The de-dollarization movement challenges the Bretton Woods system by seeking to reduce global reliance on the US dollar as the primary reserve currency, aiming to diversify international trade and finance through alternative currencies and new financial alliances. While the Bretton Woods system established a dollar-centric global economy anchored by fixed exchange rates and US gold reserves, current geopolitical shifts and economic strategies drive nations toward multipolar currency frameworks. Explore the evolving dynamics between de-dollarization efforts and the legacy of Bretton Woods to understand the future of international economic order.

Why it is important

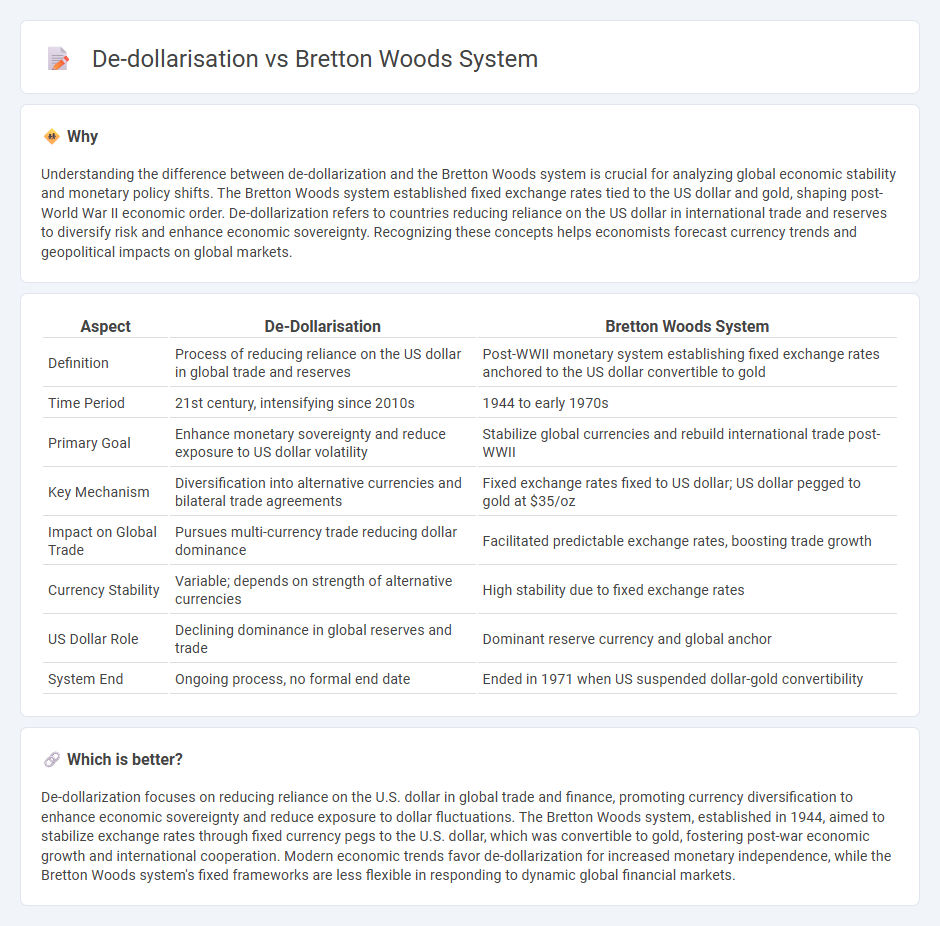

Understanding the difference between de-dollarization and the Bretton Woods system is crucial for analyzing global economic stability and monetary policy shifts. The Bretton Woods system established fixed exchange rates tied to the US dollar and gold, shaping post-World War II economic order. De-dollarization refers to countries reducing reliance on the US dollar in international trade and reserves to diversify risk and enhance economic sovereignty. Recognizing these concepts helps economists forecast currency trends and geopolitical impacts on global markets.

Comparison Table

| Aspect | De-Dollarisation | Bretton Woods System |

|---|---|---|

| Definition | Process of reducing reliance on the US dollar in global trade and reserves | Post-WWII monetary system establishing fixed exchange rates anchored to the US dollar convertible to gold |

| Time Period | 21st century, intensifying since 2010s | 1944 to early 1970s |

| Primary Goal | Enhance monetary sovereignty and reduce exposure to US dollar volatility | Stabilize global currencies and rebuild international trade post-WWII |

| Key Mechanism | Diversification into alternative currencies and bilateral trade agreements | Fixed exchange rates fixed to US dollar; US dollar pegged to gold at $35/oz |

| Impact on Global Trade | Pursues multi-currency trade reducing dollar dominance | Facilitated predictable exchange rates, boosting trade growth |

| Currency Stability | Variable; depends on strength of alternative currencies | High stability due to fixed exchange rates |

| US Dollar Role | Declining dominance in global reserves and trade | Dominant reserve currency and global anchor |

| System End | Ongoing process, no formal end date | Ended in 1971 when US suspended dollar-gold convertibility |

Which is better?

De-dollarization focuses on reducing reliance on the U.S. dollar in global trade and finance, promoting currency diversification to enhance economic sovereignty and reduce exposure to dollar fluctuations. The Bretton Woods system, established in 1944, aimed to stabilize exchange rates through fixed currency pegs to the U.S. dollar, which was convertible to gold, fostering post-war economic growth and international cooperation. Modern economic trends favor de-dollarization for increased monetary independence, while the Bretton Woods system's fixed frameworks are less flexible in responding to dynamic global financial markets.

Connection

De-dollarization refers to the process of reducing reliance on the US dollar in global trade and finance, aiming to enhance national monetary sovereignty. The Bretton Woods system, established in 1944, created a fixed exchange rate regime anchored by the US dollar convertible to gold, cementing dollar dominance in international economics. The ongoing move towards de-dollarization challenges the Bretton Woods legacy by promoting alternative currencies and financial systems to diminish dollar hegemony in global markets.

Key Terms

Bretton Woods System:

The Bretton Woods System, established in 1944, created a fixed exchange rate regime where currencies were pegged to the U.S. dollar, which was convertible to gold at $35 per ounce, stabilizing global trade and finance. This framework laid the foundation for post-World War II economic order and the dominance of the U.S. dollar as the world's primary reserve currency. Explore more about how the Bretton Woods System shaped today's international monetary policies and the challenges posed by de-dollarization trends.

Fixed Exchange Rates

The Bretton Woods system established fixed exchange rates by pegging currencies to the US dollar, which was convertible to gold, creating global monetary stability from 1944 until its collapse in 1971. De-dollarisation efforts aim to reduce reliance on the US dollar in international trade and finance, promoting currency diversification and challenging fixed exchange rate frameworks dominated by the dollar. Explore how these contrasting monetary strategies influence global economic stability and currency policy today.

Gold Standard

The Bretton Woods system established a fixed exchange rate regime linking the US dollar to gold at $35 per ounce, making the dollar the world's primary reserve currency until its collapse in 1971. De-dollarisation involves reducing global reliance on the US dollar by promoting alternative currencies and gold, aiming to restore some aspects of the gold standard's stability and limit dollar dominance. Explore the historical significance and modern implications of these monetary shifts to understand their impact on global finance.

Source and External Links

The Bretton Woods System | World Gold Council - This system, established in 1944, fixed the dollar to gold and provided a framework for international currency exchange rates, promoting economic stability and growth.

Bretton Woods Agreement - Overview, History, Significance - The agreement created a unified set of rules for fixed international currency exchange rates and established the International Monetary Fund (IMF) and the World Bank.

Bretton Woods system - Wikipedia - The system established a framework of fixed exchange rates where currencies were pegged to the U.S. dollar, which was convertible into gold, facilitating international trade and economic cooperation.

dowidth.com

dowidth.com