Entrepreneurship often involves strategic decisions like acquihire and crowdfunding to accelerate growth or secure funding. Acquihire enables startups to join established companies mainly for talent acquisition, whereas crowdfunding gathers capital directly from a wide audience in exchange for early product access or perks. Discover the key benefits and challenges of each approach to determine the best fit for your entrepreneurial journey.

Why it is important

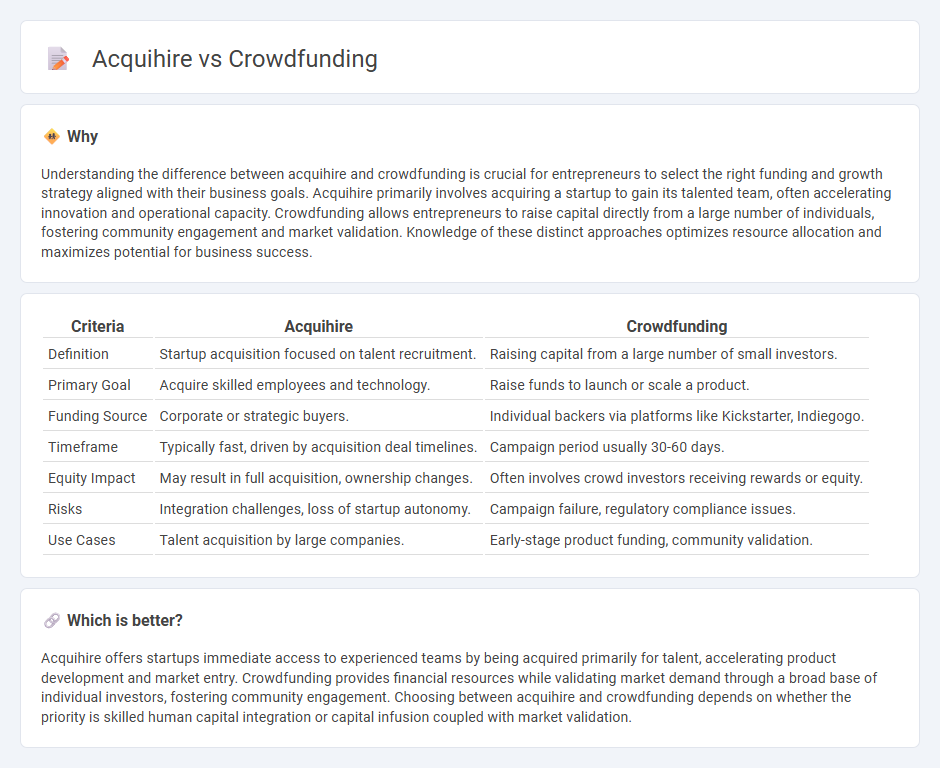

Understanding the difference between acquihire and crowdfunding is crucial for entrepreneurs to select the right funding and growth strategy aligned with their business goals. Acquihire primarily involves acquiring a startup to gain its talented team, often accelerating innovation and operational capacity. Crowdfunding allows entrepreneurs to raise capital directly from a large number of individuals, fostering community engagement and market validation. Knowledge of these distinct approaches optimizes resource allocation and maximizes potential for business success.

Comparison Table

| Criteria | Acquihire | Crowdfunding |

|---|---|---|

| Definition | Startup acquisition focused on talent recruitment. | Raising capital from a large number of small investors. |

| Primary Goal | Acquire skilled employees and technology. | Raise funds to launch or scale a product. |

| Funding Source | Corporate or strategic buyers. | Individual backers via platforms like Kickstarter, Indiegogo. |

| Timeframe | Typically fast, driven by acquisition deal timelines. | Campaign period usually 30-60 days. |

| Equity Impact | May result in full acquisition, ownership changes. | Often involves crowd investors receiving rewards or equity. |

| Risks | Integration challenges, loss of startup autonomy. | Campaign failure, regulatory compliance issues. |

| Use Cases | Talent acquisition by large companies. | Early-stage product funding, community validation. |

Which is better?

Acquihire offers startups immediate access to experienced teams by being acquired primarily for talent, accelerating product development and market entry. Crowdfunding provides financial resources while validating market demand through a broad base of individual investors, fostering community engagement. Choosing between acquihire and crowdfunding depends on whether the priority is skilled human capital integration or capital infusion coupled with market validation.

Connection

Acquihire and crowdfunding are connected through their roles in startup growth strategies, where crowdfunding validates market interest and raises initial capital, making the startup attractive for acquihire by larger companies seeking talent acquisition. Crowdfunding provides proof of concept and community support, which enhances a startup's valuation and visibility, increasing the likelihood of acquihire offers centered on retaining the founding team. By leveraging crowdfunding success, startups demonstrate both product viability and a committed user base, key factors that drive acquihire decisions in competitive tech industries.

Key Terms

Capital

Crowdfunding provides startups with access to diverse funding sources by raising small amounts of capital from a large number of investors, enabling rapid capital accumulation without giving up significant equity. Acquihires generally involve acquiring a company's talent through purchase deals, where capital allocation focuses on human resources rather than direct financial investment or product funding. Explore the strategic differences between crowdfunding and acquihiring to optimize your startup's capital growth and resource acquisition.

Talent acquisition

Crowdfunding enables startups to raise capital from diverse investors, fueling growth and innovation, whereas acquihire focuses on acquiring talented teams to accelerate product development and market entry. Talent acquisition through acquihire offers immediate access to skilled professionals and cohesive units, reducing recruitment time and costs. Explore how leveraging these strategies can optimize your talent acquisition and business growth.

Startup exit

Crowdfunding enables startups to raise capital from a broad base of individual investors, allowing for product validation and market engagement while retaining control. Acquihire involves a larger company acquiring a startup primarily for its talented team, providing an exit route that emphasizes human capital over product or revenue. Explore the strategic implications of each exit option to determine the best fit for your startup's future.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet, and involves a project initiator, supporters, and a platform.

What is crowdfunding? Here are four types to know - Stripe - Crowdfunding is a way for startups and projects to raise money collectively from many individuals online, leveraging social networks for reach and avoiding traditional financing.

Small Business Financing: A Resource Guide: Crowdfunding - Library of Congress - Crowdfunding can be donation, reward, or equity-based, and involves collecting small amounts from many individuals online, with platforms such as GoFundMe and Kickstarter facilitating these models.

dowidth.com

dowidth.com