Embedded finance integrates financial services directly within non-financial platforms, enabling seamless transactions and payments tailored to user activities. Super apps consolidate multiple services--including communication, shopping, and finance--into a single interface, offering a comprehensive user experience with diverse functionalities. Discover how these innovations reshape entrepreneurship and create new business opportunities.

Why it is important

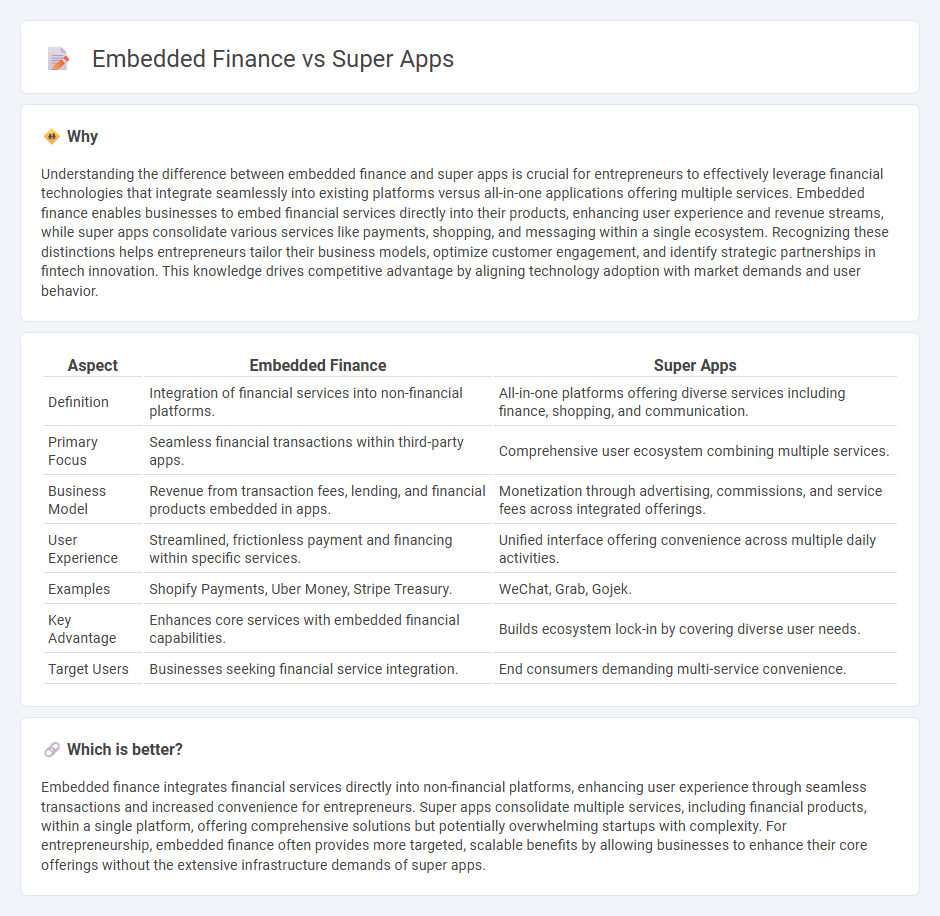

Understanding the difference between embedded finance and super apps is crucial for entrepreneurs to effectively leverage financial technologies that integrate seamlessly into existing platforms versus all-in-one applications offering multiple services. Embedded finance enables businesses to embed financial services directly into their products, enhancing user experience and revenue streams, while super apps consolidate various services like payments, shopping, and messaging within a single ecosystem. Recognizing these distinctions helps entrepreneurs tailor their business models, optimize customer engagement, and identify strategic partnerships in fintech innovation. This knowledge drives competitive advantage by aligning technology adoption with market demands and user behavior.

Comparison Table

| Aspect | Embedded Finance | Super Apps |

|---|---|---|

| Definition | Integration of financial services into non-financial platforms. | All-in-one platforms offering diverse services including finance, shopping, and communication. |

| Primary Focus | Seamless financial transactions within third-party apps. | Comprehensive user ecosystem combining multiple services. |

| Business Model | Revenue from transaction fees, lending, and financial products embedded in apps. | Monetization through advertising, commissions, and service fees across integrated offerings. |

| User Experience | Streamlined, frictionless payment and financing within specific services. | Unified interface offering convenience across multiple daily activities. |

| Examples | Shopify Payments, Uber Money, Stripe Treasury. | WeChat, Grab, Gojek. |

| Key Advantage | Enhances core services with embedded financial capabilities. | Builds ecosystem lock-in by covering diverse user needs. |

| Target Users | Businesses seeking financial service integration. | End consumers demanding multi-service convenience. |

Which is better?

Embedded finance integrates financial services directly into non-financial platforms, enhancing user experience through seamless transactions and increased convenience for entrepreneurs. Super apps consolidate multiple services, including financial products, within a single platform, offering comprehensive solutions but potentially overwhelming startups with complexity. For entrepreneurship, embedded finance often provides more targeted, scalable benefits by allowing businesses to enhance their core offerings without the extensive infrastructure demands of super apps.

Connection

Embedded finance integrates financial services directly within non-financial platforms, enabling super apps to offer seamless payment, lending, and insurance options without redirecting users to external providers. Super apps leverage embedded finance to enhance user experience, increase customer retention, and unlock new revenue streams by providing all-in-one solutions in sectors like e-commerce, ride-hailing, and social media. This synergy drives digital entrepreneurship by lowering barriers to market entry and fostering innovative business models reliant on integrated financial ecosystems.

Key Terms

Platform Ecosystem

Super apps integrate multiple services within a single platform, offering seamless user experiences through a comprehensive digital ecosystem that combines social, financial, and lifestyle features. Embedded finance, on the other hand, involves integrating financial services directly into non-financial platforms, enabling businesses to offer banking, payments, or insurance without becoming full-fledged finance providers. Explore the evolving dynamics of platform ecosystems and learn how these models reshape digital engagement and customer loyalty.

API Integration

Super apps leverage comprehensive API integration to offer multiple financial services within a single platform, enhancing user convenience and engagement. Embedded finance relies on seamless API connections to integrate financial products directly into non-financial apps, driving revenue through contextual services. Discover how advanced API strategies differentiate super apps and embedded finance to optimize user experience and business growth.

Monetization Model

Super apps generate revenue through diverse monetization models including in-app purchases, advertising, and transaction fees across multiple services integrated within one platform. Embedded finance monetizes by integrating financial services like lending, payments, and insurance directly into non-financial apps, often earning through interest margins, payment processing fees, or revenue sharing with platform partners. Explore the nuances of these monetization strategies to optimize revenue streams effectively.

Source and External Links

What Is a Super App? Reasons for Success in 2025 - Emerline - A super app is a closed ecosystem integrating many daily-use apps into a seamless platform, with prominent examples like WeChat and Alipay offering services ranging from messaging to payments and booking, widely successful especially in Asia.

15 Most Popular Super Apps in the World in 2024 - Boxo - Super apps like Kazakhstan's Kaspi and Malaysia's AirAsia Move combine financial, e-commerce, travel, and lifestyle services into one app, illustrating the global spread and diverse functions of super apps beyond Asia.

Top 10: Super apps | Technology Magazine - Super apps have revolutionized user experience by merging payment, e-commerce, ride-hailing, food delivery, and social networking services into one app, with giants like Rappi in Latin America expanding rapidly, although Western countries are still behind in this trend.

dowidth.com

dowidth.com