Roll-up acquisition consolidates multiple companies within the same industry to achieve economies of scale, increase market share, and streamline operations. Strategic alliances involve partnerships between firms to leverage complementary strengths, share resources, and enter new markets without full ownership. Explore the benefits and challenges of each approach to determine the best fit for your entrepreneurial goals.

Why it is important

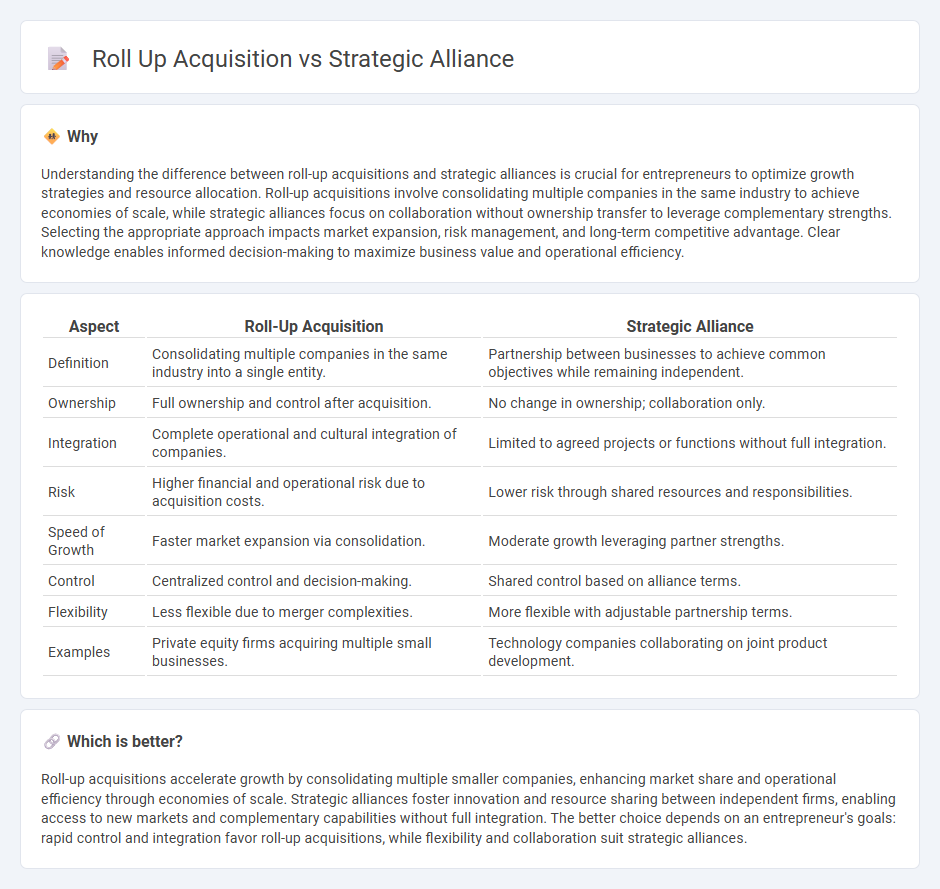

Understanding the difference between roll-up acquisitions and strategic alliances is crucial for entrepreneurs to optimize growth strategies and resource allocation. Roll-up acquisitions involve consolidating multiple companies in the same industry to achieve economies of scale, while strategic alliances focus on collaboration without ownership transfer to leverage complementary strengths. Selecting the appropriate approach impacts market expansion, risk management, and long-term competitive advantage. Clear knowledge enables informed decision-making to maximize business value and operational efficiency.

Comparison Table

| Aspect | Roll-Up Acquisition | Strategic Alliance |

|---|---|---|

| Definition | Consolidating multiple companies in the same industry into a single entity. | Partnership between businesses to achieve common objectives while remaining independent. |

| Ownership | Full ownership and control after acquisition. | No change in ownership; collaboration only. |

| Integration | Complete operational and cultural integration of companies. | Limited to agreed projects or functions without full integration. |

| Risk | Higher financial and operational risk due to acquisition costs. | Lower risk through shared resources and responsibilities. |

| Speed of Growth | Faster market expansion via consolidation. | Moderate growth leveraging partner strengths. |

| Control | Centralized control and decision-making. | Shared control based on alliance terms. |

| Flexibility | Less flexible due to merger complexities. | More flexible with adjustable partnership terms. |

| Examples | Private equity firms acquiring multiple small businesses. | Technology companies collaborating on joint product development. |

Which is better?

Roll-up acquisitions accelerate growth by consolidating multiple smaller companies, enhancing market share and operational efficiency through economies of scale. Strategic alliances foster innovation and resource sharing between independent firms, enabling access to new markets and complementary capabilities without full integration. The better choice depends on an entrepreneur's goals: rapid control and integration favor roll-up acquisitions, while flexibility and collaboration suit strategic alliances.

Connection

Roll-up acquisitions consolidate multiple smaller companies into a larger entity, enhancing market share and operational efficiency. Strategic alliances complement this by enabling partnerships that leverage combined resources and expertise without full ownership. Together, they accelerate growth and competitive advantage in entrepreneurial ventures.

Key Terms

Collaboration

Strategic alliances enable companies to collaborate by sharing resources, expertise, and market access without full ownership consolidation, fostering innovation and flexibility. Roll-up acquisitions involve purchasing multiple smaller firms to integrate operations, achieve economies of scale, and consolidate market share under a single entity. Discover how each approach impacts collaboration dynamics and business growth strategies.

Consolidation

Strategic alliances facilitate consolidation by allowing companies to collaborate without full mergers, optimizing resource sharing and market reach while maintaining operational independence. Roll-up acquisitions accelerate consolidation by acquiring multiple smaller firms, creating economies of scale and streamlining operations under unified management. Explore these consolidation strategies further to understand which approach aligns best with your business growth objectives.

Synergy

Strategic alliances create synergies by combining the unique strengths of two companies while maintaining their independence, often leading to innovation and market expansion. Roll-up acquisitions generate synergies through consolidation, cost reduction, and scale economies by integrating multiple businesses under a single corporate umbrella. Explore the key differences and potential benefits of each approach to maximize your organizational growth.

Source and External Links

Strategic alliance - Wikipedia - A strategic alliance is an agreement between two or more organizations to pursue shared objectives while remaining independent, involving cooperation such as sharing resources, expertise, and risks without forming a legal partnership or corporate affiliate relationship.

Strategic Alliance: Definition, Motives, Types (+Example) - A strategic alliance is a legal agreement where companies commit resources to achieve common goals, with success factors including clear goals, due diligence, communication, and organization.

Types and Benefits of Strategic Alliances - Corporate Finance Institute - Strategic alliances are partnerships between independent companies to cooperate on business objectives, categorized into joint ventures, equity strategic alliances, and non-equity strategic alliances depending on ownership and contractual relationships.

dowidth.com

dowidth.com