Scrap metal arbitrage capitalizes on price discrepancies in the global commodities market, leveraging differences in steel and metal values across regions to generate profits. Merger arbitrage involves exploiting pricing inefficiencies during corporate takeovers and acquisition announcements by buying and selling stocks of target and acquiring companies. Discover more about how these distinct arbitrage strategies impact investment decisions and economic dynamics.

Why it is important

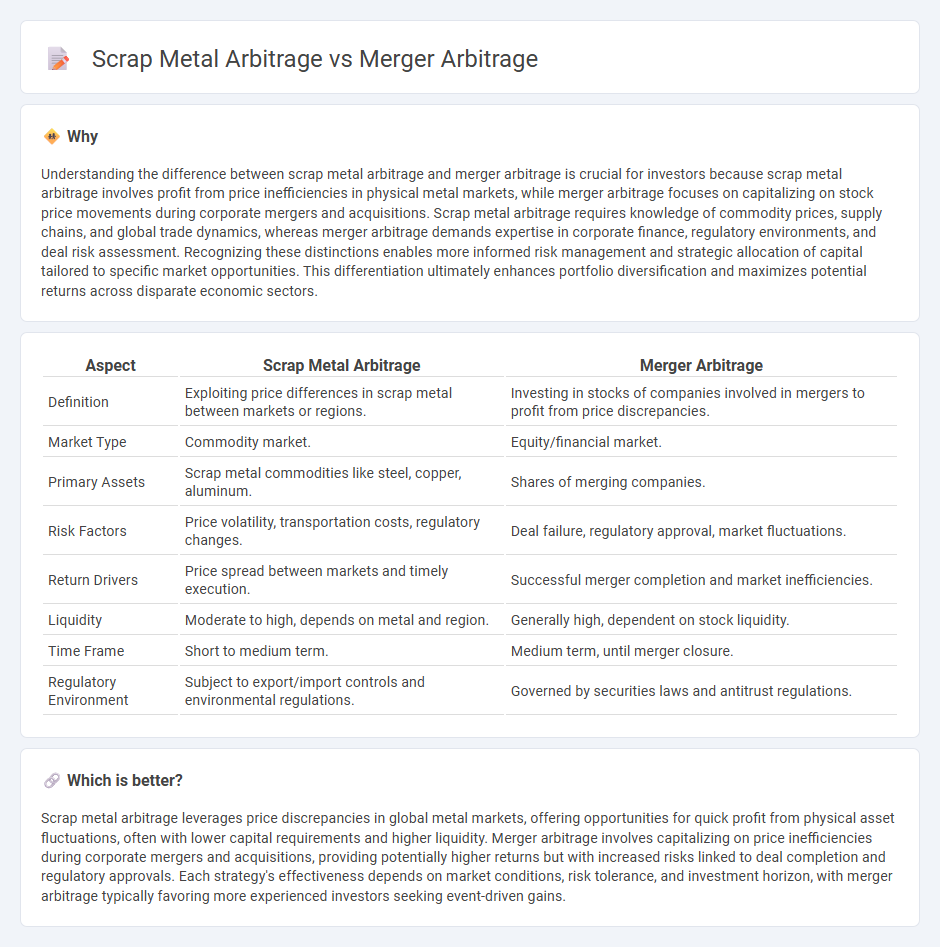

Understanding the difference between scrap metal arbitrage and merger arbitrage is crucial for investors because scrap metal arbitrage involves profit from price inefficiencies in physical metal markets, while merger arbitrage focuses on capitalizing on stock price movements during corporate mergers and acquisitions. Scrap metal arbitrage requires knowledge of commodity prices, supply chains, and global trade dynamics, whereas merger arbitrage demands expertise in corporate finance, regulatory environments, and deal risk assessment. Recognizing these distinctions enables more informed risk management and strategic allocation of capital tailored to specific market opportunities. This differentiation ultimately enhances portfolio diversification and maximizes potential returns across disparate economic sectors.

Comparison Table

| Aspect | Scrap Metal Arbitrage | Merger Arbitrage |

|---|---|---|

| Definition | Exploiting price differences in scrap metal between markets or regions. | Investing in stocks of companies involved in mergers to profit from price discrepancies. |

| Market Type | Commodity market. | Equity/financial market. |

| Primary Assets | Scrap metal commodities like steel, copper, aluminum. | Shares of merging companies. |

| Risk Factors | Price volatility, transportation costs, regulatory changes. | Deal failure, regulatory approval, market fluctuations. |

| Return Drivers | Price spread between markets and timely execution. | Successful merger completion and market inefficiencies. |

| Liquidity | Moderate to high, depends on metal and region. | Generally high, dependent on stock liquidity. |

| Time Frame | Short to medium term. | Medium term, until merger closure. |

| Regulatory Environment | Subject to export/import controls and environmental regulations. | Governed by securities laws and antitrust regulations. |

Which is better?

Scrap metal arbitrage leverages price discrepancies in global metal markets, offering opportunities for quick profit from physical asset fluctuations, often with lower capital requirements and higher liquidity. Merger arbitrage involves capitalizing on price inefficiencies during corporate mergers and acquisitions, providing potentially higher returns but with increased risks linked to deal completion and regulatory approvals. Each strategy's effectiveness depends on market conditions, risk tolerance, and investment horizon, with merger arbitrage typically favoring more experienced investors seeking event-driven gains.

Connection

Scrap metal arbitrage and merger arbitrage both exploit price discrepancies in financial markets to generate risk-adjusted returns, with scrap metal arbitrage focusing on physical commodity price differentials and merger arbitrage targeting stock price inefficiencies during corporate takeovers. Both strategies require careful analysis of market signals, supply-demand dynamics, and regulatory environments to capitalize on temporary valuation gaps. Understanding these arbitrage mechanisms enhances portfolio diversification by blending commodities and equities-driven approaches in economic cycles.

Key Terms

Risk Arbitrage

Risk arbitrage primarily involves merger arbitrage, where investors capitalize on price discrepancies following merger announcements by analyzing deal completion probabilities and regulatory risks. Scrap metal arbitrage centers on exploiting market inefficiencies in commodity pricing, influenced by global supply-demand dynamics and geopolitical factors affecting metal recycling industries. Explore deeper insights into risk arbitrage strategies and their distinct market mechanisms for enhanced investment decision-making.

Spread

Merger arbitrage capitalizes on the spread between the target company's current trading price and the acquisition price during mergers and acquisitions, offering investors potential profits from price inefficiencies. Scrap metal arbitrage exploits price differences between various scrap metal markets or regions, leveraging fluctuations in supply, demand, and transportation costs. Explore further to understand risk factors and strategies unique to each arbitrage type.

Asset Valuation

Merger arbitrage involves analyzing the valuation gap between the current trading price of a target company's stock and the anticipated acquisition price, focusing on deal risk and potential regulatory obstacles. Scrap metal arbitrage centers on assessing asset values driven by fluctuating commodity prices, supply-demand dynamics, and recycling costs that influence profit margins. Explore the nuances of asset valuation strategies in both arbitrage types for deeper insights.

Source and External Links

Merger arbitrage: Process, examples, types, and risks - Merger arbitrage is an event-driven investing strategy focusing on the merger event, where investors buy the target company's stock at a discount to its expected value if the merger succeeds, with key steps including researching the target, analyzing risk/reward, and monitoring the process.

An Introduction to Merger Arbitrage - This strategy involves profiting from the spread between the target's current stock price and the acquisition price, accounting for risks like delays or deal failure; merger types include stock-for-stock, cash, and mixed consideration mergers.

Risk arbitrage - Also called merger arbitrage, it speculates on the successful completion of mergers, with profits generated when the target's stock price moves towards the offer price, involving buying the target's stock and possibly short selling the acquirer's stock depending on the merger type.

dowidth.com

dowidth.com