what to know - Stripe - Financial APIs enable communication between different financial platforms by standardizing data exchange, powering services like banking apps and instant stock trading, and promoting innovation and improved fintech user experiences.

Top 5 Free Financial Data APIs for Building a Powerful Stock Portfolio Tracker - Key free financial APIs include Alpha Vantage, Yahoo Finance API, Finnhub, IEX Cloud, and Twelve Data, offering real-time, historical market data, stock prices, forex, and cryptocurrency information for developers building portfolio trackers and fintech apps.

What is a financial API integration and how does it work? - Plaid - Financial APIs integrate core banking systems with third-party apps to enable access to user-permissioned transaction data, account aggregation, automatic savings, investment tools, and streamlined loan application processes by connecting multiple financial accounts.

dowidth.com

dowidth.com