Exit planning focuses on strategies for business owners to successfully sell, transfer, or retire from their company, ensuring financial security and legacy preservation. Business continuity planning, on the other hand, prepares organizations to maintain operations during disruptions, safeguarding key processes and stakeholder interests. Discover how mastering both exit planning and business continuity planning can secure your entrepreneurial success.

Why it is important

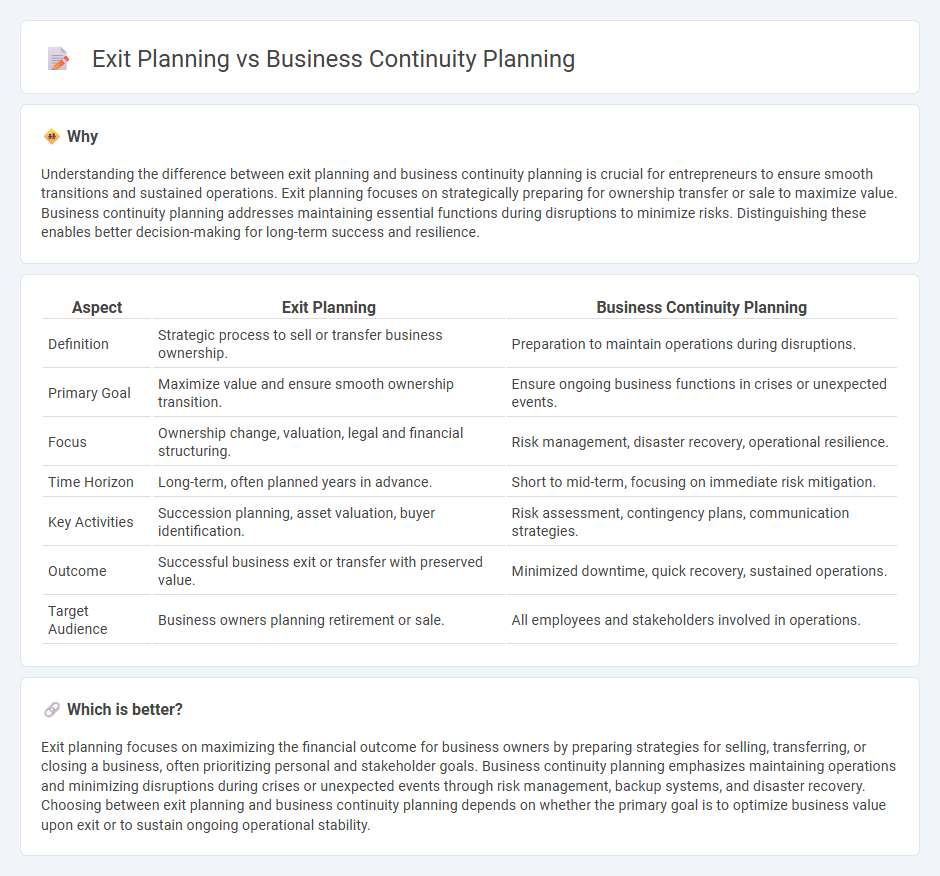

Understanding the difference between exit planning and business continuity planning is crucial for entrepreneurs to ensure smooth transitions and sustained operations. Exit planning focuses on strategically preparing for ownership transfer or sale to maximize value. Business continuity planning addresses maintaining essential functions during disruptions to minimize risks. Distinguishing these enables better decision-making for long-term success and resilience.

Comparison Table

| Aspect | Exit Planning | Business Continuity Planning |

|---|---|---|

| Definition | Strategic process to sell or transfer business ownership. | Preparation to maintain operations during disruptions. |

| Primary Goal | Maximize value and ensure smooth ownership transition. | Ensure ongoing business functions in crises or unexpected events. |

| Focus | Ownership change, valuation, legal and financial structuring. | Risk management, disaster recovery, operational resilience. |

| Time Horizon | Long-term, often planned years in advance. | Short to mid-term, focusing on immediate risk mitigation. |

| Key Activities | Succession planning, asset valuation, buyer identification. | Risk assessment, contingency plans, communication strategies. |

| Outcome | Successful business exit or transfer with preserved value. | Minimized downtime, quick recovery, sustained operations. |

| Target Audience | Business owners planning retirement or sale. | All employees and stakeholders involved in operations. |

Which is better?

Exit planning focuses on maximizing the financial outcome for business owners by preparing strategies for selling, transferring, or closing a business, often prioritizing personal and stakeholder goals. Business continuity planning emphasizes maintaining operations and minimizing disruptions during crises or unexpected events through risk management, backup systems, and disaster recovery. Choosing between exit planning and business continuity planning depends on whether the primary goal is to optimize business value upon exit or to sustain ongoing operational stability.

Connection

Exit planning and business continuity planning are interconnected strategies crucial for ensuring a smooth transition when an entrepreneur leaves a business. Exit planning focuses on maximizing the value and timing of the owner's departure, while business continuity planning safeguards the company's operations, reputation, and financial stability during and after the transition. Together, these plans mitigate risks, protect stakeholder interests, and secure the long-term success of the enterprise.

Key Terms

Risk Management

Business continuity planning centers on identifying and mitigating operational risks to ensure uninterrupted business functions during disruptions, emphasizing resilience and recovery strategies. Exit planning focuses on managing financial, legal, and market risks associated with transitioning ownership or closing a business, aiming for maximum value realization and smooth transfer. Explore comprehensive strategies to optimize your enterprise risk management in both continuity and exit scenarios.

Succession Strategy

Business continuity planning ensures ongoing operations by preparing for unexpected disruptions, emphasizing risk management and maintaining critical functions. Exit planning focuses on succession strategy, detailing the transfer of leadership, ownership, or management to ensure long-term business sustainability. Explore comprehensive succession strategies to secure your company's future leadership and operational resilience.

Value Realization

Business continuity planning ensures operational resilience by maintaining core business functions during disruptions, safeguarding long-term value for stakeholders. Exit planning strategically prepares business owners to maximize value realization through well-timed ownership transitions, mergers, or sales. Discover more about optimizing value through integrated business continuity and exit planning strategies.

Source and External Links

How to write a Business Continuity Plan (BCP)? - DataGuard - A Business Continuity Plan outlines steps to ensure business operations continue during disruptions, starting with identifying critical functions, assessing risks, developing recovery strategies, establishing communication plans, and testing the plan regularly.

Business Continuity Plan (BCP): What is it & How Does it Work? - A BCP is a documented set of actions and processes designed to maintain business stability during operational interruptions by assessing vulnerabilities and defining recovery strategies for critical functions.

Business continuity planning - Wikipedia - Business continuity planning is the process of establishing systems of prevention and recovery to ensure an organization can continue delivering its products or services following a disruptive incident, involving preparation for various disaster scenarios and recovery steps.

dowidth.com

dowidth.com