Bootstrapped software products thrive on self-funding, fostering complete control and organic growth without external pressures. In contrast, accelerator and incubator-backed products benefit from mentorship, investment, and networking opportunities, accelerating market entry and scaling potential. Explore the key advantages and challenges of both paths to determine the best entrepreneurial strategy for your venture.

Why it is important

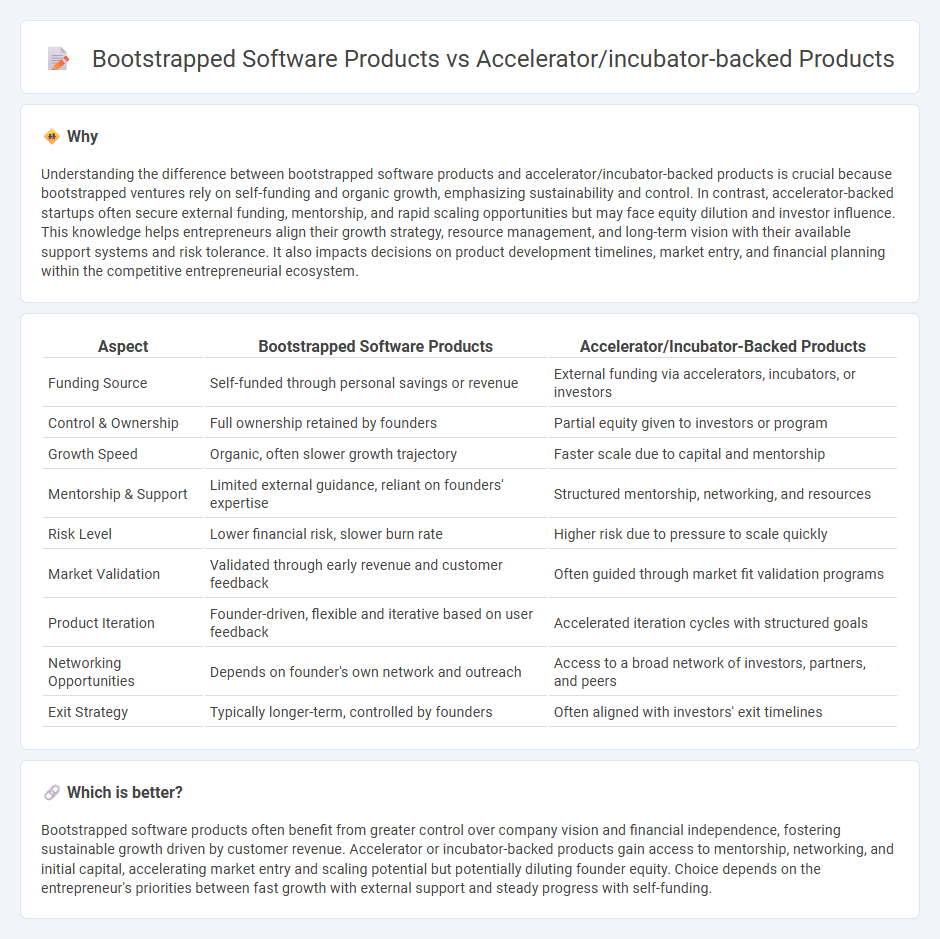

Understanding the difference between bootstrapped software products and accelerator/incubator-backed products is crucial because bootstrapped ventures rely on self-funding and organic growth, emphasizing sustainability and control. In contrast, accelerator-backed startups often secure external funding, mentorship, and rapid scaling opportunities but may face equity dilution and investor influence. This knowledge helps entrepreneurs align their growth strategy, resource management, and long-term vision with their available support systems and risk tolerance. It also impacts decisions on product development timelines, market entry, and financial planning within the competitive entrepreneurial ecosystem.

Comparison Table

| Aspect | Bootstrapped Software Products | Accelerator/Incubator-Backed Products |

|---|---|---|

| Funding Source | Self-funded through personal savings or revenue | External funding via accelerators, incubators, or investors |

| Control & Ownership | Full ownership retained by founders | Partial equity given to investors or program |

| Growth Speed | Organic, often slower growth trajectory | Faster scale due to capital and mentorship |

| Mentorship & Support | Limited external guidance, reliant on founders' expertise | Structured mentorship, networking, and resources |

| Risk Level | Lower financial risk, slower burn rate | Higher risk due to pressure to scale quickly |

| Market Validation | Validated through early revenue and customer feedback | Often guided through market fit validation programs |

| Product Iteration | Founder-driven, flexible and iterative based on user feedback | Accelerated iteration cycles with structured goals |

| Networking Opportunities | Depends on founder's own network and outreach | Access to a broad network of investors, partners, and peers |

| Exit Strategy | Typically longer-term, controlled by founders | Often aligned with investors' exit timelines |

Which is better?

Bootstrapped software products often benefit from greater control over company vision and financial independence, fostering sustainable growth driven by customer revenue. Accelerator or incubator-backed products gain access to mentorship, networking, and initial capital, accelerating market entry and scaling potential but potentially diluting founder equity. Choice depends on the entrepreneur's priorities between fast growth with external support and steady progress with self-funding.

Connection

Bootstrapped software products and accelerator-backed products connect through their shared focus on rapid development and market validation, with bootstrapped ventures relying on self-funding and lean principles while accelerator-backed startups benefit from structured mentorship and early-stage investment. Both approaches emphasize scalability and user feedback to refine software solutions, fostering innovation in competitive markets. This synergy enhances entrepreneurial agility, enabling founders to leverage resources efficiently whether independently or within accelerator ecosystems.

Key Terms

Funding Source

Accelerator/incubator-backed products benefit from structured funding, mentorship, and access to a network of investors, accelerating growth and market entry. Bootstrapped software products rely on founder resources and organic revenue, promoting lean operations and financial discipline. Explore the advantages and challenges of each funding model to determine the best path for your software venture.

Growth Strategy

Accelerator and incubator-backed products often benefit from structured mentorship, network access, and early-stage funding that fuel rapid growth through targeted scaling strategies and market validation. Bootstrapped software products rely heavily on sustainable revenue generation, lean operations, and organic customer acquisition to drive incremental growth without external dilution. Explore comprehensive insights on how growth strategies diverge between these two pathways and optimize your startup's trajectory.

Equity Ownership

Accelerator and incubator-backed software products often require founders to exchange significant equity stakes, typically ranging from 5% to 10%, in return for funding, mentorship, and market access, which can dilute long-term ownership. In contrast, bootstrapped software products maintain full equity control but face slower growth due to limited capital and resources, placing higher risk and reward on founders. Explore detailed equity ownership strategies to optimize control and growth in your software venture.

Source and External Links

Incubator vs Accelerator: Which Is Best for Your Startup? - J.P. Morgan - Accelerator/incubator-backed products differ mainly in the stage they support; incubators aid early-stage startups still refining ideas and working toward MVPs, offering non-dilutive funding and longer-term, selective mentorship, while accelerators target startups ready to scale rapidly with competitive cohorts, equity investment, and intense, programmatic mentorship.

The 60 Best Startup Incubators & Accelerators in the USA for 2025 - Accelerator/incubator-backed products benefit from funding opportunities often including seed capital, access to collaborative startup environments, and crucial mentorship to expedite product development and market traction at different startup phases.

Top 20 AI Accelerators, Incubators & Startup Programs - StartupBlink - Specific accelerator/incubator-backed products in AI receive tailored support like equity-free funding, technical workshops, cloud credits, and access to industry partnerships, helping startups scale rapidly and access global markets depending on the program's geographic and developmental focus.

dowidth.com

dowidth.com