De-dollarisation involves reducing reliance on the U.S. dollar in global trade and finance to enhance national monetary sovereignty, while digital currency adoption focuses on integrating blockchain-based or central bank digital currencies (CBDCs) to modernize payment systems. These trends influence economic stability, cross-border transactions, and monetary policy implementation in emerging and developed markets. Explore the evolving impact of de-dollarisation and digital currencies on the global economy for deeper insights.

Why it is important

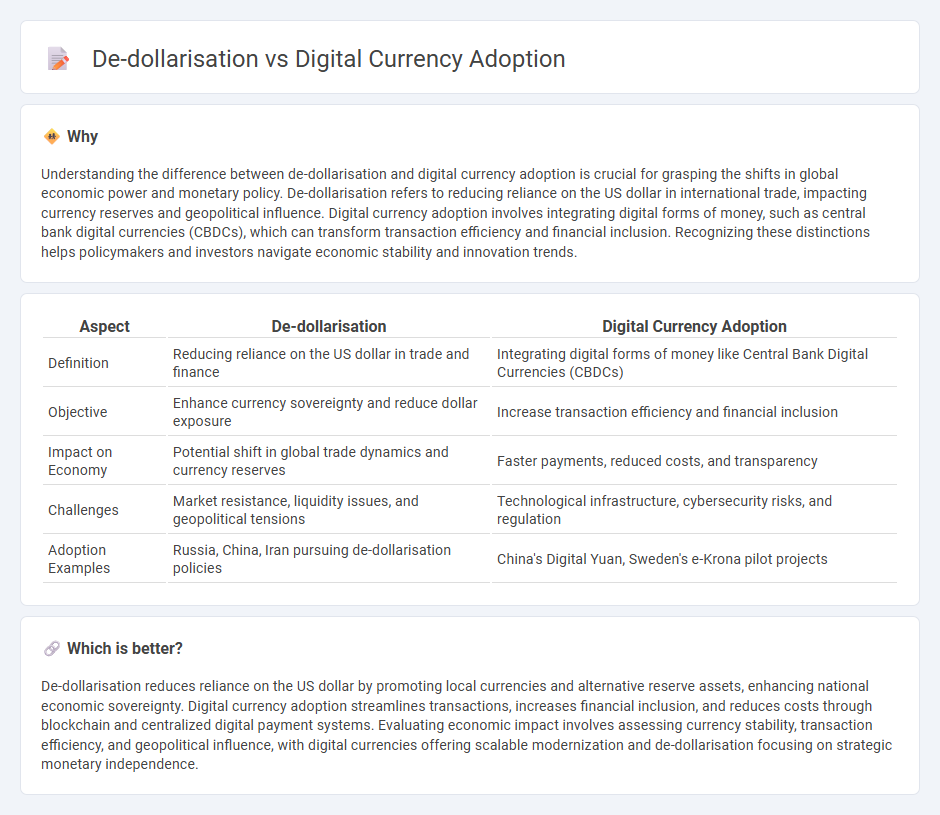

Understanding the difference between de-dollarisation and digital currency adoption is crucial for grasping the shifts in global economic power and monetary policy. De-dollarisation refers to reducing reliance on the US dollar in international trade, impacting currency reserves and geopolitical influence. Digital currency adoption involves integrating digital forms of money, such as central bank digital currencies (CBDCs), which can transform transaction efficiency and financial inclusion. Recognizing these distinctions helps policymakers and investors navigate economic stability and innovation trends.

Comparison Table

| Aspect | De-dollarisation | Digital Currency Adoption |

|---|---|---|

| Definition | Reducing reliance on the US dollar in trade and finance | Integrating digital forms of money like Central Bank Digital Currencies (CBDCs) |

| Objective | Enhance currency sovereignty and reduce dollar exposure | Increase transaction efficiency and financial inclusion |

| Impact on Economy | Potential shift in global trade dynamics and currency reserves | Faster payments, reduced costs, and transparency |

| Challenges | Market resistance, liquidity issues, and geopolitical tensions | Technological infrastructure, cybersecurity risks, and regulation |

| Adoption Examples | Russia, China, Iran pursuing de-dollarisation policies | China's Digital Yuan, Sweden's e-Krona pilot projects |

Which is better?

De-dollarisation reduces reliance on the US dollar by promoting local currencies and alternative reserve assets, enhancing national economic sovereignty. Digital currency adoption streamlines transactions, increases financial inclusion, and reduces costs through blockchain and centralized digital payment systems. Evaluating economic impact involves assessing currency stability, transaction efficiency, and geopolitical influence, with digital currencies offering scalable modernization and de-dollarisation focusing on strategic monetary independence.

Connection

De-dollarisation drives countries to reduce reliance on the US dollar by adopting digital currencies, enhancing monetary sovereignty and cross-border trade efficiency. Central bank digital currencies (CBDCs) provide an alternative to traditional dollar-dominated financial systems, enabling faster, cheaper, and more transparent transactions. This shift supports economic diversification and resilience amid fluctuating global currency dynamics and geopolitical tensions.

Key Terms

Central Bank Digital Currency (CBDC)

Central Bank Digital Currency (CBDC) adoption is accelerating globally as nations seek to modernize payment systems and enhance financial inclusion, contrasting with the de-dollarisation trend where countries reduce reliance on the US dollar to strengthen monetary sovereignty. CBDCs offer seamless cross-border transactions and mitigate risks associated with volatile foreign exchange reserves, while de-dollarisation efforts often involve diversified currency reserves and trade agreements to limit dollar dominance. Explore how CBDCs are reshaping global finance and influencing the strategic move away from dollar dependency.

Reserve Currency

The shift towards digital currency adoption accelerates global financial innovation while posing challenges to the dominance of the US dollar as the primary reserve currency. Central banks worldwide explore Central Bank Digital Currencies (CBDCs) to enhance payment efficiency and reduce reliance on traditional dollar-based systems. Discover how evolving digital currencies reshape the future of international reserves and economic sovereignty.

Cross-border Settlements

Digital currency adoption accelerates cross-border settlements by enabling faster, cheaper, and more transparent transactions compared to traditional fiat currencies. De-dollarisation efforts promote the use of alternative reserve currencies and digital assets, reducing reliance on the US dollar in global trade and finance. Explore how integrating digital currencies in cross-border payments is reshaping international economic dynamics.

Source and External Links

2025 Cryptocurrency Adoption and Consumer Sentiment Report - Cryptocurrency ownership in the U.S. has nearly doubled since 2021, with 28% of American adults owning crypto in 2025 and 14% of non-owners planning to buy it this year, although 40% of owners remain concerned about security.

Central Bank Digital Currencies in Emerging Markets - Over 80% of central banks are exploring CBDCs due to regulatory concerns around cryptocurrencies, with emerging market countries leading in crypto adoption and CBDCs seen as a way to centralize digital payments.

Central Bank Digital Currency Adoption - CBDC adoption remains slow and limited globally due to low public awareness, trust issues, and preference for existing payment methods, highlighting the need for regulatory strategies, education, and incentives to boost adoption.

dowidth.com

dowidth.com