Excess savings occur when households or businesses save more than they invest, leading to a surplus of capital that remains unused in productive ventures. This imbalance contributes to an investment shortage, limiting economic growth potential due to insufficient funding for new projects and innovation. Explore how this dynamic impacts financial markets and policy decisions.

Why it is important

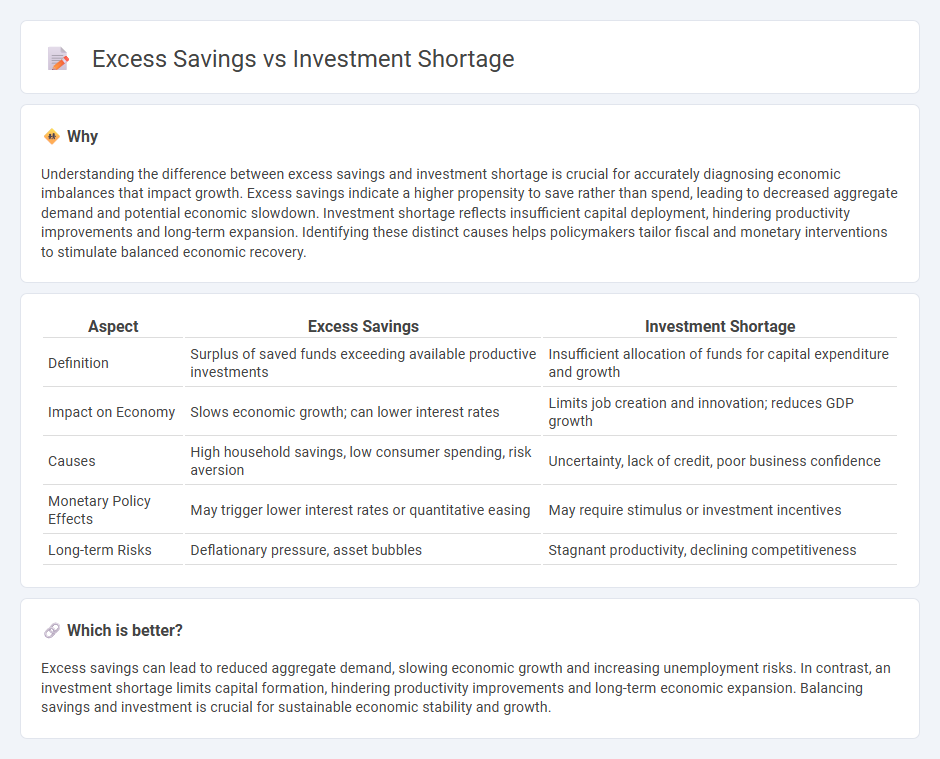

Understanding the difference between excess savings and investment shortage is crucial for accurately diagnosing economic imbalances that impact growth. Excess savings indicate a higher propensity to save rather than spend, leading to decreased aggregate demand and potential economic slowdown. Investment shortage reflects insufficient capital deployment, hindering productivity improvements and long-term expansion. Identifying these distinct causes helps policymakers tailor fiscal and monetary interventions to stimulate balanced economic recovery.

Comparison Table

| Aspect | Excess Savings | Investment Shortage |

|---|---|---|

| Definition | Surplus of saved funds exceeding available productive investments | Insufficient allocation of funds for capital expenditure and growth |

| Impact on Economy | Slows economic growth; can lower interest rates | Limits job creation and innovation; reduces GDP growth |

| Causes | High household savings, low consumer spending, risk aversion | Uncertainty, lack of credit, poor business confidence |

| Monetary Policy Effects | May trigger lower interest rates or quantitative easing | May require stimulus or investment incentives |

| Long-term Risks | Deflationary pressure, asset bubbles | Stagnant productivity, declining competitiveness |

Which is better?

Excess savings can lead to reduced aggregate demand, slowing economic growth and increasing unemployment risks. In contrast, an investment shortage limits capital formation, hindering productivity improvements and long-term economic expansion. Balancing savings and investment is crucial for sustainable economic stability and growth.

Connection

Excess savings occur when households and businesses accumulate more funds than are spent on consumption or investment, leading to a surplus of capital in the economy. This surplus can coincide with an investment shortage if firms are reluctant to undertake new projects due to low expected returns or economic uncertainty, causing a mismatch between available savings and productive investment opportunities. The imbalance dampens economic growth by reducing aggregate demand and limiting job creation, illustrating the interconnected nature of savings and investment dynamics.

Key Terms

Interest Rates

Interest rates play a critical role in balancing investment shortages and excess savings by influencing borrowing costs and the willingness of businesses and individuals to invest. When interest rates are low, excess savings tend to increase as returns on safe assets diminish, while persistent investment shortages can discourage economic growth. Explore deeper insights into how interest rate policies impact the dynamic between investment gaps and savings surpluses.

Aggregate Demand

Investment shortage limits capital formation, reducing productivity growth and aggregate demand, while excess savings indicate insufficient consumption and underutilized funds in the economy. This imbalance leads to lower economic output and hinders full employment potential due to decreased investment-driven demand. Explore deeper insights into how these factors impact macroeconomic stability and policy responses.

Liquidity Trap

A liquidity trap occurs when low interest rates fail to stimulate investment despite excess savings, leading to an investment shortage that hampers economic growth. In such scenarios, high liquidity preference causes funds to remain idle rather than being channeled into productive investments, stalling demand and output. Explore how monetary policy responds to liquidity traps to better understand strategies for overcoming investment shortages amid excess savings.

Source and External Links

(Why) Is investment weak? - Bank for International Settlements - Despite easy financing conditions globally, investment has remained weak after the Great Recession mainly due to ongoing economic uncertainty and expectations of future profits rather than a shortage of funding itself, indicating the shortage is more about business confidence than capital availability.

U.S. Housing Shortage Is Your Investment Opportunity - The U.S. is facing a significant investment shortage in housing, with a current deficit of about 5.5 million homes and rising prices, driven by strong demand and insufficient new home construction, presenting opportunities for investors amid policy efforts aimed at increasing housing supply.

$1 trillion investment shortage in senior living development - There is a projected $275 billion shortfall in senior living investment by 2030, growing to $1 trillion by 2040, resulting in a 550,000-unit housing deficit for older adults due to historically low construction rates and rapidly growing demand from demographic shifts.

dowidth.com

dowidth.com