Supercore inflation measures the persistent rise in prices excluding volatile food and energy sectors, reflecting underlying inflation trends in the overall economy. Sectoral inflation focuses on price changes within specific industries, highlighting uneven impacts across markets such as housing, healthcare, or technology. Explore how these inflation metrics influence economic policies and investment strategies.

Why it is important

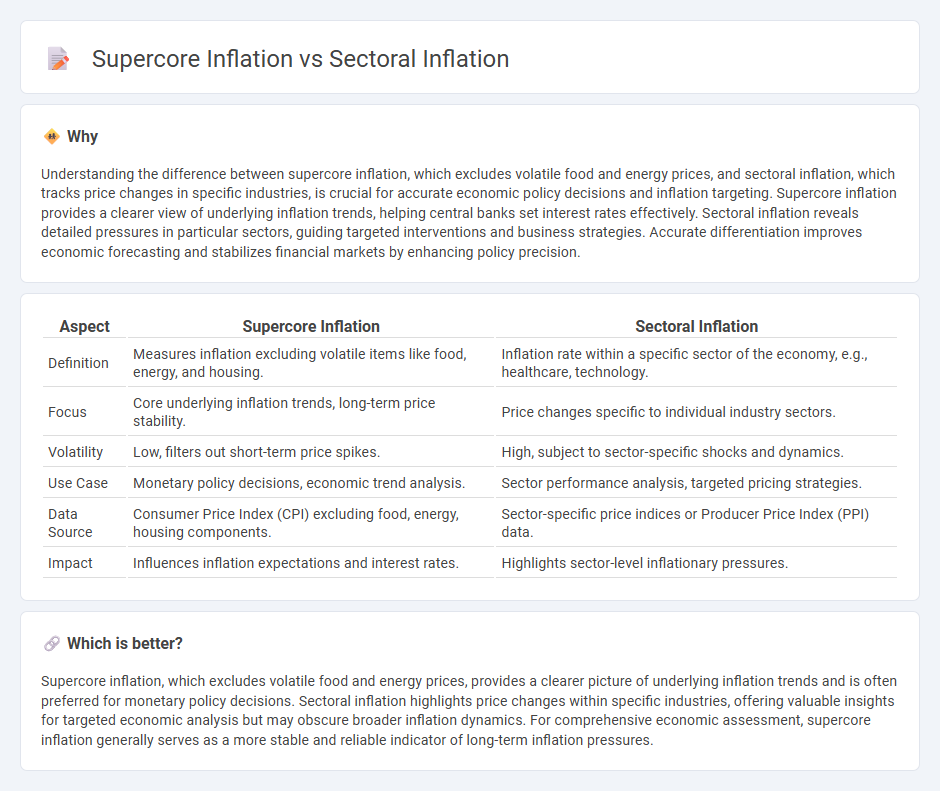

Understanding the difference between supercore inflation, which excludes volatile food and energy prices, and sectoral inflation, which tracks price changes in specific industries, is crucial for accurate economic policy decisions and inflation targeting. Supercore inflation provides a clearer view of underlying inflation trends, helping central banks set interest rates effectively. Sectoral inflation reveals detailed pressures in particular sectors, guiding targeted interventions and business strategies. Accurate differentiation improves economic forecasting and stabilizes financial markets by enhancing policy precision.

Comparison Table

| Aspect | Supercore Inflation | Sectoral Inflation |

|---|---|---|

| Definition | Measures inflation excluding volatile items like food, energy, and housing. | Inflation rate within a specific sector of the economy, e.g., healthcare, technology. |

| Focus | Core underlying inflation trends, long-term price stability. | Price changes specific to individual industry sectors. |

| Volatility | Low, filters out short-term price spikes. | High, subject to sector-specific shocks and dynamics. |

| Use Case | Monetary policy decisions, economic trend analysis. | Sector performance analysis, targeted pricing strategies. |

| Data Source | Consumer Price Index (CPI) excluding food, energy, housing components. | Sector-specific price indices or Producer Price Index (PPI) data. |

| Impact | Influences inflation expectations and interest rates. | Highlights sector-level inflationary pressures. |

Which is better?

Supercore inflation, which excludes volatile food and energy prices, provides a clearer picture of underlying inflation trends and is often preferred for monetary policy decisions. Sectoral inflation highlights price changes within specific industries, offering valuable insights for targeted economic analysis but may obscure broader inflation dynamics. For comprehensive economic assessment, supercore inflation generally serves as a more stable and reliable indicator of long-term inflation pressures.

Connection

Supercore inflation, which measures the price changes in services less affected by short-term volatility, closely relates to sectoral inflation as it reflects persistent underlying inflation trends within specific economic sectors like housing and healthcare. Sectoral inflation variations influence the supercore index by signaling price pressures that are slower to adjust, offering a detailed view of inflation persistence across different parts of the economy. Monitoring these connections helps economists gauge long-term inflationary risks and tailor monetary policy effectively.

Key Terms

Sectoral Price Index

Sectoral inflation measures price changes within specific industry sectors, highlighting variations in cost pressures across different economic segments, while supercore inflation excludes volatile food and energy prices to provide a clearer view of underlying inflation trends. The Sectoral Price Index captures these price fluctuations by aggregating data from key sectors, offering granular insights critical for targeted monetary policy and economic analysis. Explore our detailed breakdown to understand the implications of sectoral versus supercore inflation on market dynamics.

Core Personal Consumption Expenditures (Core PCE)

Sectoral inflation measures price changes within specific industries or categories, providing insights into targeted economic pressures, while supercore inflation, derived from Core Personal Consumption Expenditures (Core PCE), captures the most persistent and broad-based inflation trends by excluding volatile sectors like food and energy. Core PCE inflation is favored by policymakers for its ability to reflect underlying inflationary pressures impacting monetary policy decisions. Explore deeper into Core PCE dynamics and its implications for economic forecasting and policy strategies.

Services Excluding Housing

Sectoral inflation measures price changes in specific economic categories, while supercore inflation concentrates on stable, non-volatile services excluding housing, reflecting underlying inflation trends more accurately. Services excluding housing represent a critical component due to their lower susceptibility to supply shocks, offering insights into persistent inflation pressures. Explore deeper analyses and data to understand the nuances between sectoral and supercore inflation.

Source and External Links

The Distribution of Sectoral Price Changes and Recent Inflation Developments - Sectoral inflation shows varied price changes across goods and services sectors, with bimodal patterns where some sectors have low inflation and others remain high, revealing complex dynamics beyond aggregate inflation measures in 2023.

What Does Sectoral Inflation Tell Us About the Aggregate Trend in Inflation? - A multisector statistical model uses time-varying weights on sectoral inflation to better estimate the overall inflation trend, suggesting a lower trend inflation rate than aggregate data imply, helping guide monetary policy decisions.

Pipeline pressures and sectoral inflation dynamics (ECB paper) - Sectoral inflation is influenced significantly by sector-specific shocks and pipeline pressures within production chains, which contribute to the persistence and volatility of inflation at both sectoral and aggregate levels.

dowidth.com

dowidth.com