Alternative funding platforms such as crowdfunding, peer-to-peer lending, and angel investor networks offer entrepreneurs faster access to capital with fewer bureaucratic hurdles compared to traditional government grants. These platforms provide flexible financing options and often foster community engagement, while government grants typically require stringent eligibility criteria and lengthy application processes. Explore the benefits and challenges of each funding source to determine the best fit for your entrepreneurial venture.

Why it is important

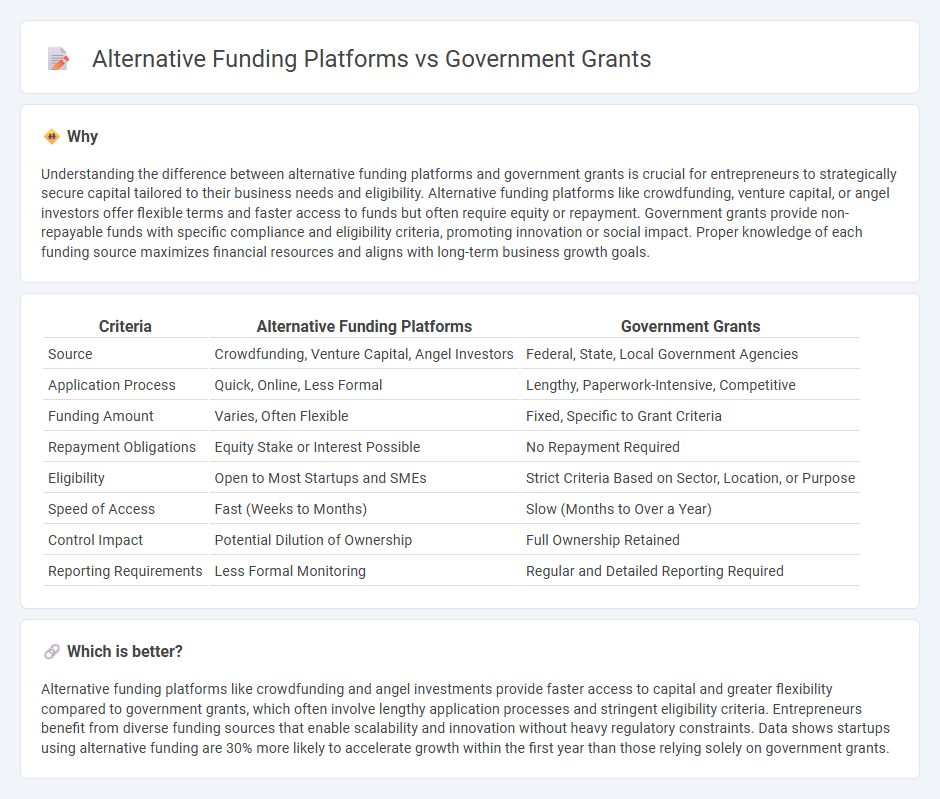

Understanding the difference between alternative funding platforms and government grants is crucial for entrepreneurs to strategically secure capital tailored to their business needs and eligibility. Alternative funding platforms like crowdfunding, venture capital, or angel investors offer flexible terms and faster access to funds but often require equity or repayment. Government grants provide non-repayable funds with specific compliance and eligibility criteria, promoting innovation or social impact. Proper knowledge of each funding source maximizes financial resources and aligns with long-term business growth goals.

Comparison Table

| Criteria | Alternative Funding Platforms | Government Grants |

|---|---|---|

| Source | Crowdfunding, Venture Capital, Angel Investors | Federal, State, Local Government Agencies |

| Application Process | Quick, Online, Less Formal | Lengthy, Paperwork-Intensive, Competitive |

| Funding Amount | Varies, Often Flexible | Fixed, Specific to Grant Criteria |

| Repayment Obligations | Equity Stake or Interest Possible | No Repayment Required |

| Eligibility | Open to Most Startups and SMEs | Strict Criteria Based on Sector, Location, or Purpose |

| Speed of Access | Fast (Weeks to Months) | Slow (Months to Over a Year) |

| Control Impact | Potential Dilution of Ownership | Full Ownership Retained |

| Reporting Requirements | Less Formal Monitoring | Regular and Detailed Reporting Required |

Which is better?

Alternative funding platforms like crowdfunding and angel investments provide faster access to capital and greater flexibility compared to government grants, which often involve lengthy application processes and stringent eligibility criteria. Entrepreneurs benefit from diverse funding sources that enable scalability and innovation without heavy regulatory constraints. Data shows startups using alternative funding are 30% more likely to accelerate growth within the first year than those relying solely on government grants.

Connection

Alternative funding platforms and government grants intersect by providing diverse financial resources that empower entrepreneurs to launch and scale their ventures. Crowdfunding, angel investors, and venture capital complement government grant programs, expanding the financial ecosystem available to startups and small businesses. Access to these combined funding opportunities enhances innovation, reduces financial barriers, and fosters economic growth within entrepreneurial ecosystems.

Key Terms

Non-dilutive Funding

Government grants provide crucial non-dilutive funding by offering financial support without requiring equity or ownership stakes, making them ideal for startups and small businesses seeking growth capital. Alternative funding platforms, such as crowdfunding and revenue-based financing, also enable access to non-dilutive capital but often come with faster approval processes and more flexible terms. Explore detailed comparisons and eligibility criteria to determine the best non-dilutive funding sources for your venture.

Crowdfunding

Government grants provide non-repayable funds typically awarded through competitive applications, offering substantial financial support for research and innovation projects. Crowdfunding platforms, such as Kickstarter and Indiegogo, enable entrepreneurs to raise capital directly from a broad audience, leveraging marketing and social proof to validate concepts and accelerate funding. Explore the advantages and strategic applications of crowdfunding compared to traditional grants to optimize your funding approach.

Venture Capital

Government grants offer non-dilutive funding with strict eligibility criteria and longer approval processes, making them suitable for early-stage startups focused on research and innovation. In contrast, venture capital provides significant capital investments in exchange for equity, facilitating rapid growth and market expansion but requiring business scalability and strong exit potential. Explore the advantages and considerations of venture capital to determine the best funding path for your startup.

Source and External Links

HHS TAGGS: Government Grants - Federal Funds Awarded - Provides detailed federal grant descriptions awarded by the Department of Health and Human Services to a wide range of recipients including businesses, nonprofits, educational and healthcare organizations, with classifications by activity, recipient type, and state since 1995.

Grants | U.S. Small Business Administration - SBA offers grants mainly to nonprofits, educational organizations, and Resource Partners for scientific research, entrepreneurship promotion, and exporting, but does not provide grants for starting or expanding most businesses.

Grants | The Administration for Children and Families - ACF under HHS provides federal financial assistance including grants and cooperative agreements aimed at supporting the economic and social well-being of children, families, and communities, with extensive guidance on application and management.

dowidth.com

dowidth.com