Passive income stream generates revenue with minimal ongoing effort by leveraging assets such as rental properties, royalties, or investment returns. License income arises from granting permission to others to use intellectual property, trademarks, or patented technologies in exchange for fees or royalties. Explore more to understand how both income types can strategically enhance entrepreneurial ventures.

Why it is important

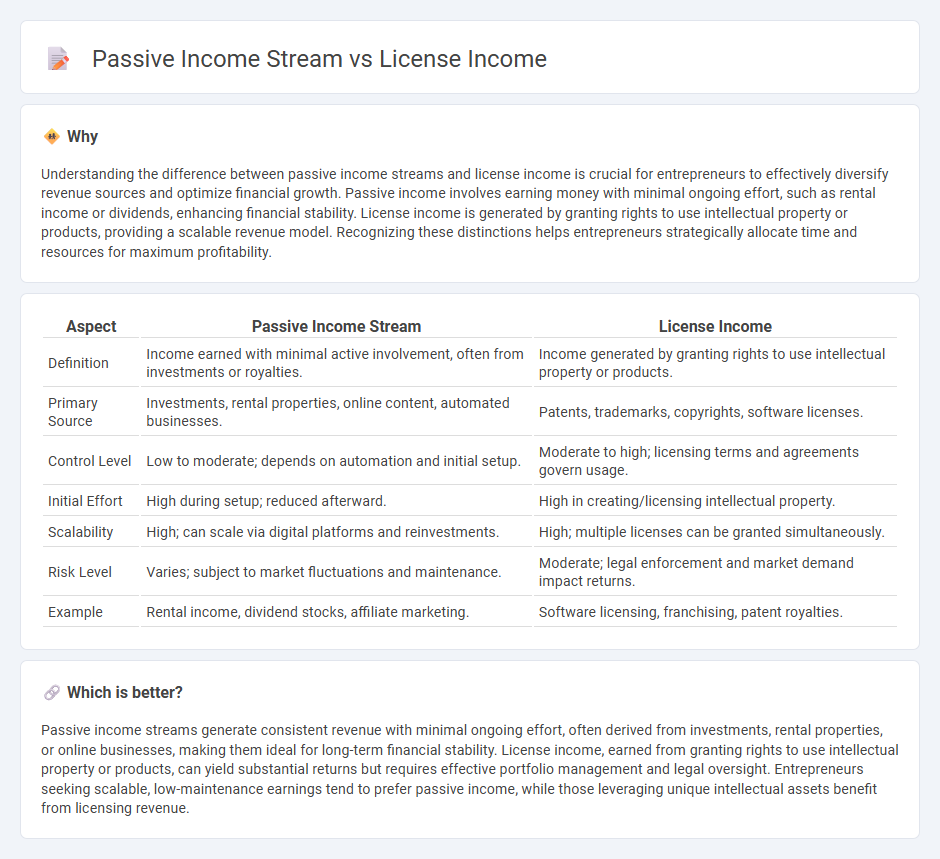

Understanding the difference between passive income streams and license income is crucial for entrepreneurs to effectively diversify revenue sources and optimize financial growth. Passive income involves earning money with minimal ongoing effort, such as rental income or dividends, enhancing financial stability. License income is generated by granting rights to use intellectual property or products, providing a scalable revenue model. Recognizing these distinctions helps entrepreneurs strategically allocate time and resources for maximum profitability.

Comparison Table

| Aspect | Passive Income Stream | License Income |

|---|---|---|

| Definition | Income earned with minimal active involvement, often from investments or royalties. | Income generated by granting rights to use intellectual property or products. |

| Primary Source | Investments, rental properties, online content, automated businesses. | Patents, trademarks, copyrights, software licenses. |

| Control Level | Low to moderate; depends on automation and initial setup. | Moderate to high; licensing terms and agreements govern usage. |

| Initial Effort | High during setup; reduced afterward. | High in creating/licensing intellectual property. |

| Scalability | High; can scale via digital platforms and reinvestments. | High; multiple licenses can be granted simultaneously. |

| Risk Level | Varies; subject to market fluctuations and maintenance. | Moderate; legal enforcement and market demand impact returns. |

| Example | Rental income, dividend stocks, affiliate marketing. | Software licensing, franchising, patent royalties. |

Which is better?

Passive income streams generate consistent revenue with minimal ongoing effort, often derived from investments, rental properties, or online businesses, making them ideal for long-term financial stability. License income, earned from granting rights to use intellectual property or products, can yield substantial returns but requires effective portfolio management and legal oversight. Entrepreneurs seeking scalable, low-maintenance earnings tend to prefer passive income, while those leveraging unique intellectual assets benefit from licensing revenue.

Connection

Passive income streams often include license income, which is generated by granting rights to use intellectual property such as patents, trademarks, or copyrighted materials. Entrepreneurs leverage licensing agreements to create sustainable revenue without active involvement, enhancing cash flow and financial stability. This approach allows business owners to scale their income by monetizing intangible assets while focusing on core operations.

Key Terms

Royalties

License income from royalties generates revenue by allowing others to use intellectual property such as music, patents, or trademarks in exchange for payments. This income stream is often categorized as passive income because it requires minimal ongoing effort after the initial licensing agreement is established. Explore how maximizing royalty agreements can significantly boost your passive income portfolio.

Intellectual Property (IP)

License income from Intellectual Property (IP) arises when creators or rights holders grant permissions to third parties to use patents, trademarks, copyrights, or trade secrets in exchange for royalties, providing a direct revenue stream linked to the value of their IP assets. Passive income streams involve earnings from IP that require minimal ongoing effort, such as royalties from licensing agreements, which allow IP owners to monetize their creations without active management. Explore how strategically leveraging IP for licensing can maximize passive income potential and secure long-term financial growth.

Automated Revenue

License income generates automated revenue by allowing businesses or individuals to earn royalties from intellectual property such as patents, trademarks, or copyrighted content without active involvement. Passive income streams include rental income, dividends, or affiliate marketing, but license income stands out by leveraging legally protected assets for continuous earnings. Explore how license income can optimize your automated revenue strategy.

Source and External Links

Defining Sublicense Income To Avoid Problems Down The Road - Sublicensing income generally includes fees such as license issue fees, milestone payments, but excludes royalties on sales or distribution of licensed products, distinguishing milestone payments as event-driven and separate from royalties in licensing agreements.

License Income Definition - Law Insider - License income is defined as the gross amount received in consideration for granting sublicenses to sublicensees, often detailed in agreements to include royalties, fees, and other related payments.

Policy on Distribution of Licensing Revenue - UM - Licensing revenue includes basic licensing revenues like license issue fees, option fees, milestone fees, and minimum or annual royalties, which are allocated among inventors according to university policy.

dowidth.com

dowidth.com