Embedded finance integrates financial services directly into non-financial platforms, enhancing customer experience by offering seamless payment, lending, or investment options within everyday applications. Embedded insurance, a subset of embedded finance, focuses specifically on incorporating insurance products such as coverage or risk protection into these platforms, providing users with immediate and relevant insurance solutions during their purchase journey. Explore how these innovative models are transforming entrepreneurship by creating new revenue streams and improving customer engagement.

Why it is important

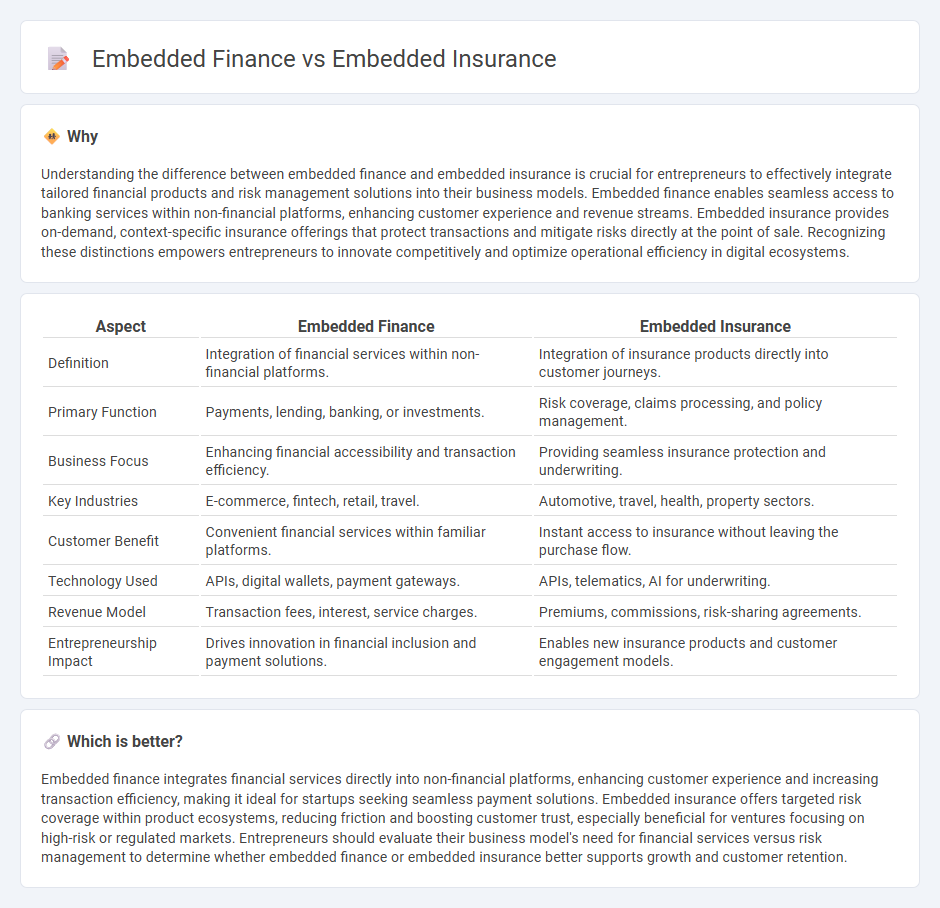

Understanding the difference between embedded finance and embedded insurance is crucial for entrepreneurs to effectively integrate tailored financial products and risk management solutions into their business models. Embedded finance enables seamless access to banking services within non-financial platforms, enhancing customer experience and revenue streams. Embedded insurance provides on-demand, context-specific insurance offerings that protect transactions and mitigate risks directly at the point of sale. Recognizing these distinctions empowers entrepreneurs to innovate competitively and optimize operational efficiency in digital ecosystems.

Comparison Table

| Aspect | Embedded Finance | Embedded Insurance |

|---|---|---|

| Definition | Integration of financial services within non-financial platforms. | Integration of insurance products directly into customer journeys. |

| Primary Function | Payments, lending, banking, or investments. | Risk coverage, claims processing, and policy management. |

| Business Focus | Enhancing financial accessibility and transaction efficiency. | Providing seamless insurance protection and underwriting. |

| Key Industries | E-commerce, fintech, retail, travel. | Automotive, travel, health, property sectors. |

| Customer Benefit | Convenient financial services within familiar platforms. | Instant access to insurance without leaving the purchase flow. |

| Technology Used | APIs, digital wallets, payment gateways. | APIs, telematics, AI for underwriting. |

| Revenue Model | Transaction fees, interest, service charges. | Premiums, commissions, risk-sharing agreements. |

| Entrepreneurship Impact | Drives innovation in financial inclusion and payment solutions. | Enables new insurance products and customer engagement models. |

Which is better?

Embedded finance integrates financial services directly into non-financial platforms, enhancing customer experience and increasing transaction efficiency, making it ideal for startups seeking seamless payment solutions. Embedded insurance offers targeted risk coverage within product ecosystems, reducing friction and boosting customer trust, especially beneficial for ventures focusing on high-risk or regulated markets. Entrepreneurs should evaluate their business model's need for financial services versus risk management to determine whether embedded finance or embedded insurance better supports growth and customer retention.

Connection

Embedded finance integrates financial services directly into non-financial platforms, enabling businesses to offer seamless payment, lending, or insurance options within their ecosystems. Embedded insurance, a subset of embedded finance, automatically incorporates insurance products into everyday transactions, enhancing customer experience and reducing friction for entrepreneurs. These interconnected technologies empower startups to provide comprehensive solutions, streamline operations, and drive revenue growth through tailored financial services.

Key Terms

**Embedded Insurance:**

Embedded insurance integrates insurance products directly into the purchase of goods and services, providing seamless risk protection at the point of sale. This approach enhances customer experience by offering tailored coverage options without requiring a separate transaction or lengthy process. Discover how embedded insurance transforms risk management and customer engagement by exploring its key benefits and use cases.

Risk Coverage

Embedded insurance integrates risk coverage directly into products or services, offering seamless protection tailored to specific customer needs. Embedded finance encompasses a broader spectrum, including payments, lending, and insurance, but with an emphasis on financial transactions rather than solely risk management. Explore how embedded insurance enhances risk coverage within the embedded finance ecosystem for comprehensive financial solutions.

Policy Integration

Embedded insurance seamlessly integrates coverage options directly within the purchase of products or services, enhancing customer convenience and immediate risk protection. Embedded finance broadens this integration by incorporating banking and financial services, such as payments or lending, into non-financial platforms, creating a holistic financial ecosystem. Explore how policy integration differentiates these models and drives innovation in customer experience.

Source and External Links

What is embedded insurance - Embedded insurance integrates risk protection directly into customers' purchase journeys, enabling seamless add-on or included coverage at the point of sale for products or services.

Embedded insurance: Definition, types, benefits - Embedded insurance is coverage automatically offered during product or service purchases, making insurance more accessible and enhancing customer experience compared to traditional separate insurance buying.

The Rise of Embedded Insurance: Opportunities & Challenges - Embedded insurance is reshaping how insurance is sold by embedding it within other transactions, with forecasts showing rapid market growth and benefits like improved customer experience through seamless integration at the point of sale.

dowidth.com

dowidth.com