Exit planning involves strategically preparing a business for transfer or sale to maximize value and ensure smooth ownership transition, while a liquidation strategy focuses on selling off assets to close the business and settle debts efficiently. Entrepreneurs leveraging exit planning often aim for sustained legacy and financial gain, whereas liquidation is typically a last resort to recover capital after operational viability ends. Explore detailed strategies to optimize business transition and asset management for lasting entrepreneurial success.

Why it is important

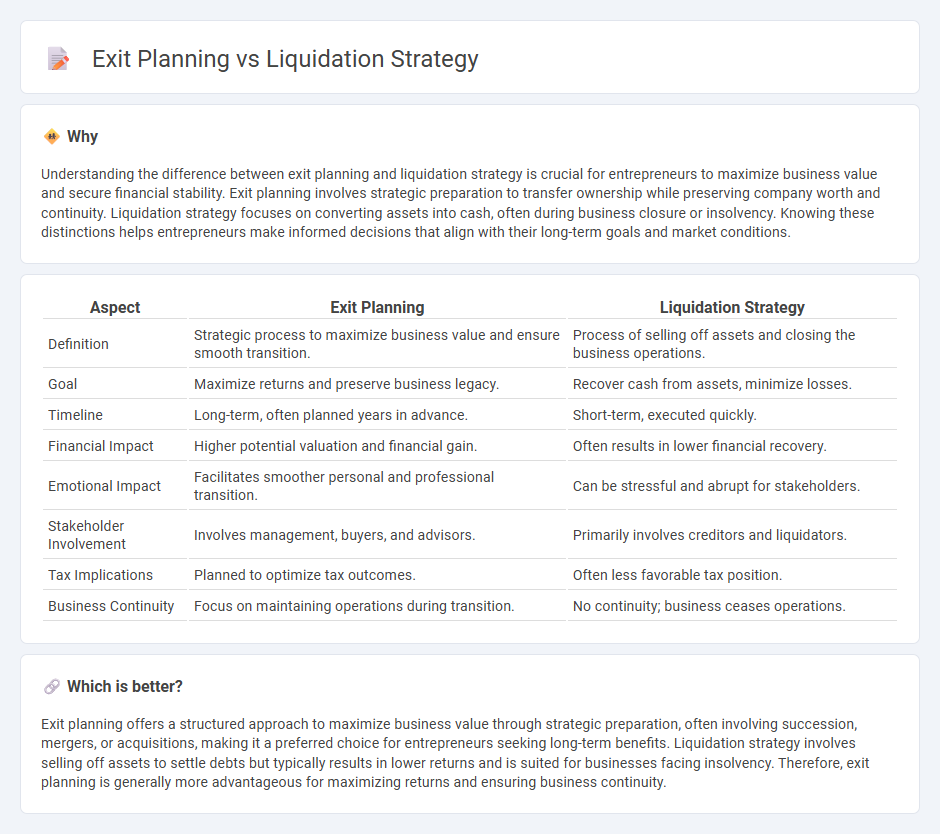

Understanding the difference between exit planning and liquidation strategy is crucial for entrepreneurs to maximize business value and secure financial stability. Exit planning involves strategic preparation to transfer ownership while preserving company worth and continuity. Liquidation strategy focuses on converting assets into cash, often during business closure or insolvency. Knowing these distinctions helps entrepreneurs make informed decisions that align with their long-term goals and market conditions.

Comparison Table

| Aspect | Exit Planning | Liquidation Strategy |

|---|---|---|

| Definition | Strategic process to maximize business value and ensure smooth transition. | Process of selling off assets and closing the business operations. |

| Goal | Maximize returns and preserve business legacy. | Recover cash from assets, minimize losses. |

| Timeline | Long-term, often planned years in advance. | Short-term, executed quickly. |

| Financial Impact | Higher potential valuation and financial gain. | Often results in lower financial recovery. |

| Emotional Impact | Facilitates smoother personal and professional transition. | Can be stressful and abrupt for stakeholders. |

| Stakeholder Involvement | Involves management, buyers, and advisors. | Primarily involves creditors and liquidators. |

| Tax Implications | Planned to optimize tax outcomes. | Often less favorable tax position. |

| Business Continuity | Focus on maintaining operations during transition. | No continuity; business ceases operations. |

Which is better?

Exit planning offers a structured approach to maximize business value through strategic preparation, often involving succession, mergers, or acquisitions, making it a preferred choice for entrepreneurs seeking long-term benefits. Liquidation strategy involves selling off assets to settle debts but typically results in lower returns and is suited for businesses facing insolvency. Therefore, exit planning is generally more advantageous for maximizing returns and ensuring business continuity.

Connection

Exit planning and liquidation strategy are critical components of entrepreneurship focused on maximizing business value during ownership transition or closure. Exit planning involves preparing a systematic approach to sell, merge, or transfer ownership, ensuring financial goals and legacy considerations are met. Liquidation strategy serves as a contingency within exit planning, providing a structured method to convert assets into cash when market conditions or business performance necessitate shutting down operations.

Key Terms

Asset Sale

Liquidation strategy involves selling off all assets of a business to pay creditors and distribute remaining funds to owners, often as a final step during business closure. Exit planning, focused on asset sale, strategically prepares a business to maximize value by timing the sale, identifying potential buyers, and ensuring smooth transfer of ownership. Explore detailed guidance on optimizing asset sales within exit planning to enhance financial outcomes.

Succession Planning

Liquidation strategy involves selling off assets to pay debts and close the business, often resulting in the end of ownership transfer, whereas exit planning centers on preparing a business owner's transition to new ownership through strategic succession planning. Succession planning emphasizes identifying and developing internal or external candidates to ensure business continuity, preserving enterprise value and stakeholder interests over time. Explore effective succession planning methods to safeguard your business legacy and ensure a smooth exit.

Acquisition

Liquidation strategy involves dissolving a business to sell off assets quickly, often resulting in lower returns, while exit planning targets structured acquisition for maximizing company value and stakeholder benefits. An acquisition-focused exit plan emphasizes strategic buyer alignment, thorough due diligence, and negotiation to ensure optimal transaction outcomes. Discover more about how acquisition strategies can enhance your exit planning success.

Source and External Links

Liquidation Strategies: Explained with examples and case study - Liquidation strategies are methods to close a business by selling assets to pay creditors, including orderly liquidation (gradual sale to maximize price), forced liquidation (quick sale under distress), and voluntary liquidation initiated by owners or creditors.

Exit Strategy - Definition, Liquidation, Transfer - Liquidation as an exit strategy involves closing a business by selling all assets and is often used when other exit options fail; gradual liquidation allows owners to wind down operations slowly, while transfers keep the business within a family or sell it to another company.

Liquidation Strategy: Concept, Types, Examples, Advantages and Disadvantages - Liquidation strategy entails closing a business and selling assets to cover liabilities, mainly classified into voluntary liquidation (initiated by shareholders, either solvent or insolvent scenarios) and involuntary liquidation (usually forced by creditors).

dowidth.com

dowidth.com