Acquihire focuses on acquiring a company primarily to gain its talented team, often in the tech industry, while acquisition involves purchasing a company's assets, products, or market share for strategic business expansion. The key difference lies in the emphasis on human capital versus operational capabilities. Explore deeper to understand which strategy aligns best with your entrepreneurial goals.

Why it is important

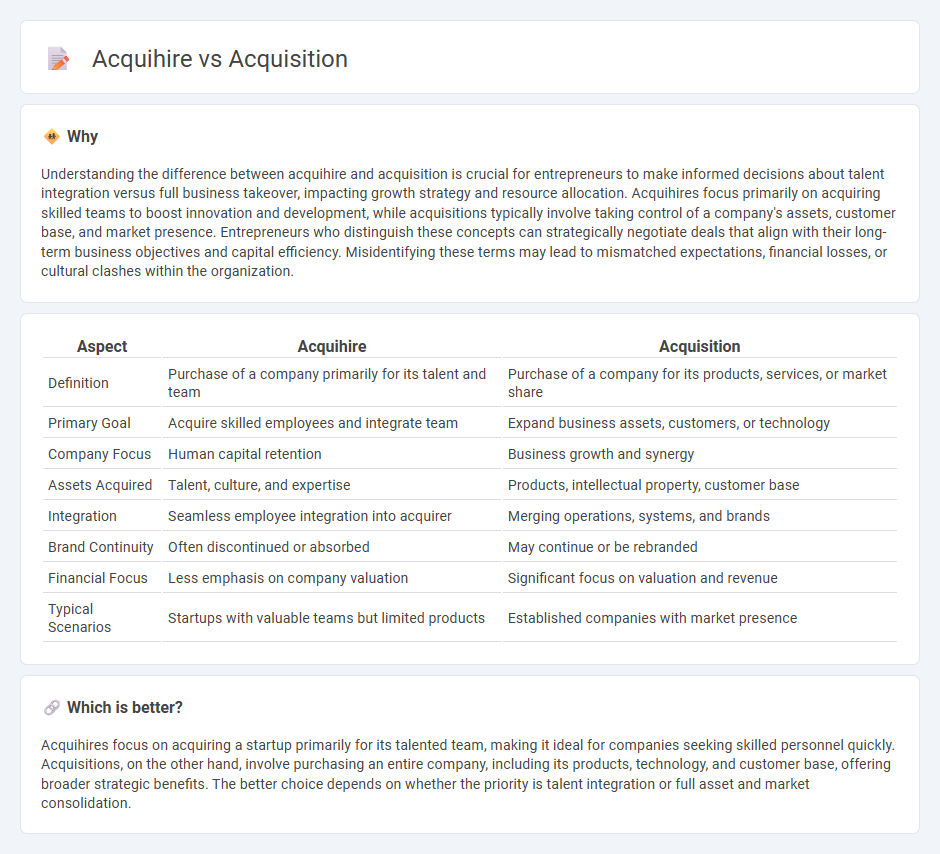

Understanding the difference between acquihire and acquisition is crucial for entrepreneurs to make informed decisions about talent integration versus full business takeover, impacting growth strategy and resource allocation. Acquihires focus primarily on acquiring skilled teams to boost innovation and development, while acquisitions typically involve taking control of a company's assets, customer base, and market presence. Entrepreneurs who distinguish these concepts can strategically negotiate deals that align with their long-term business objectives and capital efficiency. Misidentifying these terms may lead to mismatched expectations, financial losses, or cultural clashes within the organization.

Comparison Table

| Aspect | Acquihire | Acquisition |

|---|---|---|

| Definition | Purchase of a company primarily for its talent and team | Purchase of a company for its products, services, or market share |

| Primary Goal | Acquire skilled employees and integrate team | Expand business assets, customers, or technology |

| Company Focus | Human capital retention | Business growth and synergy |

| Assets Acquired | Talent, culture, and expertise | Products, intellectual property, customer base |

| Integration | Seamless employee integration into acquirer | Merging operations, systems, and brands |

| Brand Continuity | Often discontinued or absorbed | May continue or be rebranded |

| Financial Focus | Less emphasis on company valuation | Significant focus on valuation and revenue |

| Typical Scenarios | Startups with valuable teams but limited products | Established companies with market presence |

Which is better?

Acquihires focus on acquiring a startup primarily for its talented team, making it ideal for companies seeking skilled personnel quickly. Acquisitions, on the other hand, involve purchasing an entire company, including its products, technology, and customer base, offering broader strategic benefits. The better choice depends on whether the priority is talent integration or full asset and market consolidation.

Connection

Acquihires are a strategic form of acquisition primarily aimed at acquiring skilled talent rather than just products or market share. Both acquihires and traditional acquisitions involve one company purchasing another, but acquihires focus on integrating a startup's workforce to enhance innovation and operational capacity. This synergy leverages human capital to accelerate growth and competitive advantage in entrepreneurship.

Key Terms

Talent

Acquisition primarily targets company assets and ongoing operations, while acquihire centers on securing valuable talent and expertise by absorbing a startup's team. In acquihires, companies prioritize human capital to accelerate innovation and enhance competitive advantage without significant interest in the startup's products or services. Explore detailed strategies and benefits of acquihire to optimize your talent acquisition approach.

Intellectual Property

Acquisition involves purchasing a company's intellectual property (IP) assets, such as patents, trademarks, and copyrights, to enhance a business's technology portfolio and competitive advantage. Acquihire focuses on acquiring a startup primarily for its skilled team, with IP often being a secondary benefit rather than the main target. Explore more about how leveraging IP strategies can impact your acquisition decisions and business growth.

Company Integration

An acquisition involves purchasing a company to integrate its products, services, and workforce into the buyer's existing business operations, aiming for long-term strategic growth. An acquihire primarily targets the acquisition of a startup's talent, with less emphasis on products or services, often leading to quicker onboarding and cultural integration challenges. Explore the key differences and strategic implications of acquisition versus acquihire for effective company integration.

Source and External Links

Mergers and acquisitions - Acquisition is the purchase of one business by another, where the acquiring company gains ownership of most or all assets or equity, and can be friendly or hostile.

Acquisition - Definition, Pros, Cons, vs Merger - An acquisition is a corporate transaction in which one company buys shares or assets of another to gain control, with both companies continuing as separate legal entities.

What Is an Acquisition? Definition, Types, and Examples - A business acquisition involves one company buying most or all shares of another to control its assets and operations, and includes types like horizontal acquisitions where companies in similar industries merge.

dowidth.com

dowidth.com