Rentvesting offers flexibility by allowing individuals to rent where they want to live while investing in affordable properties elsewhere, maximizing financial growth opportunities. Build-to-rent developments provide purpose-built rental housing, catering to tenants seeking modern amenities and long-term stability. Explore the benefits and considerations of rentvesting versus build-to-rent to make informed investment decisions.

Why it is important

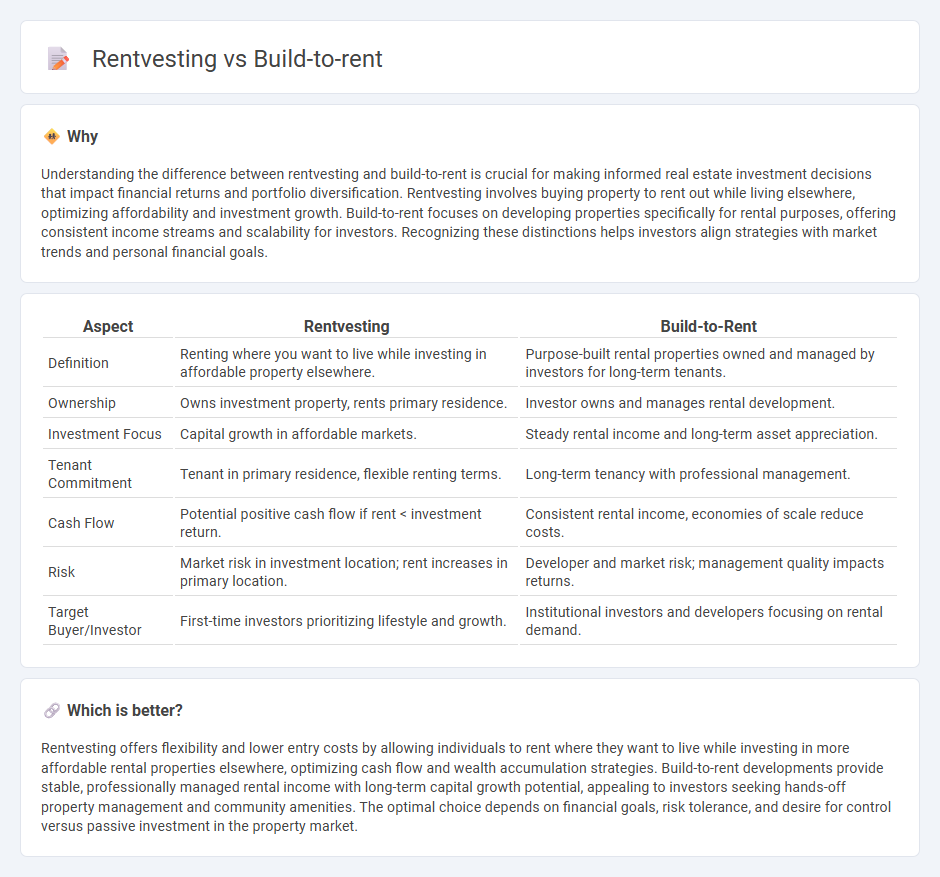

Understanding the difference between rentvesting and build-to-rent is crucial for making informed real estate investment decisions that impact financial returns and portfolio diversification. Rentvesting involves buying property to rent out while living elsewhere, optimizing affordability and investment growth. Build-to-rent focuses on developing properties specifically for rental purposes, offering consistent income streams and scalability for investors. Recognizing these distinctions helps investors align strategies with market trends and personal financial goals.

Comparison Table

| Aspect | Rentvesting | Build-to-Rent |

|---|---|---|

| Definition | Renting where you want to live while investing in affordable property elsewhere. | Purpose-built rental properties owned and managed by investors for long-term tenants. |

| Ownership | Owns investment property, rents primary residence. | Investor owns and manages rental development. |

| Investment Focus | Capital growth in affordable markets. | Steady rental income and long-term asset appreciation. |

| Tenant Commitment | Tenant in primary residence, flexible renting terms. | Long-term tenancy with professional management. |

| Cash Flow | Potential positive cash flow if rent < investment return. | Consistent rental income, economies of scale reduce costs. |

| Risk | Market risk in investment location; rent increases in primary location. | Developer and market risk; management quality impacts returns. |

| Target Buyer/Investor | First-time investors prioritizing lifestyle and growth. | Institutional investors and developers focusing on rental demand. |

Which is better?

Rentvesting offers flexibility and lower entry costs by allowing individuals to rent where they want to live while investing in more affordable rental properties elsewhere, optimizing cash flow and wealth accumulation strategies. Build-to-rent developments provide stable, professionally managed rental income with long-term capital growth potential, appealing to investors seeking hands-off property management and community amenities. The optimal choice depends on financial goals, risk tolerance, and desire for control versus passive investment in the property market.

Connection

Rentvesting allows individuals to rent properties in desirable locations while investing in build-to-rent developments, which offer purpose-built rental homes designed for long-term tenants. This strategy enables investors to generate steady rental income from build-to-rent projects while maintaining housing flexibility through rentvesting. The synergy between rentvesting and build-to-rent supports a growing rental market and encourages diversified property investment portfolios.

Key Terms

Asset Ownership

Build-to-rent properties offer tenants the opportunity to reside in purpose-built rental homes owned by institutional investors, ensuring professional management and consistent maintenance. Rentvesting allows individuals to purchase investment properties while renting where they prefer to live, enabling asset accumulation without relocating. Explore the benefits and implications of asset ownership in both strategies to determine the best approach for your financial goals.

Cash Flow

Build-to-rent properties generate consistent cash flow by providing stable rental income, often supported by professional management and high tenant demand. Rentvesting allows investors to live in affordable areas while renting out properties in higher-yield markets, maximizing cash flow through rental returns and potential capital growth. Explore the strategies to optimize your cash flow and investment portfolio further.

Investment Strategy

Build-to-rent developments offer investors steady rental income through purpose-built properties designed for long-term tenancy. Rentvesting enables individuals to invest in affordable locations while renting where they want to live, balancing property ownership with lifestyle flexibility. Explore detailed comparisons to choose the optimal investment strategy for your financial goals.

Source and External Links

What Is Build-to-Rent? | An Introductory Guide - Build-to-rent (BTR) properties are residential developments specifically designed and constructed for long-term renters, offering an alternative to traditional homeownership and catering to the growing demand for flexible, maintenance-free housing.

Build-to-Rent (BTR) Development Model - Build-to-rent communities typically consist of attached or detached homes developed together in a neighborhood, all owned and managed by a single entity, often featuring amenities similar to those in multifamily complexes and providing a sense of community alongside the benefits of single-family living.

The Build-to-Rent Shift: What Does It Mean for the US Housing Market - Build-to-rent housing refers to residential properties built primarily for rental purposes, often as entire communities, and usually retained under institutional ownership, offering renters the experience of living in single-family-style homes while benefiting from professional management and shared amenities despite market unaffordability.

dowidth.com

dowidth.com