The gig economy involves short-term, freelance work facilitated by digital platforms, contributing significantly to modern economic flexibility and innovation. In contrast, the shadow economy comprises informal or unregulated economic activities that evade taxation and legal scrutiny, impacting government revenue and economic policy. Explore the distinctions between these economic sectors to understand their implications on labor markets and fiscal strategies.

Why it is important

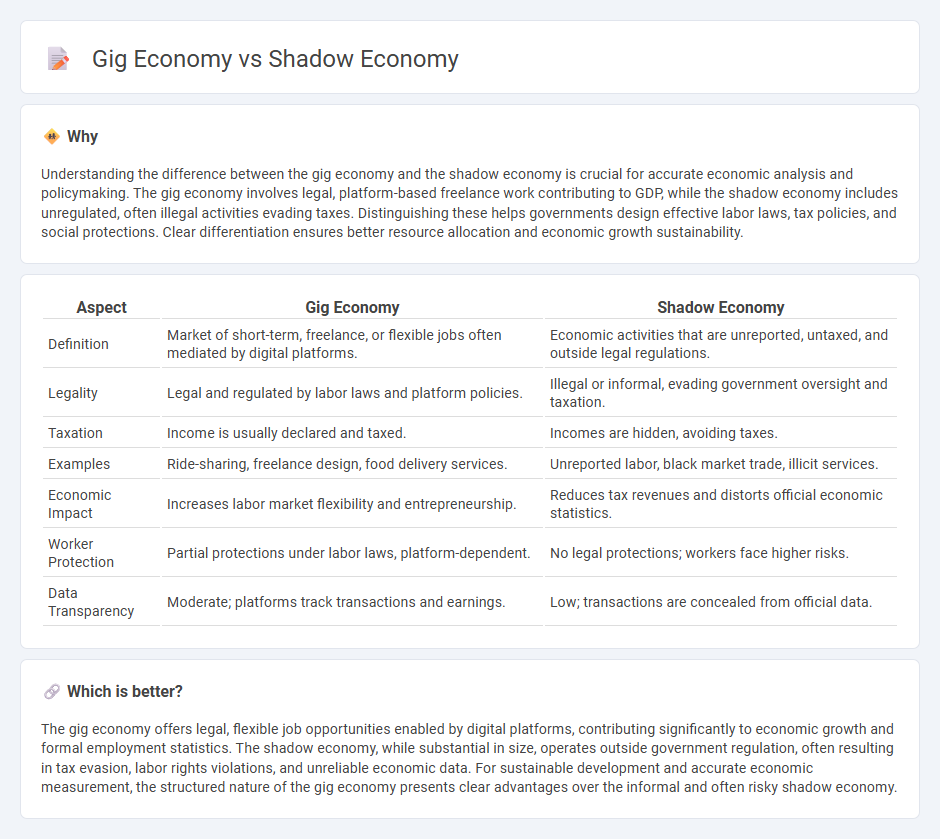

Understanding the difference between the gig economy and the shadow economy is crucial for accurate economic analysis and policymaking. The gig economy involves legal, platform-based freelance work contributing to GDP, while the shadow economy includes unregulated, often illegal activities evading taxes. Distinguishing these helps governments design effective labor laws, tax policies, and social protections. Clear differentiation ensures better resource allocation and economic growth sustainability.

Comparison Table

| Aspect | Gig Economy | Shadow Economy |

|---|---|---|

| Definition | Market of short-term, freelance, or flexible jobs often mediated by digital platforms. | Economic activities that are unreported, untaxed, and outside legal regulations. |

| Legality | Legal and regulated by labor laws and platform policies. | Illegal or informal, evading government oversight and taxation. |

| Taxation | Income is usually declared and taxed. | Incomes are hidden, avoiding taxes. |

| Examples | Ride-sharing, freelance design, food delivery services. | Unreported labor, black market trade, illicit services. |

| Economic Impact | Increases labor market flexibility and entrepreneurship. | Reduces tax revenues and distorts official economic statistics. |

| Worker Protection | Partial protections under labor laws, platform-dependent. | No legal protections; workers face higher risks. |

| Data Transparency | Moderate; platforms track transactions and earnings. | Low; transactions are concealed from official data. |

Which is better?

The gig economy offers legal, flexible job opportunities enabled by digital platforms, contributing significantly to economic growth and formal employment statistics. The shadow economy, while substantial in size, operates outside government regulation, often resulting in tax evasion, labor rights violations, and unreliable economic data. For sustainable development and accurate economic measurement, the structured nature of the gig economy presents clear advantages over the informal and often risky shadow economy.

Connection

The gig economy and shadow economy intersect through their reliance on informal, flexible labor arrangements that often escape traditional regulatory frameworks. Both sectors contribute significantly to economic activity by enabling income generation outside formal employment, yet they pose challenges for taxation and social security systems. Understanding their overlap reveals critical implications for labor policies and economic measurement accuracy.

Key Terms

Informality

The shadow economy involves unregulated and untaxed activities operating outside official economic channels, often characterized by informality and lack of legal protections. In contrast, the gig economy, driven by digital platforms, offers flexible work opportunities but still exhibits elements of informality through inconsistent income and limited labor rights. Explore the distinctions and implications of informality in both economies to understand their impact on global labor markets.

Flexibility

The shadow economy operates outside legal frameworks, offering unregulated work with flexible hours but lacking worker protections and social benefits. In contrast, the gig economy provides legal, app-mediated jobs granting workers autonomy over schedules and task choices while ensuring some degree of platform oversight and payment security. Explore deeper insights into how flexibility differentiates these economies and impacts labor dynamics.

Regulation

The shadow economy operates outside government regulation, involving unreported income and informal work that evade taxation and labor laws, whereas the gig economy consists of flexible, often digital platform-based work generally subject to some level of regulation despite ongoing debates around worker classification and protections. Regulatory frameworks for the gig economy aim to balance innovation with worker rights, including minimum wage laws, social security, and benefits, while the shadow economy poses significant challenges for enforcement, tax revenue, and social welfare systems. Explore how evolving policies address these distinct economic sectors and their impact on legal compliance and labor market dynamics.

Source and External Links

Unveiling the Shadow Economy | BCG - The shadow economy, also known as the informal or underground economy, includes economic activities operating outside official regulation and record keeping, involving both illegal acts and unreported legal transactions, often providing jobs and income for marginalized groups but causing challenges like tax revenue loss and reduced productivity.

Shadow economy | Treasury.gov.au - The shadow economy encompasses people and businesses that evade taxes and regulations through practices like under-reporting income, off-the-books wages, welfare fraud, and is recognized as undermining tax systems and creating unfair competition.

Hiding in the Shadows : The Growth of the Underground Economy - Major forces driving shadow economy growth are high tax and social security burdens plus labor market restrictions, which inflate labor costs and incentivize workers and employers to avoid official economy participation.

dowidth.com

dowidth.com