Consumer behavior diverges sharply between doom spending, characterized by cautious saving during economic uncertainty, and revenge spending, marked by a surge in purchases fueled by pent-up demand following periods of restriction. Doom spending reflects a defensive financial strategy amid fears of recession, while revenge spending drives accelerated economic recovery through increased retail sales and services. Explore the dynamics and implications of these contrasting spending patterns in today's economy.

Why it is important

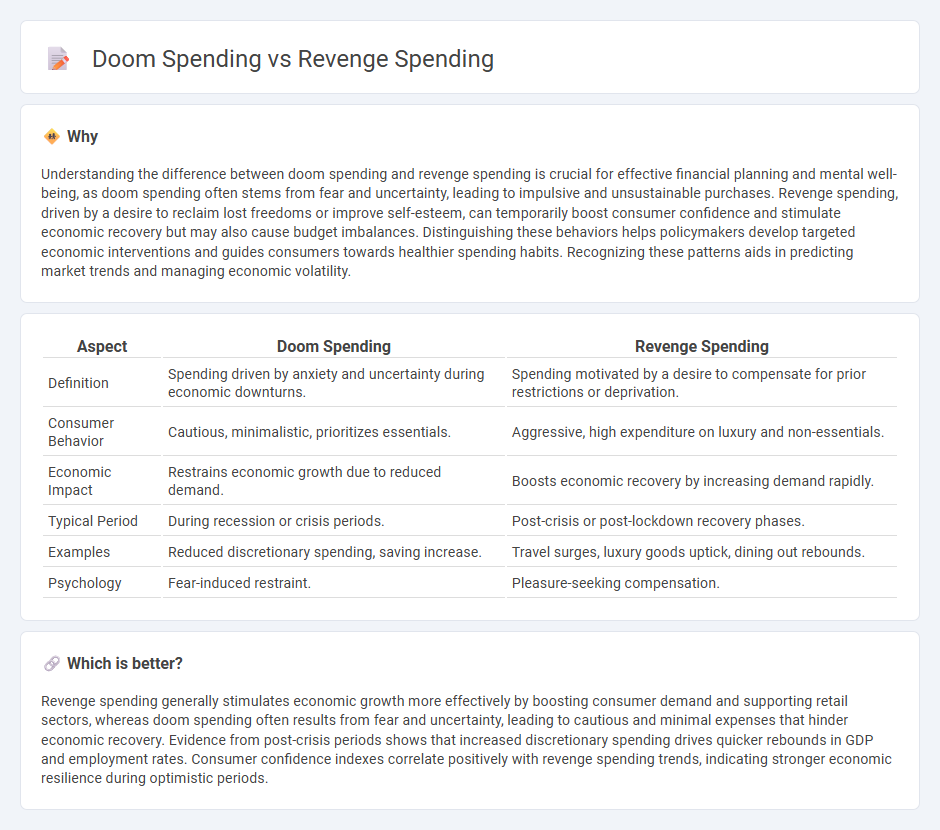

Understanding the difference between doom spending and revenge spending is crucial for effective financial planning and mental well-being, as doom spending often stems from fear and uncertainty, leading to impulsive and unsustainable purchases. Revenge spending, driven by a desire to reclaim lost freedoms or improve self-esteem, can temporarily boost consumer confidence and stimulate economic recovery but may also cause budget imbalances. Distinguishing these behaviors helps policymakers develop targeted economic interventions and guides consumers towards healthier spending habits. Recognizing these patterns aids in predicting market trends and managing economic volatility.

Comparison Table

| Aspect | Doom Spending | Revenge Spending |

|---|---|---|

| Definition | Spending driven by anxiety and uncertainty during economic downturns. | Spending motivated by a desire to compensate for prior restrictions or deprivation. |

| Consumer Behavior | Cautious, minimalistic, prioritizes essentials. | Aggressive, high expenditure on luxury and non-essentials. |

| Economic Impact | Restrains economic growth due to reduced demand. | Boosts economic recovery by increasing demand rapidly. |

| Typical Period | During recession or crisis periods. | Post-crisis or post-lockdown recovery phases. |

| Examples | Reduced discretionary spending, saving increase. | Travel surges, luxury goods uptick, dining out rebounds. |

| Psychology | Fear-induced restraint. | Pleasure-seeking compensation. |

Which is better?

Revenge spending generally stimulates economic growth more effectively by boosting consumer demand and supporting retail sectors, whereas doom spending often results from fear and uncertainty, leading to cautious and minimal expenses that hinder economic recovery. Evidence from post-crisis periods shows that increased discretionary spending drives quicker rebounds in GDP and employment rates. Consumer confidence indexes correlate positively with revenge spending trends, indicating stronger economic resilience during optimistic periods.

Connection

Doom spending and revenge spending both reflect consumer behavioral responses to economic uncertainty and social restrictions, where doom spending arises from anxiety and fear during downturns, while revenge spending emerges as a rebound effect when consumers regain confidence. These phenomena impact economic recovery cycles, influencing sectors like retail and hospitality by fluctuating demand patterns. Understanding their interplay helps businesses and policymakers anticipate shifts in consumer expenditure and tailor strategies to stabilize markets.

Key Terms

Consumer Behavior

Revenge spending, characterized by increased consumer purchases following periods of restricted activity, contrasts with doom spending, where consumers conserve funds due to economic uncertainty or fear. Both behaviors reflect psychological responses to external stressors but diverge in their impact on market demand and sectors like retail and travel. Explore the dynamics of these contrasting consumer behaviors to better understand shifting economic trends.

Economic Recovery

Revenge spending, characterized by increased consumer expenditure following periods of economic restriction, stimulates economic recovery by boosting demand for goods and services, leading to job creation and business growth. Doom spending, driven by fear and uncertainty during economic downturns, forces consumers to cut non-essential expenses, thereby slowing economic recovery and exacerbating financial instability. Explore more about how these contrasting consumer behaviors influence strategies for sustainable economic rebound.

Recession

Revenge spending refers to the surge in consumer purchases as people seek to reclaim pre-recession lifestyles, often seen after pandemic-related lockdowns, while doom spending reflects cautious, necessity-driven buying behavior during economic downturns. In recessions, revenge spending can stimulate economic recovery but may also risk financial overextension, whereas doom spending typically slows market demand, prolonging economic hardship. Explore how these contrasting consumer behaviors impact recession dynamics and recovery strategies.

Source and External Links

Revenge buying - Wikipedia - Revenge spending (also called revenge buying or shopping) is a surge in purchasing non-essential goods like luxury items after being deprived of shopping for extended periods, as a psychological reaction to restrictions and negative feelings like frustration caused by events such as COVID-19 lockdowns.

How to Resist Pandemic Revenge Spending - TD Stories - Revenge spending happens when people spend lavishly to compensate for difficult experiences, such as the COVID-19 pandemic, often driven by emotions or fear of missing out, but it can lead to debt and depleted savings if uncontrolled.

What Is Revenge Spending (& How Can You Avoid It)? - Western & Southern - Revenge spending is impulsive splurging on desires over needs, frequently with credit cards after periods of restriction, and can be managed by budgeting, automating savings, and selecting low-cost social activities to avoid debt and maintain financial security.

dowidth.com

dowidth.com