Exit-ready startups focus on rapid growth and scalability to attract investors for a profitable sale or public offering, often emphasizing innovation and market disruption. Family businesses prioritize long-term stability, generational legacy, and control, balancing tradition with gradual growth and reinvestment. Discover more about how these distinct entrepreneurial models shape business strategy and success.

Why it is important

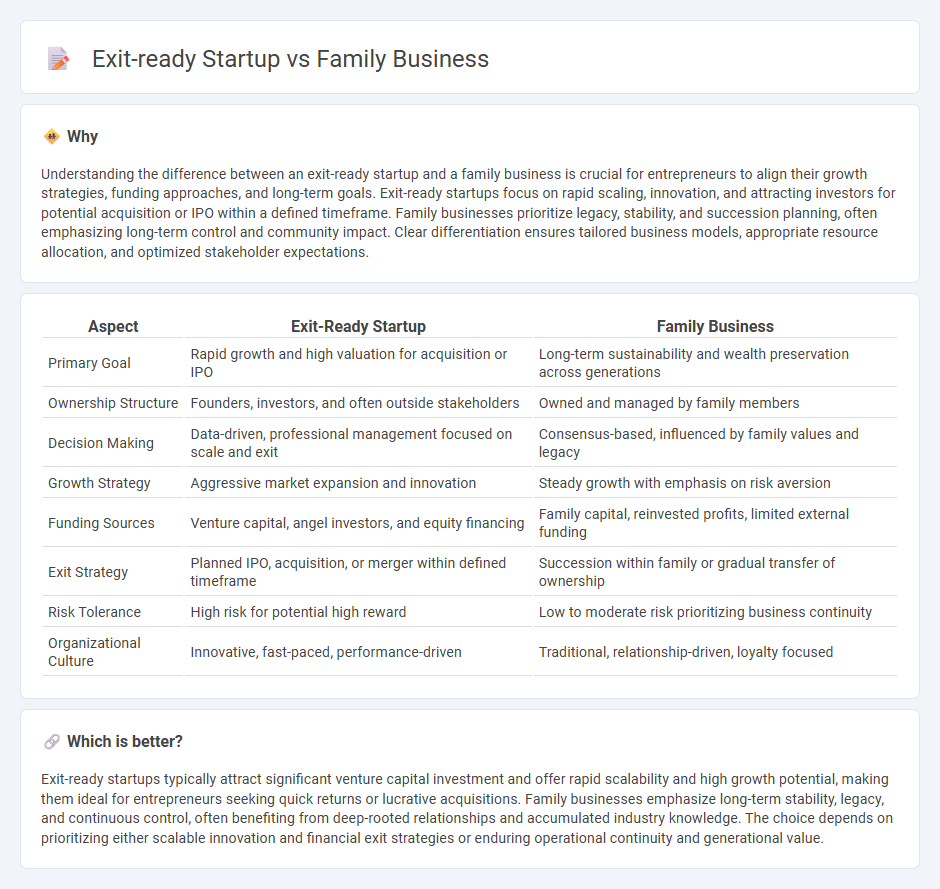

Understanding the difference between an exit-ready startup and a family business is crucial for entrepreneurs to align their growth strategies, funding approaches, and long-term goals. Exit-ready startups focus on rapid scaling, innovation, and attracting investors for potential acquisition or IPO within a defined timeframe. Family businesses prioritize legacy, stability, and succession planning, often emphasizing long-term control and community impact. Clear differentiation ensures tailored business models, appropriate resource allocation, and optimized stakeholder expectations.

Comparison Table

| Aspect | Exit-Ready Startup | Family Business |

|---|---|---|

| Primary Goal | Rapid growth and high valuation for acquisition or IPO | Long-term sustainability and wealth preservation across generations |

| Ownership Structure | Founders, investors, and often outside stakeholders | Owned and managed by family members |

| Decision Making | Data-driven, professional management focused on scale and exit | Consensus-based, influenced by family values and legacy |

| Growth Strategy | Aggressive market expansion and innovation | Steady growth with emphasis on risk aversion |

| Funding Sources | Venture capital, angel investors, and equity financing | Family capital, reinvested profits, limited external funding |

| Exit Strategy | Planned IPO, acquisition, or merger within defined timeframe | Succession within family or gradual transfer of ownership |

| Risk Tolerance | High risk for potential high reward | Low to moderate risk prioritizing business continuity |

| Organizational Culture | Innovative, fast-paced, performance-driven | Traditional, relationship-driven, loyalty focused |

Which is better?

Exit-ready startups typically attract significant venture capital investment and offer rapid scalability and high growth potential, making them ideal for entrepreneurs seeking quick returns or lucrative acquisitions. Family businesses emphasize long-term stability, legacy, and continuous control, often benefiting from deep-rooted relationships and accumulated industry knowledge. The choice depends on prioritizing either scalable innovation and financial exit strategies or enduring operational continuity and generational value.

Connection

Exit-ready startups and family businesses both prioritize long-term value creation and succession planning, ensuring smooth ownership transitions and maximizing returns. Family businesses often face complex dynamics that influence their exit strategies, whereas startups focus on scalable growth to attract potential buyers or investors. Strategic preparation, including financial transparency and robust governance, aligns both entities toward successful exits.

Key Terms

Succession Planning

Succession planning in family businesses often emphasizes legacy preservation, leadership continuity, and gradual transition to ensure long-term stability. Exit-ready startups prioritize scalability, investor returns, and streamlined leadership handover to maximize valuation and attract acquirers. Discover key strategies to optimize succession planning for both business models.

Scalability

Family businesses often emphasize steady growth and long-term sustainability, leveraging established customer relationships and legacy practices. Exit-ready startups prioritize scalability through rapid innovation, market disruption, and attracting venture capital to accelerate growth trajectories. Explore key strategies differentiating scalable startups from traditional family enterprises to optimize your business model.

Liquidity Event

Family businesses often prioritize long-term stability and intergenerational wealth transfer, typically delaying liquidity events such as sales or public offerings. Exit-ready startups, in contrast, are designed to achieve rapid growth and profitability with the explicit goal of triggering liquidity events like acquisitions or IPOs within a shorter timeframe. Explore deeper insights on how liquidity strategies differ between these business models for effective financial planning.

Source and External Links

Family business - A family business is a commercial organization where management decisions are influenced by multiple generations of a family, often characterized by unique family dynamics and long-term vision.

Family Business Beer Company - A family-owned and operated brewery near Austin, Texas, offering award-winning beers with a focus on quality and community.

The Family Business (American TV series) - A crime family drama about the Duncan family who run an exotic car dealership while managing a dangerous secret life.

dowidth.com

dowidth.com