Carbon border tax imposes import fees on goods from countries with lax carbon regulations to incentivize lower emissions globally. Renewable energy certificates represent proof that electricity is generated from renewable sources, enabling businesses to meet sustainability goals and support clean energy development. Explore how these mechanisms shape the future of global trade and environmental policy.

Why it is important

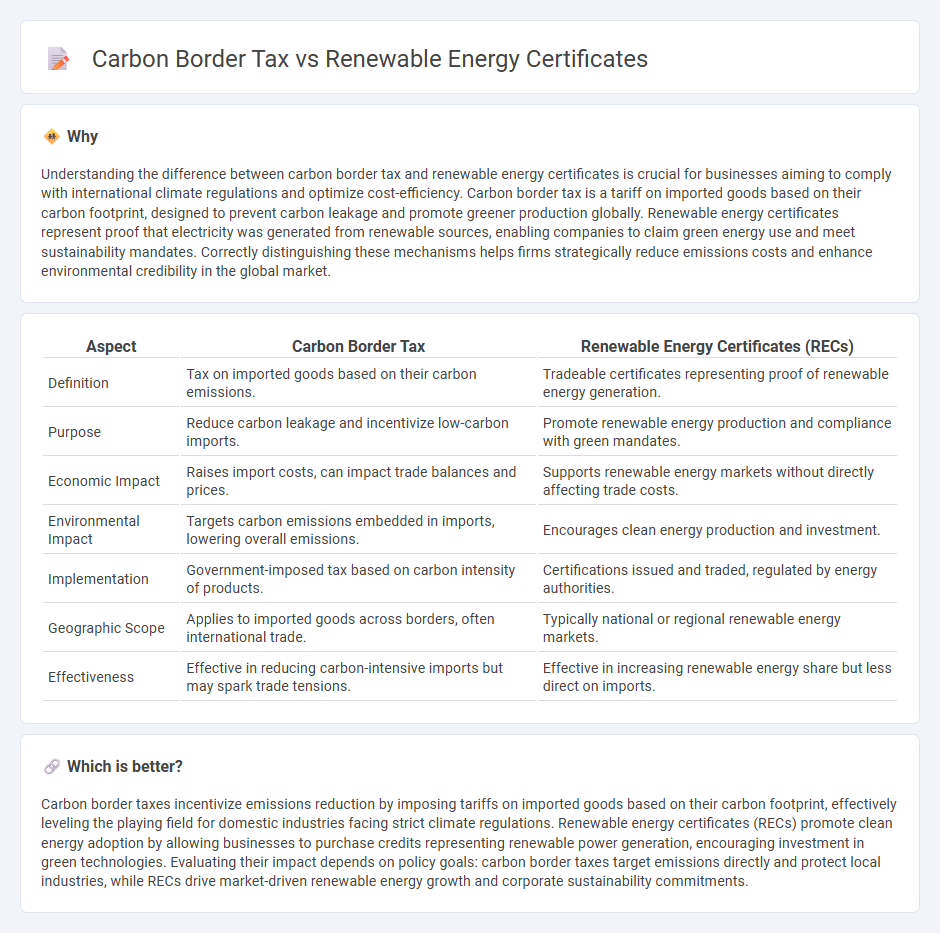

Understanding the difference between carbon border tax and renewable energy certificates is crucial for businesses aiming to comply with international climate regulations and optimize cost-efficiency. Carbon border tax is a tariff on imported goods based on their carbon footprint, designed to prevent carbon leakage and promote greener production globally. Renewable energy certificates represent proof that electricity was generated from renewable sources, enabling companies to claim green energy use and meet sustainability mandates. Correctly distinguishing these mechanisms helps firms strategically reduce emissions costs and enhance environmental credibility in the global market.

Comparison Table

| Aspect | Carbon Border Tax | Renewable Energy Certificates (RECs) |

|---|---|---|

| Definition | Tax on imported goods based on their carbon emissions. | Tradeable certificates representing proof of renewable energy generation. |

| Purpose | Reduce carbon leakage and incentivize low-carbon imports. | Promote renewable energy production and compliance with green mandates. |

| Economic Impact | Raises import costs, can impact trade balances and prices. | Supports renewable energy markets without directly affecting trade costs. |

| Environmental Impact | Targets carbon emissions embedded in imports, lowering overall emissions. | Encourages clean energy production and investment. |

| Implementation | Government-imposed tax based on carbon intensity of products. | Certifications issued and traded, regulated by energy authorities. |

| Geographic Scope | Applies to imported goods across borders, often international trade. | Typically national or regional renewable energy markets. |

| Effectiveness | Effective in reducing carbon-intensive imports but may spark trade tensions. | Effective in increasing renewable energy share but less direct on imports. |

Which is better?

Carbon border taxes incentivize emissions reduction by imposing tariffs on imported goods based on their carbon footprint, effectively leveling the playing field for domestic industries facing strict climate regulations. Renewable energy certificates (RECs) promote clean energy adoption by allowing businesses to purchase credits representing renewable power generation, encouraging investment in green technologies. Evaluating their impact depends on policy goals: carbon border taxes target emissions directly and protect local industries, while RECs drive market-driven renewable energy growth and corporate sustainability commitments.

Connection

Carbon border tax imposes a tariff on imported goods based on their carbon emissions, encouraging producers to lower their carbon footprint. Renewable energy certificates (RECs) track and verify renewable energy generation, enabling companies to claim renewable energy use and reduce reported emissions. Together, these mechanisms incentivize cleaner production methods by linking import costs with verified renewable energy consumption, promoting global carbon reduction efforts.

Key Terms

Greenhouse Gas Emissions

Renewable Energy Certificates (RECs) represent proof that electricity was generated from a renewable energy resource, directly contributing to the reduction of greenhouse gas emissions by supporting clean energy projects. The Carbon Border Tax imposes a fee on imported goods based on their carbon footprint, aiming to prevent carbon leakage and encourage producers worldwide to lower greenhouse gas emissions. Explore how these mechanisms interact to drive global efforts in mitigating climate change and promoting sustainable trade.

Trade Regulation

Renewable Energy Certificates (RECs) serve as market-based instruments allowing companies to claim usage of renewable energy, facilitating compliance with environmental standards across borders without directly imposing restrictions on imports. Carbon Border Tax, also known as Carbon Border Adjustment Mechanism (CBAM), is a trade regulation tool designed to impose tariffs on imported goods based on their carbon emissions, aiming to prevent carbon leakage and level the playing field for domestic industries adhering to stringent climate policies. Explore how these mechanisms interact to shape international trade regulations and the evolving landscape of carbon accountability.

Market Incentives

Renewable energy certificates (RECs) offer market incentives by enabling companies to demonstrate their commitment to green energy through tradable certificates, thus promoting investment in renewable power generation. Carbon border tax imposes tariffs on imported goods based on their carbon footprint, creating a financial motive for exporters to reduce emissions and align with stricter environmental standards. Explore more about how these mechanisms drive global sustainability and economic competitiveness.

Source and External Links

Renewable Energy Certificate (United States) - Wikipedia - Renewable Energy Certificates (RECs) are tradable certificates representing proof that 1 MWh of electricity was generated from renewable resources and fed into the grid, used in compliance and voluntary markets in the U.S.

Renewable Energy Credits (RECs): What You Need To Know - RECs represent the clean energy attributes of renewable electricity and allow buyers to claim the renewable aspect of electricity generation, even when the physical electrons come from mixed sources on the grid.

Renewable Energy Certificates (RECs) | US EPA - RECs are market-based instruments assigning rights to environmental and social attributes of 1 MWh of renewable electricity generation, including detailed data about the source and issuance to track renewable energy production.

dowidth.com

dowidth.com