Acquihire involves acquiring a company primarily to gain access to its skilled employees rather than its products or services, often used by startups to quickly build talent teams. Mergers combine two companies into one entity, aiming for synergy in resources, market share, and operational capabilities. Explore the key differences and strategic benefits of acquihires and mergers to make informed business decisions.

Why it is important

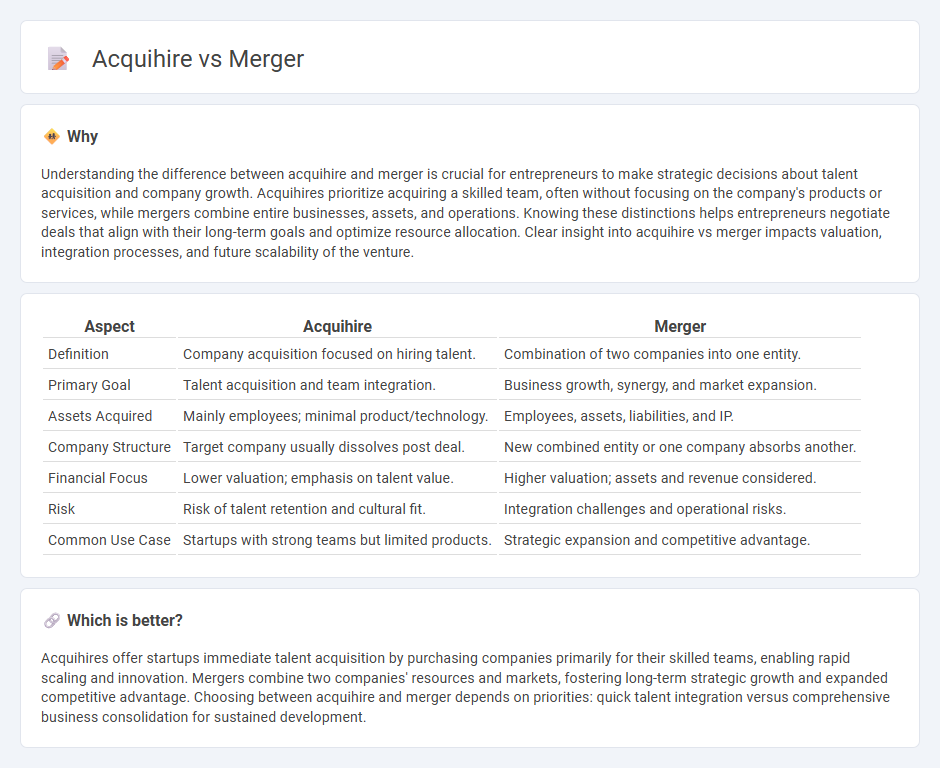

Understanding the difference between acquihire and merger is crucial for entrepreneurs to make strategic decisions about talent acquisition and company growth. Acquihires prioritize acquiring a skilled team, often without focusing on the company's products or services, while mergers combine entire businesses, assets, and operations. Knowing these distinctions helps entrepreneurs negotiate deals that align with their long-term goals and optimize resource allocation. Clear insight into acquihire vs merger impacts valuation, integration processes, and future scalability of the venture.

Comparison Table

| Aspect | Acquihire | Merger |

|---|---|---|

| Definition | Company acquisition focused on hiring talent. | Combination of two companies into one entity. |

| Primary Goal | Talent acquisition and team integration. | Business growth, synergy, and market expansion. |

| Assets Acquired | Mainly employees; minimal product/technology. | Employees, assets, liabilities, and IP. |

| Company Structure | Target company usually dissolves post deal. | New combined entity or one company absorbs another. |

| Financial Focus | Lower valuation; emphasis on talent value. | Higher valuation; assets and revenue considered. |

| Risk | Risk of talent retention and cultural fit. | Integration challenges and operational risks. |

| Common Use Case | Startups with strong teams but limited products. | Strategic expansion and competitive advantage. |

Which is better?

Acquihires offer startups immediate talent acquisition by purchasing companies primarily for their skilled teams, enabling rapid scaling and innovation. Mergers combine two companies' resources and markets, fostering long-term strategic growth and expanded competitive advantage. Choosing between acquihire and merger depends on priorities: quick talent integration versus comprehensive business consolidation for sustained development.

Connection

Acquihires and mergers both involve the consolidation of companies to enhance business capabilities and market position. An acquihire focuses on acquiring a company primarily to gain its talented workforce, whereas a merger combines two companies to create a larger entity with integrated operations. These strategies intersect when talent acquisition plays a critical role in the strategic goals of a merger, driving innovation and competitive advantage.

Key Terms

Synergy

Mergers focus on creating synergy by combining companies' resources, talents, and market share to enhance competitive advantage and drive growth. Acquihires prioritize acquiring skilled teams to bolster innovation and accelerate product development, often at the expense of acquiring the target company's broader assets. Explore the strategic differences between mergers and acquihires to optimize your business growth approach.

Talent Acquisition

Merger strategies often emphasize integrating entire companies, including their products, market share, and operational systems, to achieve strategic growth and synergy. Acquihires concentrate specifically on talent acquisition, aiming to quickly onboard skilled teams or individuals to boost innovation and capabilities without acquiring full business assets. Discover key differences and strategic benefits by exploring detailed insights on merger versus acquihire in talent acquisition.

Valuation

Valuation in mergers often hinges on comprehensive assessments of assets, market position, and future earnings potential, impacting the overall deal price significantly. Acquihires mainly focus on valuing human capital, where the talent pool's skills and expertise are the primary drivers rather than traditional financial metrics. Explore further to understand how valuation strategies differ between mergers and acquihires and affect your deal outcomes.

Source and External Links

Merger - Overview, Types, Advantages and Disadvantages - A merger is a corporate strategy to combine with another company and operate as a single legal entity, typically between companies of equal size, which may be horizontal, vertical, or conglomerate mergers to increase market share and efficiency.

Mergers and acquisitions - Wikipedia - Mergers and acquisitions (M&A) involve the transfer or consolidation of company ownership, where a merger legally consolidates two businesses into one, differentiating it from acquisitions that involve taking ownership of one company by another.

Merge and acquire businesses | U.S. Small Business Administration - Mergers combine two separate businesses into a single new legal entity, which is rare due to equal company sizes required, differing from acquisitions where one company fully absorbs another without forming a new entity.

dowidth.com

dowidth.com