Neobank stacking enables customers to access multiple digital banking services through a single platform, streamlining financial management and enhancing user convenience. Digital wallets store and manage payment information, facilitating quick transactions but often lacking the comprehensive banking functions found in neobanks. Explore how these innovations reshape the future of personal finance and digital transactions.

Why it is important

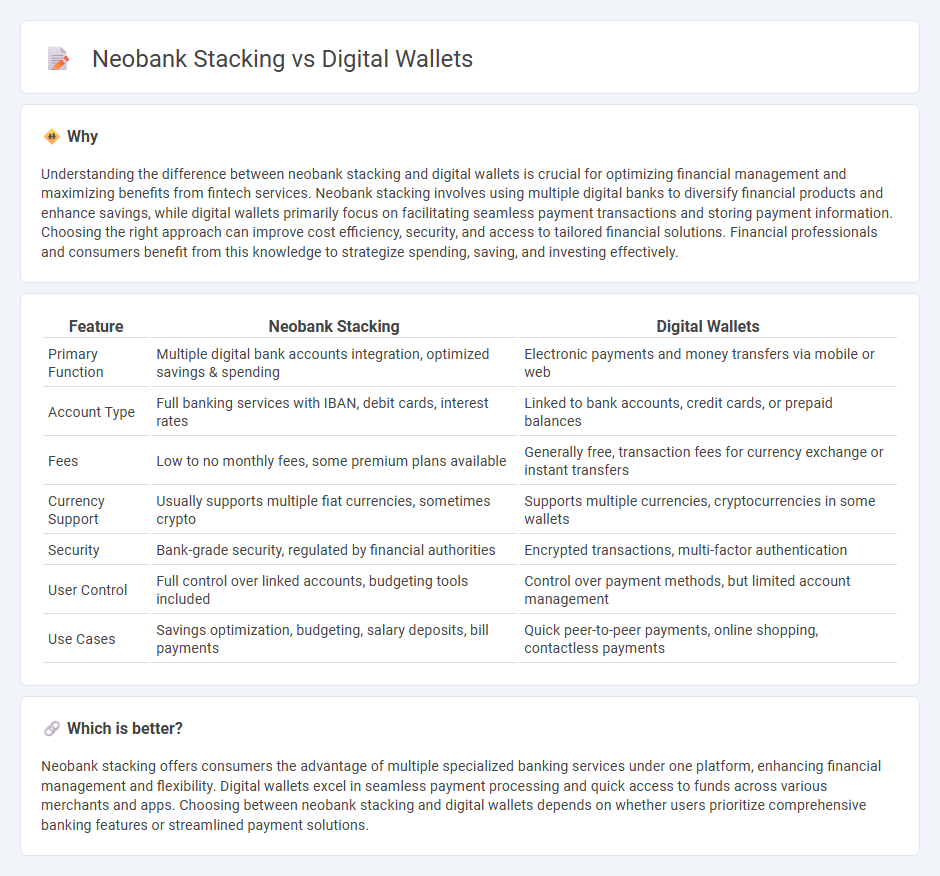

Understanding the difference between neobank stacking and digital wallets is crucial for optimizing financial management and maximizing benefits from fintech services. Neobank stacking involves using multiple digital banks to diversify financial products and enhance savings, while digital wallets primarily focus on facilitating seamless payment transactions and storing payment information. Choosing the right approach can improve cost efficiency, security, and access to tailored financial solutions. Financial professionals and consumers benefit from this knowledge to strategize spending, saving, and investing effectively.

Comparison Table

| Feature | Neobank Stacking | Digital Wallets |

|---|---|---|

| Primary Function | Multiple digital bank accounts integration, optimized savings & spending | Electronic payments and money transfers via mobile or web |

| Account Type | Full banking services with IBAN, debit cards, interest rates | Linked to bank accounts, credit cards, or prepaid balances |

| Fees | Low to no monthly fees, some premium plans available | Generally free, transaction fees for currency exchange or instant transfers |

| Currency Support | Usually supports multiple fiat currencies, sometimes crypto | Supports multiple currencies, cryptocurrencies in some wallets |

| Security | Bank-grade security, regulated by financial authorities | Encrypted transactions, multi-factor authentication |

| User Control | Full control over linked accounts, budgeting tools included | Control over payment methods, but limited account management |

| Use Cases | Savings optimization, budgeting, salary deposits, bill payments | Quick peer-to-peer payments, online shopping, contactless payments |

Which is better?

Neobank stacking offers consumers the advantage of multiple specialized banking services under one platform, enhancing financial management and flexibility. Digital wallets excel in seamless payment processing and quick access to funds across various merchants and apps. Choosing between neobank stacking and digital wallets depends on whether users prioritize comprehensive banking features or streamlined payment solutions.

Connection

Neobank stacking allows users to manage multiple neobank accounts seamlessly within one platform, enhancing the accessibility and usability of digital wallets. Digital wallets integrate with neobank services by providing streamlined payment solutions, instant transfers, and real-time balance updates across various accounts. This synergy drives financial inclusion and boosts the adoption of cashless transactions globally.

Key Terms

Digital Payments

Digital wallets enable seamless, contactless transactions by securely storing payment information on mobile devices, promoting faster and more convenient digital payments. Neobank stacking integrates multiple financial services within digital banks, offering enhanced user experiences through unified account management and advanced payment options. Explore how these innovations are revolutionizing digital payment ecosystems and user engagement.

Banking-as-a-Service

Digital wallets offer convenient access to funds and facilitate seamless transactions, while neobank stacking leverages Banking-as-a-Service (BaaS) to provide customizable, multi-institutional banking experiences through integrated platforms. BaaS enables fintechs and neobanks to build on established banking infrastructure, enhancing scalability and regulatory compliance without holding a banking license. Discover how Banking-as-a-Service transforms financial services by enabling seamless neobank stacking and digital wallet integration.

Financial Inclusion

Digital wallets provide widespread access to basic financial services through mobile devices, enabling underbanked populations to send and receive money securely without traditional bank accounts. Neobank stacking offers enhanced financial inclusion by combining multiple digital banking services, such as savings, loans, and investment products, in a single platform tailored for underserved users. Explore how integrating digital wallets with neobank stacking can transform financial inclusion strategies worldwide.

Source and External Links

Digital wallet - Wikipedia - A digital wallet, also known as an e-wallet or mobile wallet, is an electronic device, online service, or software that allows electronic transactions of digital currency or payment information for goods and services, sometimes including ID documents and using technologies like NFC.

15 Types of Digital Wallets: Comprehensive Guide - DashDevs - Digital wallets can be centralized, managed by institutions like banks (e.g., PayPal, Apple Pay), or decentralized wallets (DeFi) running on blockchain that give full user control, with key differences in security, privacy, and management.

What is a digital wallet and how do they work? - Ramp - Digital wallets store digital versions of payment cards, bank accounts, and IDs, enabling users to pay easily via smartphone taps or online checkouts, with rising global use and transaction value in billions as they become essential for businesses and consumers.

dowidth.com

dowidth.com