De-dollarization refers to the process where countries reduce their reliance on the U.S. dollar for trade, finance, and reserves, aiming to strengthen their own monetary sovereignty. Local currencyization involves increasing the use of a nation's domestic currency in international and domestic transactions to boost economic stability and reduce exchange rate risks. Explore the benefits and challenges of these strategies to understand their impact on global and local economies.

Why it is important

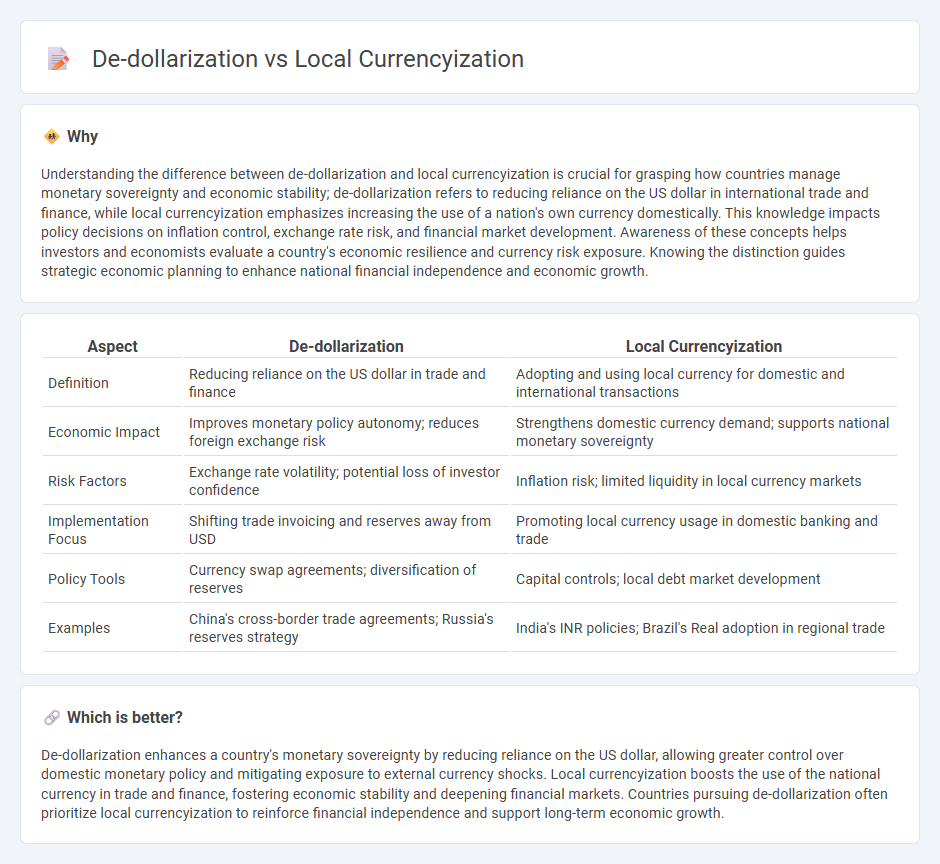

Understanding the difference between de-dollarization and local currencyization is crucial for grasping how countries manage monetary sovereignty and economic stability; de-dollarization refers to reducing reliance on the US dollar in international trade and finance, while local currencyization emphasizes increasing the use of a nation's own currency domestically. This knowledge impacts policy decisions on inflation control, exchange rate risk, and financial market development. Awareness of these concepts helps investors and economists evaluate a country's economic resilience and currency risk exposure. Knowing the distinction guides strategic economic planning to enhance national financial independence and economic growth.

Comparison Table

| Aspect | De-dollarization | Local Currencyization |

|---|---|---|

| Definition | Reducing reliance on the US dollar in trade and finance | Adopting and using local currency for domestic and international transactions |

| Economic Impact | Improves monetary policy autonomy; reduces foreign exchange risk | Strengthens domestic currency demand; supports national monetary sovereignty |

| Risk Factors | Exchange rate volatility; potential loss of investor confidence | Inflation risk; limited liquidity in local currency markets |

| Implementation Focus | Shifting trade invoicing and reserves away from USD | Promoting local currency usage in domestic banking and trade |

| Policy Tools | Currency swap agreements; diversification of reserves | Capital controls; local debt market development |

| Examples | China's cross-border trade agreements; Russia's reserves strategy | India's INR policies; Brazil's Real adoption in regional trade |

Which is better?

De-dollarization enhances a country's monetary sovereignty by reducing reliance on the US dollar, allowing greater control over domestic monetary policy and mitigating exposure to external currency shocks. Local currencyization boosts the use of the national currency in trade and finance, fostering economic stability and deepening financial markets. Countries pursuing de-dollarization often prioritize local currencyization to reinforce financial independence and support long-term economic growth.

Connection

De-dollarization and local currencyization are closely connected as both strategies aim to strengthen national economies by reducing reliance on the US dollar in international trade and domestic finance. Transitioning to local currency transactions enhances monetary sovereignty, stabilizes exchange rates, and supports inflation control by limiting exposure to dollar volatility. This shift promotes economic independence, fosters local financial market development, and enables more effective implementation of monetary policy tailored to the specific economic conditions of a country.

Key Terms

Exchange Rate Regime

Local currencyization promotes stability by encouraging the use of the domestic currency in transactions, reducing dependence on foreign currencies and mitigating exchange rate volatility. De-dollarization involves systematic efforts to reduce reliance on the US dollar in the economy through policy measures, aiming to strengthen monetary sovereignty and control over exchange rate regimes. Explore deeper insights into how these strategies reshape exchange rate policies and economic resilience.

Monetary Sovereignty

Local currencyization strengthens monetary sovereignty by promoting the use of a nation's own currency in domestic transactions, reducing dependence on foreign currencies and allowing for independent monetary policy control. De-dollarization specifically targets the reduction of U.S. dollar usage in an economy, aiming to mitigate exchange rate risks and enhance financial stability. Explore the strategies and impacts of these monetary policies to understand their role in economic independence.

Foreign Currency Substitution

Foreign Currency Substitution occurs when residents of a country use a foreign currency alongside or instead of the domestic currency, often due to economic instability or lack of trust in the local currency. Local currencyization aims to reverse this trend by encouraging the use of the national currency for transactions, savings, and contracts, enhancing monetary sovereignty and reducing exchange rate risks. Explore more about strategies and impacts of shifting from foreign currency substitution to local currencyization.

Source and External Links

Local currency - Wikipedia - Local currency is a currency accepted only in a specific region, designed to keep economic benefits within the community by encouraging local spending and maximizing the use of local resources.

Local Currencies in the 21st Century - Local currencies define regional trading areas, support independent businesses, and can take forms like consumer credit, gift money, or investment capital to strengthen local economies and community bonds.

Implementing a Local Currency Program - Establishing a local currency often involves community institutions or local government acceptance, which legitimizes the currency and enables funding of local projects without reliance on traditional banking systems.

dowidth.com

dowidth.com