Revenge spending describes the surge in consumer expenditures following periods of restricted spending, often seen after economic lockdowns or crises. Forced saving occurs when individuals are unable to spend due to external constraints, resulting in accumulated savings that may later fuel consumption bursts. Discover how these contrasting behaviors impact economic recovery and consumer trends.

Why it is important

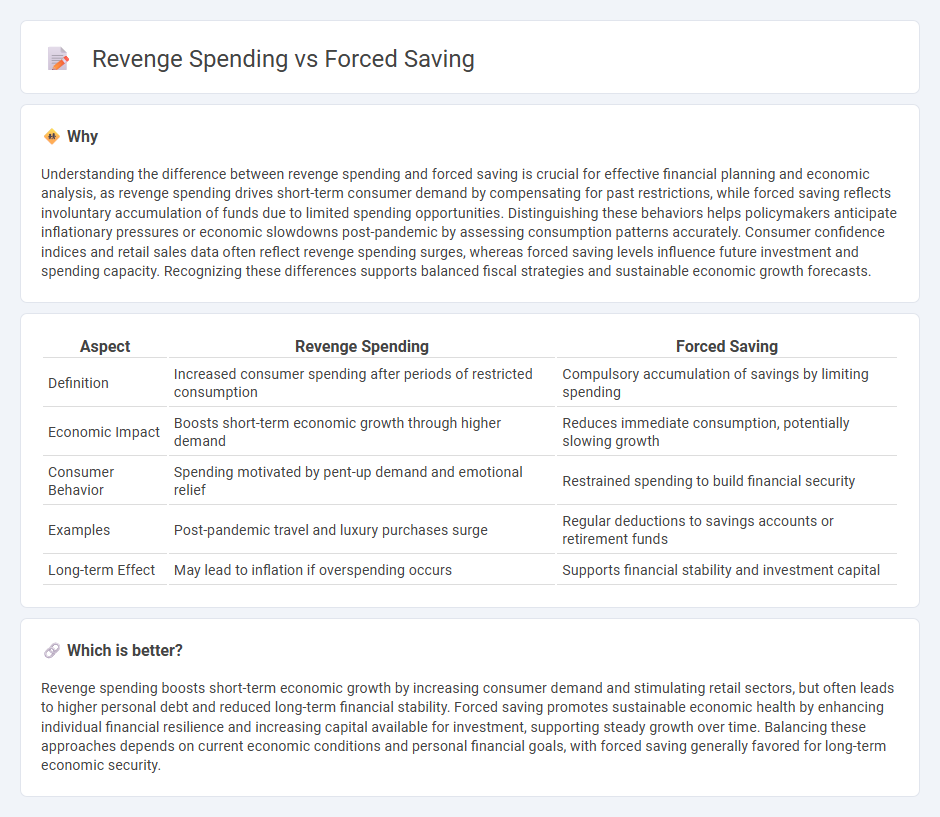

Understanding the difference between revenge spending and forced saving is crucial for effective financial planning and economic analysis, as revenge spending drives short-term consumer demand by compensating for past restrictions, while forced saving reflects involuntary accumulation of funds due to limited spending opportunities. Distinguishing these behaviors helps policymakers anticipate inflationary pressures or economic slowdowns post-pandemic by assessing consumption patterns accurately. Consumer confidence indices and retail sales data often reflect revenge spending surges, whereas forced saving levels influence future investment and spending capacity. Recognizing these differences supports balanced fiscal strategies and sustainable economic growth forecasts.

Comparison Table

| Aspect | Revenge Spending | Forced Saving |

|---|---|---|

| Definition | Increased consumer spending after periods of restricted consumption | Compulsory accumulation of savings by limiting spending |

| Economic Impact | Boosts short-term economic growth through higher demand | Reduces immediate consumption, potentially slowing growth |

| Consumer Behavior | Spending motivated by pent-up demand and emotional relief | Restrained spending to build financial security |

| Examples | Post-pandemic travel and luxury purchases surge | Regular deductions to savings accounts or retirement funds |

| Long-term Effect | May lead to inflation if overspending occurs | Supports financial stability and investment capital |

Which is better?

Revenge spending boosts short-term economic growth by increasing consumer demand and stimulating retail sectors, but often leads to higher personal debt and reduced long-term financial stability. Forced saving promotes sustainable economic health by enhancing individual financial resilience and increasing capital available for investment, supporting steady growth over time. Balancing these approaches depends on current economic conditions and personal financial goals, with forced saving generally favored for long-term economic security.

Connection

Revenge spending drives consumer demand by encouraging individuals to increase expenditures after periods of restricted spending, boosting economic activity. Forced saving occurs when consumers are unable to spend freely during economic downturns or lockdowns, accumulating savings unintentionally. The interplay between forced saving and revenge spending creates a surge in consumption once restrictions ease, impacting inflation and growth trends in the economy.

Key Terms

Consumption patterns

Forced saving occurs when individuals reduce consumption due to external constraints such as lockdowns or limited spending opportunities, resulting in accumulated savings. Revenge spending refers to a surge in consumption as consumers seek to compensate for prior restrictions by increasing discretionary purchases, especially in sectors like travel, dining, and luxury goods. Explore how these contrasting consumption patterns impact economic recovery and consumer behavior trends.

Disposable income

Forced saving occurs when individuals are unable to spend their disposable income due to external restrictions or limited access to goods and services, leading to unintentional accumulation of savings. Revenge spending, in contrast, happens when individuals intentionally increase their consumption, often splurging on discretionary items as a response to previous financial restraint or deprivation, utilizing their available disposable income to compensate for past limitations. Explore more to understand how shifts in disposable income influence consumer behavior between forced saving and revenge spending.

Behavioral economics

Forced saving occurs when individuals involuntarily set aside money, often due to deductions like automatic transfers or employer contributions, influencing their future financial security through behavioral nudges. Revenge spending reflects consumer behavior where individuals increase discretionary spending in response to prior deprivation or stress, driven by psychological mechanisms like emotional compensation and perceived loss of control. Explore deeper insights into how these behavioral economics concepts shape financial decision-making and consumer patterns.

Source and External Links

Forced saving - Wikipedia - Forced saving occurs when people spend less than they earn due to consumer goods shortages, often leading to involuntary reduction in consumption.

Forced Savings Plan - A forced savings plan involves automatic transfers to ensure savings goals are met, helping individuals manage debt and achieve financial objectives.

Do you have 'forced savings', and if so what should you do with them? - Forced savings can arise from situations like the COVID pandemic, where households accumulated savings due to reduced spending, and should be managed to avoid inflation erosion and debt.

dowidth.com

dowidth.com