De-dollarization involves reducing reliance on the U.S. dollar in global trade and finance, aiming to curb vulnerabilities linked to dollar fluctuations and U.S. monetary policy. Special Drawing Rights (SDRs) are international reserve assets created by the IMF to supplement member countries' official reserves and provide liquidity support without dependence on any single national currency. Explore how these mechanisms impact global economic stability and reshape international financial systems.

Why it is important

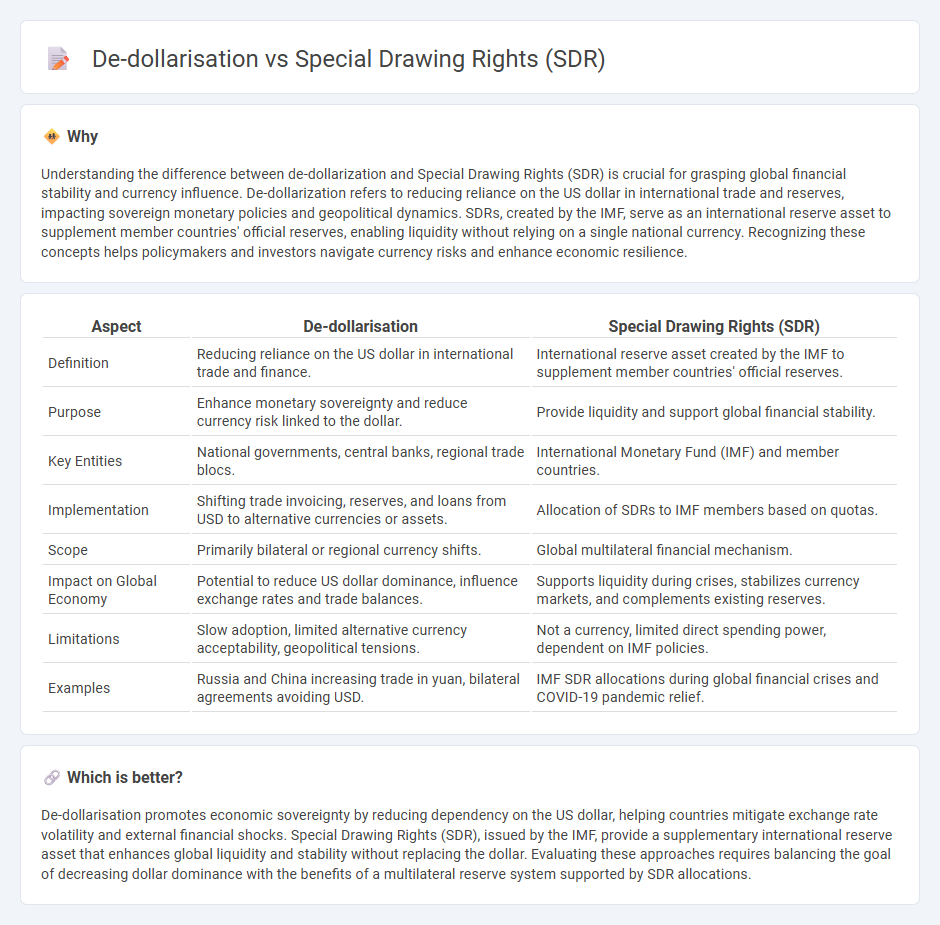

Understanding the difference between de-dollarization and Special Drawing Rights (SDR) is crucial for grasping global financial stability and currency influence. De-dollarization refers to reducing reliance on the US dollar in international trade and reserves, impacting sovereign monetary policies and geopolitical dynamics. SDRs, created by the IMF, serve as an international reserve asset to supplement member countries' official reserves, enabling liquidity without relying on a single national currency. Recognizing these concepts helps policymakers and investors navigate currency risks and enhance economic resilience.

Comparison Table

| Aspect | De-dollarisation | Special Drawing Rights (SDR) |

|---|---|---|

| Definition | Reducing reliance on the US dollar in international trade and finance. | International reserve asset created by the IMF to supplement member countries' official reserves. |

| Purpose | Enhance monetary sovereignty and reduce currency risk linked to the dollar. | Provide liquidity and support global financial stability. |

| Key Entities | National governments, central banks, regional trade blocs. | International Monetary Fund (IMF) and member countries. |

| Implementation | Shifting trade invoicing, reserves, and loans from USD to alternative currencies or assets. | Allocation of SDRs to IMF members based on quotas. |

| Scope | Primarily bilateral or regional currency shifts. | Global multilateral financial mechanism. |

| Impact on Global Economy | Potential to reduce US dollar dominance, influence exchange rates and trade balances. | Supports liquidity during crises, stabilizes currency markets, and complements existing reserves. |

| Limitations | Slow adoption, limited alternative currency acceptability, geopolitical tensions. | Not a currency, limited direct spending power, dependent on IMF policies. |

| Examples | Russia and China increasing trade in yuan, bilateral agreements avoiding USD. | IMF SDR allocations during global financial crises and COVID-19 pandemic relief. |

Which is better?

De-dollarisation promotes economic sovereignty by reducing dependency on the US dollar, helping countries mitigate exchange rate volatility and external financial shocks. Special Drawing Rights (SDR), issued by the IMF, provide a supplementary international reserve asset that enhances global liquidity and stability without replacing the dollar. Evaluating these approaches requires balancing the goal of decreasing dollar dominance with the benefits of a multilateral reserve system supported by SDR allocations.

Connection

De-dollarisation reduces reliance on the US dollar in international trade and finance, prompting countries to seek alternative reserves such as Special Drawing Rights (SDR) issued by the International Monetary Fund (IMF). SDRs offer a basket of major currencies, providing a diversified and stable asset that supports global liquidity without dependency on any single national currency. Increased SDR allocations enable nations to strengthen foreign exchange reserves and cushion economic shocks in a de-dollarised financial landscape.

Key Terms

Reserve currency

Special Drawing Rights (SDR), created by the International Monetary Fund, serve as an international reserve asset to supplement member countries' official reserves and reduce reliance on any single currency, particularly the US dollar. De-dollarization refers to efforts by some economies to decrease the dominance of the US dollar in global trade and financial systems, shifting towards alternative currencies or SDR allocations to enhance monetary sovereignty and stability. Explore the dynamics and implications of SDR and de-dollarization strategies to understand their impact on the future of global reserve currencies.

International Monetary Fund (IMF)

Special Drawing Rights (SDRs) are an international reserve asset created by the International Monetary Fund (IMF) to supplement member countries' official reserves and enhance global liquidity without relying on a single national currency. De-dollarisation refers to the process of reducing reliance on the US dollar in international trade and finance, prompting growing interest in SDRs as a more stable and neutral alternative reserve asset. Explore how the IMF's role in managing SDRs could influence the future of global monetary systems and the trajectory of de-dollarisation efforts.

Currency diversification

Special Drawing Rights (SDRs) issued by the International Monetary Fund serve as a global reserve asset designed to supplement member countries' official reserves and promote currency diversification beyond the US dollar. De-dollarization trends reflect growing efforts by countries to reduce dependency on the USD in global trade and finance, seeking stability through a basket of currencies, including the SDR, euro, yuan, and others. Explore more about how SDRs and de-dollarization strategies are reshaping international currency dynamics.

Source and External Links

What are Special Drawing Rights and why do they matter for Africa? - Special Drawing Rights (SDRs) are interest-bearing international reserve assets created by the IMF that supplement member countries' reserves and derive value from a basket of five major currencies including the US dollar, euro, yen, pound sterling, and Chinese renminbi.

Special drawing rights - Wikipedia - SDRs are supplementary foreign exchange reserve assets defined by the IMF, not a currency but a claim on freely usable currencies of IMF members, with the ISO code XDR and a value set daily based on fixed currency amounts and exchange rates of the basket currencies.

CAF completes two years as holder of Special Drawing Rights - Created by the IMF 55 years ago to strengthen countries' reserve positions, SDRs are now valued daily against a basket of five currencies and accessible only to the IMF, member countries, and authorized holders like major multilateral institutions.

dowidth.com

dowidth.com