Entrepreneurship often involves choosing between a passive income stream, where earnings grow independently of active work, and a linear income stream, which relies directly on continuous effort and time investment. Passive income sources include rental properties, royalties, and online businesses that generate revenue with minimal day-to-day involvement, while linear income depends on hourly wages or fixed salaries. Discover strategic approaches to balance and maximize both income types for sustainable financial growth.

Why it is important

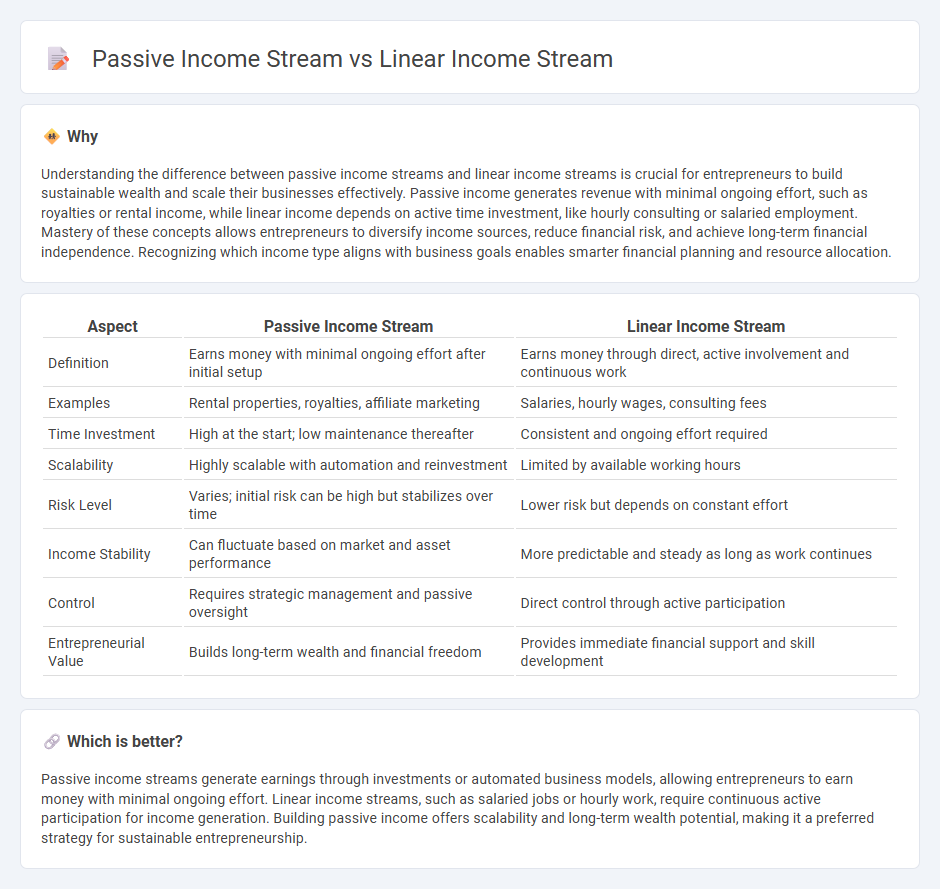

Understanding the difference between passive income streams and linear income streams is crucial for entrepreneurs to build sustainable wealth and scale their businesses effectively. Passive income generates revenue with minimal ongoing effort, such as royalties or rental income, while linear income depends on active time investment, like hourly consulting or salaried employment. Mastery of these concepts allows entrepreneurs to diversify income sources, reduce financial risk, and achieve long-term financial independence. Recognizing which income type aligns with business goals enables smarter financial planning and resource allocation.

Comparison Table

| Aspect | Passive Income Stream | Linear Income Stream |

|---|---|---|

| Definition | Earns money with minimal ongoing effort after initial setup | Earns money through direct, active involvement and continuous work |

| Examples | Rental properties, royalties, affiliate marketing | Salaries, hourly wages, consulting fees |

| Time Investment | High at the start; low maintenance thereafter | Consistent and ongoing effort required |

| Scalability | Highly scalable with automation and reinvestment | Limited by available working hours |

| Risk Level | Varies; initial risk can be high but stabilizes over time | Lower risk but depends on constant effort |

| Income Stability | Can fluctuate based on market and asset performance | More predictable and steady as long as work continues |

| Control | Requires strategic management and passive oversight | Direct control through active participation |

| Entrepreneurial Value | Builds long-term wealth and financial freedom | Provides immediate financial support and skill development |

Which is better?

Passive income streams generate earnings through investments or automated business models, allowing entrepreneurs to earn money with minimal ongoing effort. Linear income streams, such as salaried jobs or hourly work, require continuous active participation for income generation. Building passive income offers scalability and long-term wealth potential, making it a preferred strategy for sustainable entrepreneurship.

Connection

Passive income streams complement linear income streams by providing financial stability and diversified revenue sources for entrepreneurs. While linear income depends on active work hours, passive income generates earnings with minimal ongoing effort, reducing risk and enhancing cash flow. This connection allows entrepreneurs to leverage active labor for immediate profits while building scalable, automated income channels for long-term wealth.

Key Terms

Active Engagement

A linear income stream relies on active engagement, requiring continuous time and effort to generate earnings, such as freelancing or hourly work, where income is directly tied to hours worked. Passive income streams, in contrast, generate revenue with minimal ongoing involvement after initial setup, exemplified by rental properties or royalties. Explore the benefits and challenges of each to determine which income model suits your financial goals.

Residual Earnings

A linear income stream relies on continuous active effort, such as hourly wages or freelance projects, limiting growth potential once work stops. Passive income streams, particularly those generating residual earnings like dividends, royalties, or rental income, create ongoing revenue without daily involvement. Explore how building residual earnings can enhance financial freedom and long-term wealth.

Time-Leverage

Linear income streams require direct time investment, earning money proportionally to hours worked, resulting in limited scalability due to time constraints. Passive income streams leverage time by generating earnings with minimal ongoing effort, often through investments, royalties, or automated businesses, allowing exponential growth potential. Explore how optimizing time-leverage can transform your financial strategy and maximize income efficiency.

Source and External Links

Linear Income: Definition and Examples - Yieldstreet - Linear income is earnings such as wages or salary that are paid based on hours worked or tasks completed, typically requiring physical presence or active work, unlike residual income which continues without constant effort.

Residual and Linear Income - What are they? - Linear income, also called active income, is the traditional wage-based earnings directly tied to time spent working and has a natural limit based on hours worked and pay rate.

Linear Income - Fundrise - Linear income is commonly described as "trading time for money," where income increases only through working more hours or getting a higher wage, exemplifying a direct relation between hours worked and pay received.

dowidth.com

dowidth.com