Entrepreneurship offers diverse income opportunities, with passive income streams generating earnings through minimal ongoing effort, such as rental properties or royalties, while portfolio income arises from investments like stocks, bonds, or dividends. Understanding the distinctions between passive and portfolio income is crucial for optimizing financial growth and tax strategies. Explore further to discover how combining these income types can enhance your entrepreneurial success.

Why it is important

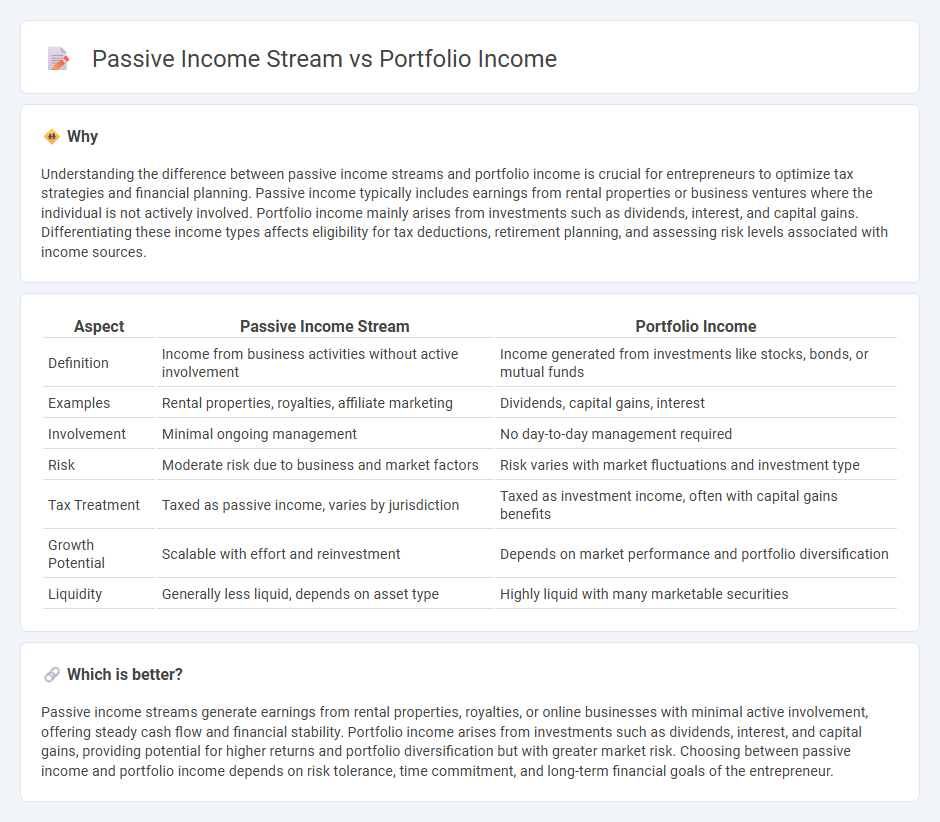

Understanding the difference between passive income streams and portfolio income is crucial for entrepreneurs to optimize tax strategies and financial planning. Passive income typically includes earnings from rental properties or business ventures where the individual is not actively involved. Portfolio income mainly arises from investments such as dividends, interest, and capital gains. Differentiating these income types affects eligibility for tax deductions, retirement planning, and assessing risk levels associated with income sources.

Comparison Table

| Aspect | Passive Income Stream | Portfolio Income |

|---|---|---|

| Definition | Income from business activities without active involvement | Income generated from investments like stocks, bonds, or mutual funds |

| Examples | Rental properties, royalties, affiliate marketing | Dividends, capital gains, interest |

| Involvement | Minimal ongoing management | No day-to-day management required |

| Risk | Moderate risk due to business and market factors | Risk varies with market fluctuations and investment type |

| Tax Treatment | Taxed as passive income, varies by jurisdiction | Taxed as investment income, often with capital gains benefits |

| Growth Potential | Scalable with effort and reinvestment | Depends on market performance and portfolio diversification |

| Liquidity | Generally less liquid, depends on asset type | Highly liquid with many marketable securities |

Which is better?

Passive income streams generate earnings from rental properties, royalties, or online businesses with minimal active involvement, offering steady cash flow and financial stability. Portfolio income arises from investments such as dividends, interest, and capital gains, providing potential for higher returns and portfolio diversification but with greater market risk. Choosing between passive income and portfolio income depends on risk tolerance, time commitment, and long-term financial goals of the entrepreneur.

Connection

Passive income streams often generate portfolio income through investments in assets such as stocks, bonds, or real estate that produce recurring earnings without active involvement. Entrepreneurs leverage portfolio income to diversify revenue sources, enhancing financial stability and enabling reinvestment into business ventures. This connection fosters sustainable wealth creation by combining asset appreciation with consistent passive cash flow.

Key Terms

Investments

Portfolio income primarily derives from dividends, interest, and capital gains generated by investments such as stocks, bonds, and mutual funds, reflecting active management of assets. Passive income streams, on the other hand, include earnings from rental properties, limited partnerships, or business ventures where the investor is not actively involved in daily operations, allowing for ongoing revenue without constant effort. Explore investment strategies to optimize both portfolio and passive income for financial growth and stability.

Cash flow

Portfolio income primarily comes from investments like stocks, bonds, and mutual funds, generating cash flow through dividends, interest, and capital gains. Passive income streams, such as rental properties or royalties, offer consistent cash flow with minimal active involvement. Explore detailed strategies to maximize cash flow from both portfolio income and passive income streams.

Asset diversification

Portfolio income derives from investments such as stocks, bonds, and mutual funds, emphasizing returns through dividends, interest, and capital gains, whereas passive income streams include earnings from rental properties, royalties, or business ventures requiring minimal active involvement. Asset diversification in portfolio income reduces risk by spreading investments across various asset classes and sectors, enhancing financial stability and growth potential. Explore strategies to balance portfolio income and passive income streams for optimal asset diversification and long-term wealth building.

Source and External Links

3 Types of Income Explained - Capital One - Portfolio income, also called investment income, includes interest, dividends, and capital gains generated from your financial assets such as stocks, bonds, mutual funds, savings accounts, and CDs.

What is portfolio income? - Fidelity Investments - Portfolio income is income generated from investments like stocks, bonds, mutual funds, ETFs, or real estate and mainly comprises capital gains, dividends, and interest earned from these assets.

Internal Revenue Service - For tax purposes, portfolio income generally includes gross income from interest, dividends, annuities, or royalties not related to the ordinary course of a trade or business, distinguishing it from passive income.

dowidth.com

dowidth.com