Alternative funding platforms such as crowdfunding and peer-to-peer lending offer entrepreneurs flexible access to capital without the stringent requirements often imposed by traditional investors. Corporate Venture Capital (CVC) provides startups with strategic resources and industry expertise alongside funding, fostering deep collaborations between startups and established corporations. Explore more to understand which funding avenue aligns best with your business growth strategy.

Why it is important

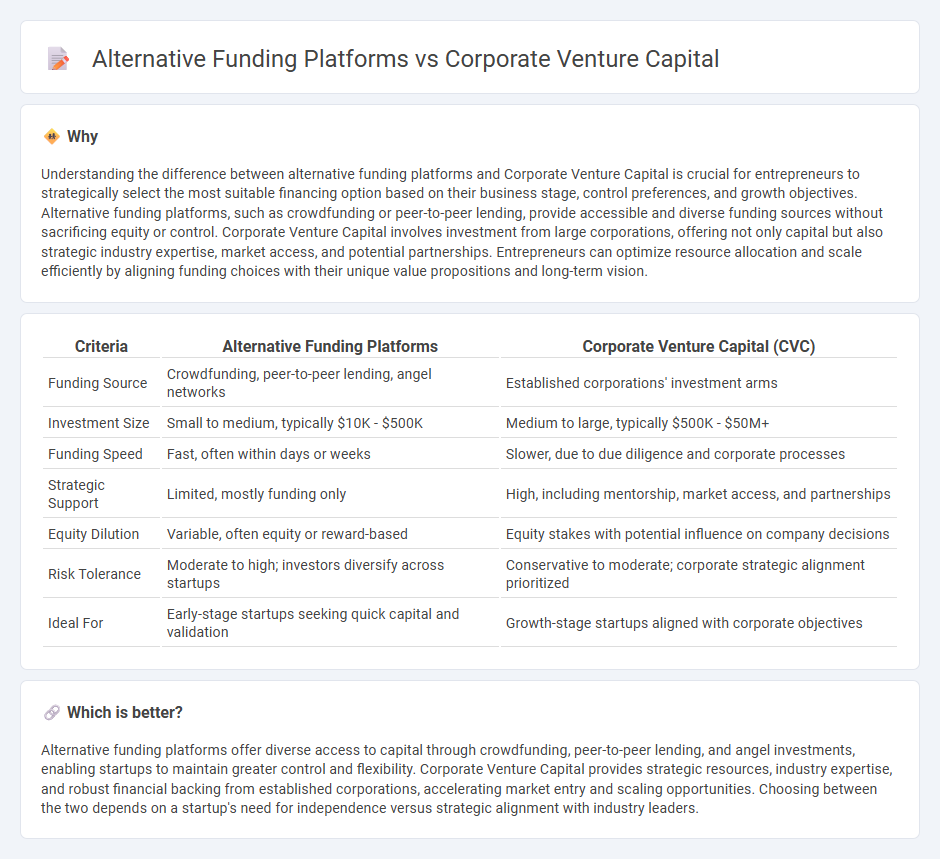

Understanding the difference between alternative funding platforms and Corporate Venture Capital is crucial for entrepreneurs to strategically select the most suitable financing option based on their business stage, control preferences, and growth objectives. Alternative funding platforms, such as crowdfunding or peer-to-peer lending, provide accessible and diverse funding sources without sacrificing equity or control. Corporate Venture Capital involves investment from large corporations, offering not only capital but also strategic industry expertise, market access, and potential partnerships. Entrepreneurs can optimize resource allocation and scale efficiently by aligning funding choices with their unique value propositions and long-term vision.

Comparison Table

| Criteria | Alternative Funding Platforms | Corporate Venture Capital (CVC) |

|---|---|---|

| Funding Source | Crowdfunding, peer-to-peer lending, angel networks | Established corporations' investment arms |

| Investment Size | Small to medium, typically $10K - $500K | Medium to large, typically $500K - $50M+ |

| Funding Speed | Fast, often within days or weeks | Slower, due to due diligence and corporate processes |

| Strategic Support | Limited, mostly funding only | High, including mentorship, market access, and partnerships |

| Equity Dilution | Variable, often equity or reward-based | Equity stakes with potential influence on company decisions |

| Risk Tolerance | Moderate to high; investors diversify across startups | Conservative to moderate; corporate strategic alignment prioritized |

| Ideal For | Early-stage startups seeking quick capital and validation | Growth-stage startups aligned with corporate objectives |

Which is better?

Alternative funding platforms offer diverse access to capital through crowdfunding, peer-to-peer lending, and angel investments, enabling startups to maintain greater control and flexibility. Corporate Venture Capital provides strategic resources, industry expertise, and robust financial backing from established corporations, accelerating market entry and scaling opportunities. Choosing between the two depends on a startup's need for independence versus strategic alignment with industry leaders.

Connection

Alternative funding platforms, such as crowdfunding and peer-to-peer lending, provide startups with access to diverse capital sources outside traditional venture capital. Corporate Venture Capital (CVC) complements these platforms by injecting strategic investments from established corporations, fostering innovation and market expansion. Both funding avenues collaborate to enhance entrepreneurial ecosystem liquidity and enable scalable growth opportunities.

Key Terms

Strategic Investment

Corporate Venture Capital (CVC) provides startups with more than just financial backing, offering strategic investment through industry expertise, market access, and long-term partnership opportunities that alternative funding platforms often lack. Unlike crowdfunding or traditional venture capital, CVC aligns the startup's growth objectives with the corporation's innovation goals, enhancing synergies and competitive advantage. Explore how strategic investments via CVC can accelerate your startup's market positioning and innovation potential.

Equity Crowdfunding

Corporate Venture Capital (CVC) involves strategic investments by established companies in startups, providing not only capital but also industry expertise and networks. Equity crowdfunding platforms democratize startup investment by allowing a broad base of investors to acquire equity stakes, often resulting in faster fundraising and increased market validation. Explore more to understand the key differences and benefits of Corporate Venture Capital versus Equity Crowdfunding.

Syndicate Networks

Corporate Venture Capital (CVC) provides strategic investment from established companies, offering startups not only capital but also industry expertise and market access. Alternative funding platforms like syndicate networks enable groups of investors to pool resources, increasing funding reach and diversifying risk through collaborative investment opportunities. Explore the unique benefits and dynamics of syndicate networks compared to CVC to optimize your startup funding strategy.

Source and External Links

Corporate Venturing - Definition, Benefits, Examples - Corporate venture capital (CVC) is the practice of large corporations investing directly in startups to gain competitive advantage and access innovation, combining strategic and financial objectives without using third-party investment firms.

Corporate Venture Capital vs Traditional VCs - CVC differs from traditional venture capital by aligning investments with the strategic interests of the corporate parent, providing startups funding plus strategic and operational support to enhance corporate growth and innovation.

Corporate venture capital - Corporate venture capital involves investing company funds directly into innovative startups in exchange for equity, aiming to achieve competitive advantages through strategic partnerships and expertise sharing with the startups.

dowidth.com

dowidth.com