Sweat equity marketplaces enable entrepreneurs to exchange their labor and skills for ownership stakes, creating value without upfront capital investment. Royalty-based financing allows startups to raise funds by agreeing to share a percentage of future revenues with investors, aligning repayment with business performance. Explore the benefits and risks of these innovative financing options to determine the best fit for your venture.

Why it is important

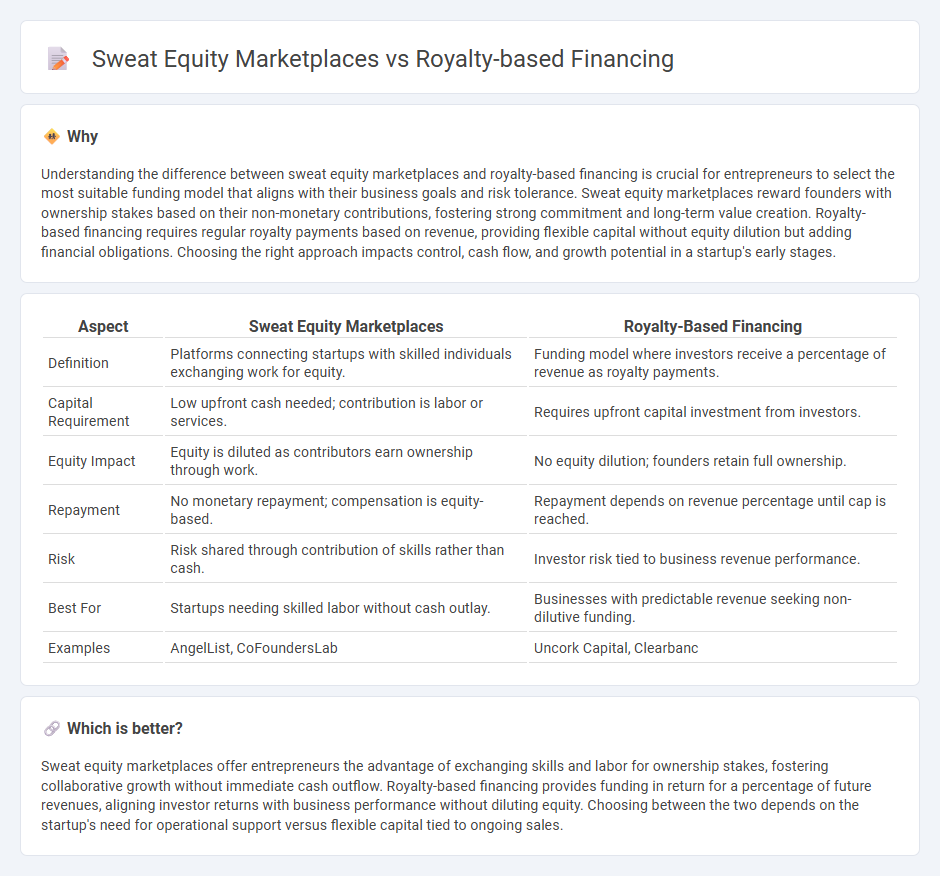

Understanding the difference between sweat equity marketplaces and royalty-based financing is crucial for entrepreneurs to select the most suitable funding model that aligns with their business goals and risk tolerance. Sweat equity marketplaces reward founders with ownership stakes based on their non-monetary contributions, fostering strong commitment and long-term value creation. Royalty-based financing requires regular royalty payments based on revenue, providing flexible capital without equity dilution but adding financial obligations. Choosing the right approach impacts control, cash flow, and growth potential in a startup's early stages.

Comparison Table

| Aspect | Sweat Equity Marketplaces | Royalty-Based Financing |

|---|---|---|

| Definition | Platforms connecting startups with skilled individuals exchanging work for equity. | Funding model where investors receive a percentage of revenue as royalty payments. |

| Capital Requirement | Low upfront cash needed; contribution is labor or services. | Requires upfront capital investment from investors. |

| Equity Impact | Equity is diluted as contributors earn ownership through work. | No equity dilution; founders retain full ownership. |

| Repayment | No monetary repayment; compensation is equity-based. | Repayment depends on revenue percentage until cap is reached. |

| Risk | Risk shared through contribution of skills rather than cash. | Investor risk tied to business revenue performance. |

| Best For | Startups needing skilled labor without cash outlay. | Businesses with predictable revenue seeking non-dilutive funding. |

| Examples | AngelList, CoFoundersLab | Uncork Capital, Clearbanc |

Which is better?

Sweat equity marketplaces offer entrepreneurs the advantage of exchanging skills and labor for ownership stakes, fostering collaborative growth without immediate cash outflow. Royalty-based financing provides funding in return for a percentage of future revenues, aligning investor returns with business performance without diluting equity. Choosing between the two depends on the startup's need for operational support versus flexible capital tied to ongoing sales.

Connection

Sweat equity marketplaces enable entrepreneurs to exchange labor and expertise for ownership stakes, facilitating startup growth without upfront capital. Royalty-based financing links directly by allowing investors to receive a percentage of future revenues instead of equity, aligning returns with company performance. Both models emphasize alternative funding mechanisms that reduce reliance on traditional venture capital while fostering innovation and shared risk.

Key Terms

Revenue Sharing

Royalty-based financing allows investors to receive a percentage of a company's ongoing gross revenues until a predetermined return is met, providing flexible capital without equity dilution. Sweat equity marketplaces enable founders and contributors to exchange services and expertise for ownership stakes, aligning incentives but often complicating revenue sharing arrangements. Explore the intricate differences and benefits of revenue sharing models in these financing methods to determine the best fit for your business growth strategy.

Equity Ownership

Royalty-based financing allows investors to receive a percentage of revenue without diluting equity, preserving founders' ownership stakes. Sweat equity marketplaces facilitate contributions through labor or expertise in exchange for equity shares, directly impacting ownership distribution. Explore the nuances of equity ownership in these models to determine the optimal funding strategy for your business.

Performance-Based Compensation

Performance-based compensation in royalty-based financing involves investors earning a percentage of revenue until a fixed return is achieved, aligning incentives with business success and risk reduction. Sweat equity marketplaces reward individuals with ownership stakes based on their contribution of time and expertise, fostering long-term commitment and value creation without immediate cash outlay. Explore how these models optimize growth and investor alignment by diving deeper into their operational frameworks.

Source and External Links

Revenue-Based Financing - Overview, How It Works - Revenue-based financing is a capital-raising method where investors provide funds to a company in exchange for a set percentage of the company's ongoing gross revenues, without requiring equity stakes or collateral.

Revenue-based financing - Investors inject capital into a business in return for a fixed percentage of ongoing gross revenues, with payments adjusting based on business performance and typically lasting until a predetermined cap is reached, all without diluting ownership.

Understanding Royalty Loan Agreements in Business - Royalty financing is used by businesses that want growth capital without giving up equity, particularly in industries with scalable or predictable revenue streams like SaaS, biotech, media, and franchising.

dowidth.com

dowidth.com