Price gouging involves sellers significantly increasing prices during emergencies, exploiting urgent demand, while collusion occurs when competing businesses secretly agree to fix prices, reduce supply, or divide markets, undermining fair competition. Both practices distort market efficiency and harm consumers by inflating costs and limiting options. Explore deeper insights and impacts of price gouging and collusion in economic markets here.

Why it is important

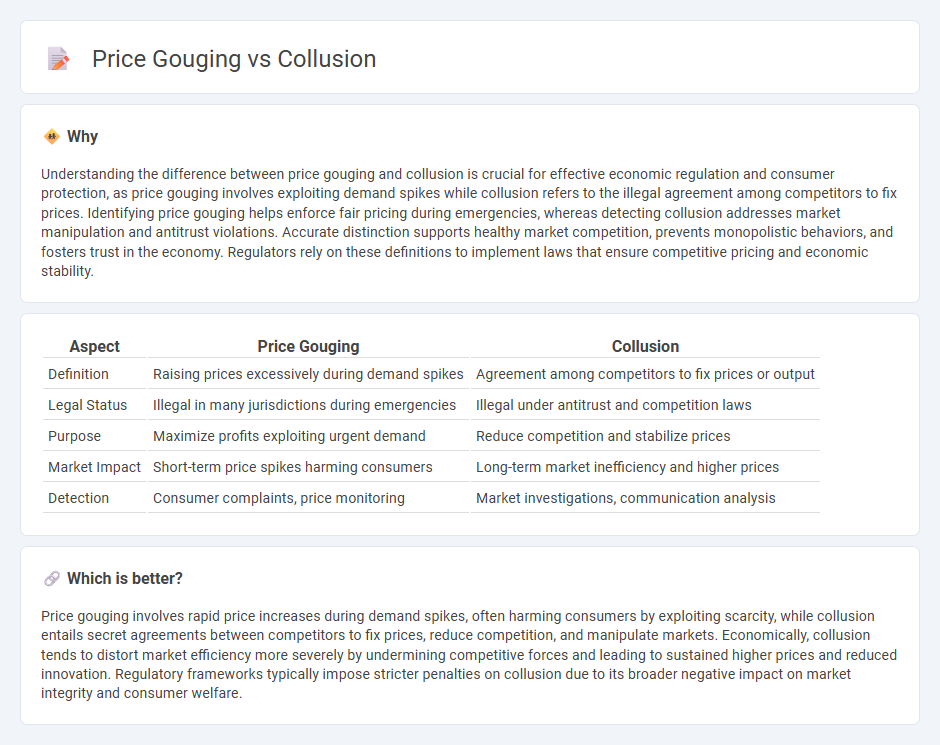

Understanding the difference between price gouging and collusion is crucial for effective economic regulation and consumer protection, as price gouging involves exploiting demand spikes while collusion refers to the illegal agreement among competitors to fix prices. Identifying price gouging helps enforce fair pricing during emergencies, whereas detecting collusion addresses market manipulation and antitrust violations. Accurate distinction supports healthy market competition, prevents monopolistic behaviors, and fosters trust in the economy. Regulators rely on these definitions to implement laws that ensure competitive pricing and economic stability.

Comparison Table

| Aspect | Price Gouging | Collusion |

|---|---|---|

| Definition | Raising prices excessively during demand spikes | Agreement among competitors to fix prices or output |

| Legal Status | Illegal in many jurisdictions during emergencies | Illegal under antitrust and competition laws |

| Purpose | Maximize profits exploiting urgent demand | Reduce competition and stabilize prices |

| Market Impact | Short-term price spikes harming consumers | Long-term market inefficiency and higher prices |

| Detection | Consumer complaints, price monitoring | Market investigations, communication analysis |

Which is better?

Price gouging involves rapid price increases during demand spikes, often harming consumers by exploiting scarcity, while collusion entails secret agreements between competitors to fix prices, reduce competition, and manipulate markets. Economically, collusion tends to distort market efficiency more severely by undermining competitive forces and leading to sustained higher prices and reduced innovation. Regulatory frameworks typically impose stricter penalties on collusion due to its broader negative impact on market integrity and consumer welfare.

Connection

Price gouging and collusion both distort market prices by reducing competition, leading to unfairly high prices for consumers. Collusion occurs when firms conspire to fix prices or limit supply, which can facilitate price gouging during high-demand periods. These anti-competitive behaviors undermine market efficiency, harm consumer welfare, and attract regulatory scrutiny aimed at promoting fair trade.

Key Terms

Oligopoly

In oligopolies, collusion occurs when a few dominant firms secretly agree to fix prices, limit production, or divide markets, undermining competition and harming consumers. Price gouging, on the other hand, involves firms exploiting market power during crises by raising prices excessively without necessarily coordinating with competitors. Explore in-depth insights on how oligopolistic market structures influence these anticompetitive behaviors and regulatory responses.

Price Fixing

Price fixing, a form of collusion, occurs when competitors agree to set prices at a certain level rather than allowing market forces to determine them, undermining competition and harming consumers. This practice contrasts with price gouging, which involves excessively raising prices during emergencies without coordinated agreements. Explore the differences and implications of price fixing in market dynamics for a deeper understanding.

Market Power

Collusion occurs when firms with significant market power coordinate to fix prices, restrict output, or divide markets, undermining competition and harming consumers. Price gouging involves firms exploiting sudden market power during emergencies by charging exorbitant prices for essential goods, often without prior collusion. Learn more about how market power influences these anti-competitive behaviors and their impact on consumer welfare.

Source and External Links

collusion | Wex | US Law | LII / Legal Information Institute - Collusion is when two or more parties secretly agree to defraud a third party or accomplish an illegal purpose, including price-fixing or market division among competitors.

Collusion - Wikipedia - Collusion is a secret agreement or cooperation between parties to limit competition, including legal tacit collusion and illegal explicit collusion such as bid rigging and price fixing.

COLLUSION | definition in the Cambridge English Dictionary - Collusion is the act of doing something secret or illegal with another person or company to deceive people, often used in legal or formal contexts.

dowidth.com

dowidth.com