Exit planning focuses on preparing business owners for a strategic transition out of their company, emphasizing valuation, succession, and tax optimization. Mergers and acquisitions (M&A) planning involves structuring deals to combine or transfer ownership efficiently while maximizing shareholder value and minimizing risks. Explore detailed strategies to choose the best path for your business growth and legacy.

Why it is important

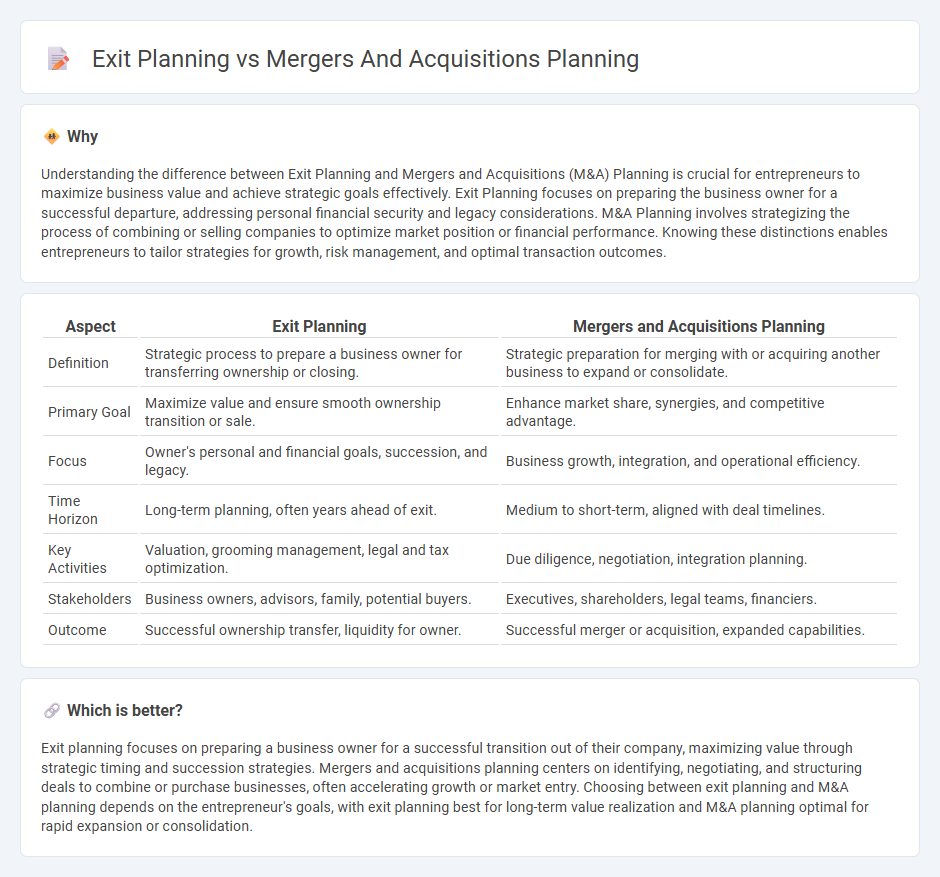

Understanding the difference between Exit Planning and Mergers and Acquisitions (M&A) Planning is crucial for entrepreneurs to maximize business value and achieve strategic goals effectively. Exit Planning focuses on preparing the business owner for a successful departure, addressing personal financial security and legacy considerations. M&A Planning involves strategizing the process of combining or selling companies to optimize market position or financial performance. Knowing these distinctions enables entrepreneurs to tailor strategies for growth, risk management, and optimal transaction outcomes.

Comparison Table

| Aspect | Exit Planning | Mergers and Acquisitions Planning |

|---|---|---|

| Definition | Strategic process to prepare a business owner for transferring ownership or closing. | Strategic preparation for merging with or acquiring another business to expand or consolidate. |

| Primary Goal | Maximize value and ensure smooth ownership transition or sale. | Enhance market share, synergies, and competitive advantage. |

| Focus | Owner's personal and financial goals, succession, and legacy. | Business growth, integration, and operational efficiency. |

| Time Horizon | Long-term planning, often years ahead of exit. | Medium to short-term, aligned with deal timelines. |

| Key Activities | Valuation, grooming management, legal and tax optimization. | Due diligence, negotiation, integration planning. |

| Stakeholders | Business owners, advisors, family, potential buyers. | Executives, shareholders, legal teams, financiers. |

| Outcome | Successful ownership transfer, liquidity for owner. | Successful merger or acquisition, expanded capabilities. |

Which is better?

Exit planning focuses on preparing a business owner for a successful transition out of their company, maximizing value through strategic timing and succession strategies. Mergers and acquisitions planning centers on identifying, negotiating, and structuring deals to combine or purchase businesses, often accelerating growth or market entry. Choosing between exit planning and M&A planning depends on the entrepreneur's goals, with exit planning best for long-term value realization and M&A planning optimal for rapid expansion or consolidation.

Connection

Exit planning and mergers and acquisitions (M&A) planning are interconnected strategies focused on maximizing business value during ownership transition. Exit planning prepares entrepreneurs by identifying optimal timing, valuation, and potential buyers, closely aligning with M&A processes that execute these sales through negotiation, due diligence, and integration. Effective collaboration between exit planning and M&A ensures seamless transfer of assets, smooth transition of leadership, and alignment of stakeholder interests to capitalize on market opportunities.

Key Terms

Due Diligence

Mergers and acquisitions planning emphasizes thorough due diligence to evaluate financial health, legal compliance, and operational risks, ensuring informed decision-making and valuation accuracy. Exit planning due diligence focuses on preparing the business for sale by identifying and addressing potential red flags that could reduce buyer confidence or deal value. Explore detailed strategies and best practices in due diligence to enhance both M&A success and exit planning outcomes.

Valuation

Valuation plays a critical role in both mergers and acquisitions (M&A) planning and exit planning, serving as the foundation for determining fair market value and negotiating deal terms. M&A valuation focuses on assessing synergy potential and future growth prospects, while exit planning valuation emphasizes maximizing personal wealth and tax efficiency for business owners. Explore comprehensive strategies to optimize valuation in your M&A or exit planning process.

Succession Strategy

Mergers and acquisitions planning focuses on integrating companies to maximize value creation and market presence, while exit planning emphasizes preparing business owners for a strategic transition, often driven by succession strategy to ensure leadership continuity. A well-crafted succession plan aligns with both goals by identifying and developing future leaders, safeguarding organizational stability, and enhancing company valuation. Explore how effective succession strategies bridge the gap between M&A and exit planning for sustainable business growth.

Source and External Links

M&A Best Practices: From Initial Planning to Successful Integration - Effective M&A planning involves starting integration planning early during due diligence to set clear goals, assign responsibilities, and develop communication strategies, while balancing integration efforts with maintaining ongoing business operations.

Ultimate Guide to Mergers & Acquisitions - Cloudficient - M&A planning typically entails developing a clear acquisition strategy, identifying suitable targets, conducting thorough due diligence, and valuing the target company to align with strategic objectives.

How to write a comprehensive business acquisition plan - A comprehensive M&A plan includes due diligence, deal structure, detailed integration planning, risk assessment, assignment of acquisition team roles, and potentially an exit strategy for long-term flexibility.

dowidth.com

dowidth.com