Passive income streams generate revenue with minimal ongoing effort by leveraging investments, automated systems, or digital products, allowing entrepreneurs to build wealth over time. Freelance income depends on trading time and skills for payment, offering immediate cash flow but limited scalability and higher time commitment. Explore effective strategies to balance passive and freelance income for sustainable entrepreneurial success.

Why it is important

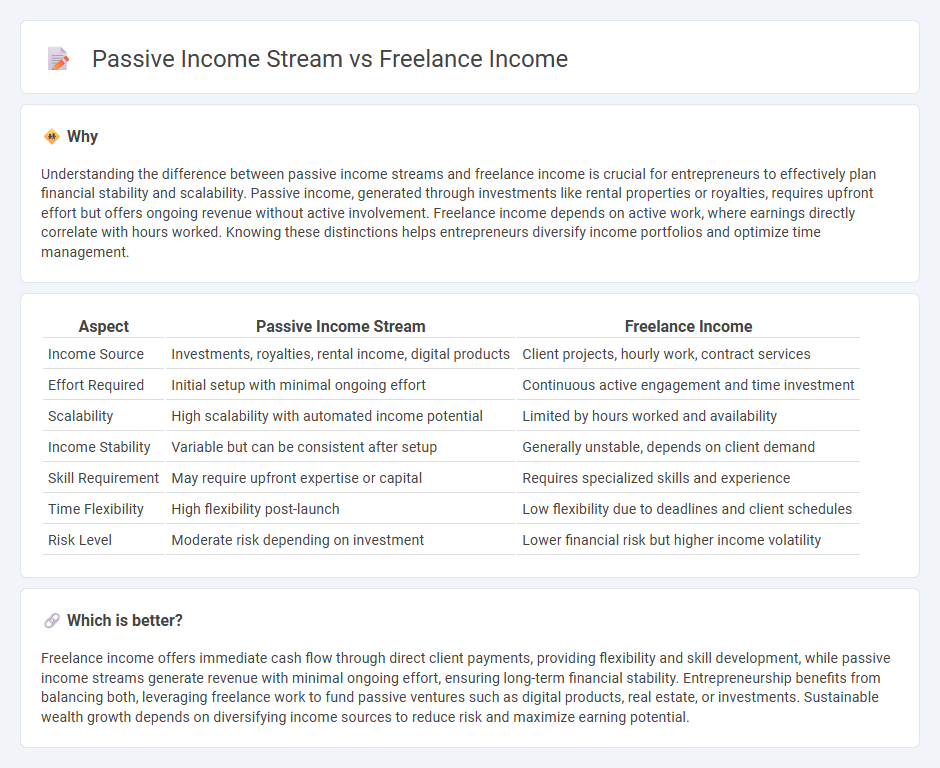

Understanding the difference between passive income streams and freelance income is crucial for entrepreneurs to effectively plan financial stability and scalability. Passive income, generated through investments like rental properties or royalties, requires upfront effort but offers ongoing revenue without active involvement. Freelance income depends on active work, where earnings directly correlate with hours worked. Knowing these distinctions helps entrepreneurs diversify income portfolios and optimize time management.

Comparison Table

| Aspect | Passive Income Stream | Freelance Income |

|---|---|---|

| Income Source | Investments, royalties, rental income, digital products | Client projects, hourly work, contract services |

| Effort Required | Initial setup with minimal ongoing effort | Continuous active engagement and time investment |

| Scalability | High scalability with automated income potential | Limited by hours worked and availability |

| Income Stability | Variable but can be consistent after setup | Generally unstable, depends on client demand |

| Skill Requirement | May require upfront expertise or capital | Requires specialized skills and experience |

| Time Flexibility | High flexibility post-launch | Low flexibility due to deadlines and client schedules |

| Risk Level | Moderate risk depending on investment | Lower financial risk but higher income volatility |

Which is better?

Freelance income offers immediate cash flow through direct client payments, providing flexibility and skill development, while passive income streams generate revenue with minimal ongoing effort, ensuring long-term financial stability. Entrepreneurship benefits from balancing both, leveraging freelance work to fund passive ventures such as digital products, real estate, or investments. Sustainable wealth growth depends on diversifying income sources to reduce risk and maximize earning potential.

Connection

Passive income streams and freelance income are interconnected as both provide flexible financial opportunities for entrepreneurs seeking multiple revenue sources. Freelance work allows individuals to leverage their skills on a project basis, which can be reinvested into developing passive income assets such as digital products or online courses. This synergy enhances income stability and accelerates wealth-building by combining active effort with automated earnings.

Key Terms

Active Earnings

Freelance income represents active earnings generated through direct work, typically requiring ongoing effort and time investment. Passive income streams, in contrast, involve earnings from investments or assets that require minimal daily management once established. Explore how balancing freelance work and passive income can enhance your financial stability.

Residual Revenue

Freelance income depends on active work hours, limiting earning potential to the time invested, while passive income streams, particularly residual revenue, generate continuous earnings from prior efforts such as royalties, subscriptions, or affiliate programs. Residual revenue builds financial stability by creating ongoing cash flow without constant involvement, making it a scalable and sustainable income source. Explore strategies to transform your freelance work into reliable residual revenue for long-term financial freedom.

Time Leverage

Freelance income typically requires active work hours directly traded for payment, limiting potential scale and time freedom. Passive income streams, such as investments or royalties, generate revenue with minimal ongoing effort, offering greater time leverage and financial growth. Explore how optimizing your income sources can maximize your earnings while freeing up valuable time.

Source and External Links

How Much Can Freelancers Make in 2025? - Upwork - Freelancers in the U.S. earn an average salary of over $99,000 per year, with rates ranging from $31,000 to $275,000, and some of the highest-paying freelance jobs include public relations manager, business consultant, and media buyer.

Freelance Salary: Hourly Rate July 2025 United States - ZipRecruiter - The average hourly pay for freelancers in the U.S. is $47.71, with wages ranging from $14.90 to $132.21, varying greatly by skill, location, and experience.

A Freelancer's Guide to Taxes - TurboTax Tax Tips & Videos - Intuit - Freelancers must report all income via multiple 1099 forms and pay self-employment tax of 15.3%, with recent updates to IRS reporting thresholds for third-party payments effective in 2025.

dowidth.com

dowidth.com