Shadow bailouts represent indirect financial support mechanisms that stabilize markets without formal government intervention, often involving central banks or regulatory forbearance. Automatic stabilizers, such as unemployment benefits and progressive taxation, trigger fiscal responses that naturally counteract economic fluctuations without new legislation. Explore the distinct roles and impacts of shadow bailouts and automatic stabilizers in maintaining economic stability.

Why it is important

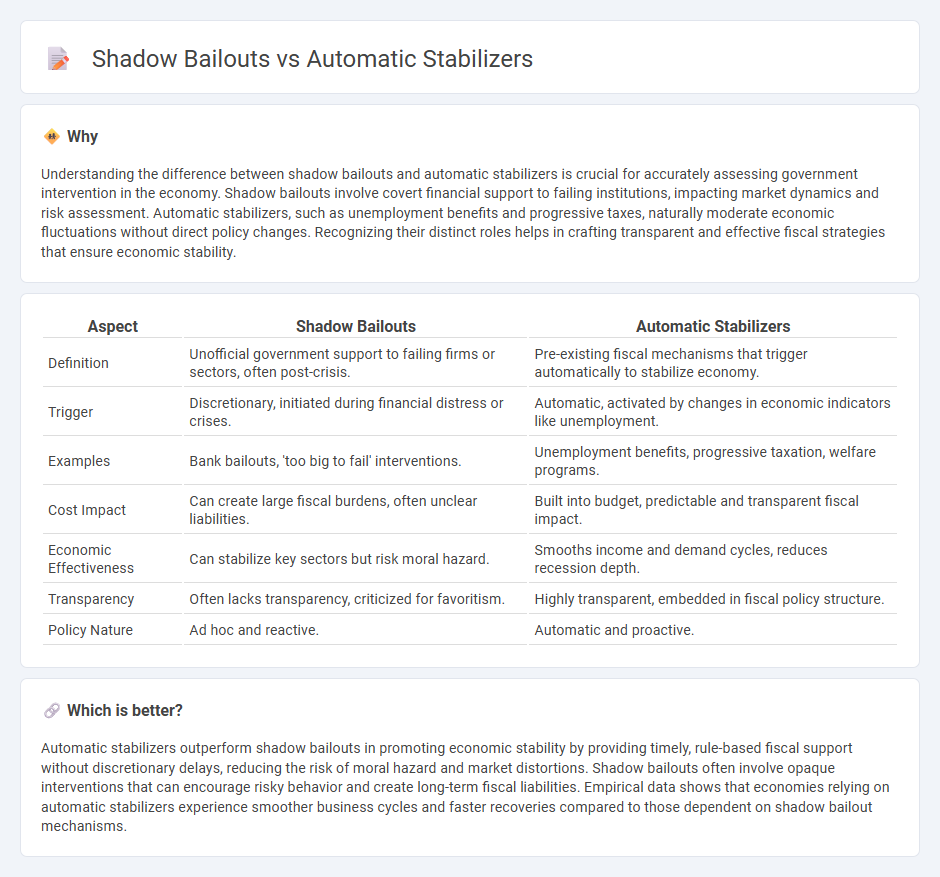

Understanding the difference between shadow bailouts and automatic stabilizers is crucial for accurately assessing government intervention in the economy. Shadow bailouts involve covert financial support to failing institutions, impacting market dynamics and risk assessment. Automatic stabilizers, such as unemployment benefits and progressive taxes, naturally moderate economic fluctuations without direct policy changes. Recognizing their distinct roles helps in crafting transparent and effective fiscal strategies that ensure economic stability.

Comparison Table

| Aspect | Shadow Bailouts | Automatic Stabilizers |

|---|---|---|

| Definition | Unofficial government support to failing firms or sectors, often post-crisis. | Pre-existing fiscal mechanisms that trigger automatically to stabilize economy. |

| Trigger | Discretionary, initiated during financial distress or crises. | Automatic, activated by changes in economic indicators like unemployment. |

| Examples | Bank bailouts, 'too big to fail' interventions. | Unemployment benefits, progressive taxation, welfare programs. |

| Cost Impact | Can create large fiscal burdens, often unclear liabilities. | Built into budget, predictable and transparent fiscal impact. |

| Economic Effectiveness | Can stabilize key sectors but risk moral hazard. | Smooths income and demand cycles, reduces recession depth. |

| Transparency | Often lacks transparency, criticized for favoritism. | Highly transparent, embedded in fiscal policy structure. |

| Policy Nature | Ad hoc and reactive. | Automatic and proactive. |

Which is better?

Automatic stabilizers outperform shadow bailouts in promoting economic stability by providing timely, rule-based fiscal support without discretionary delays, reducing the risk of moral hazard and market distortions. Shadow bailouts often involve opaque interventions that can encourage risky behavior and create long-term fiscal liabilities. Empirical data shows that economies relying on automatic stabilizers experience smoother business cycles and faster recoveries compared to those dependent on shadow bailout mechanisms.

Connection

Shadow bailouts mitigate financial crises by supporting distressed sectors without formal government intervention, playing a crucial role alongside automatic stabilizers like unemployment benefits and tax policies that stabilize aggregate demand during economic downturns. These mechanisms work together to cushion economic shocks by providing liquidity and sustaining consumer spending, thereby preventing deeper recessions. Understanding their interplay helps policymakers design more resilient economic frameworks.

Key Terms

Fiscal Policy

Automatic stabilizers like unemployment benefits and progressive taxes help smooth economic fluctuations by increasing government spending or lowering taxes during downturns without new legislation. Shadow bailouts involve covert or unreported government support to financial institutions or sectors to prevent systemic collapse, often bypassing standard fiscal transparency and accountability. Explore how these mechanisms influence fiscal policy effectiveness and public trust in economic resilience strategies.

Government Intervention

Automatic stabilizers such as unemployment benefits and progressive taxation help governments reduce economic fluctuations by automatically increasing spending or cutting taxes during downturns without additional legislative action. Shadow bailouts involve discreet government interventions providing financial support to endangered private firms or financial institutions to prevent systemic collapse, often avoiding public scrutiny. Explore the differences between these mechanisms to understand their impact on economic stability and policy effectiveness.

Countercyclical Measures

Automatic stabilizers such as unemployment benefits and progressive taxes provide built-in countercyclical fiscal support, reducing economic volatility by boosting demand during downturns without additional legislative action. Shadow bailouts involve indirect government interventions, often through central banks and implicit guarantees to financial institutions, which restore market confidence but can increase moral hazard and long-term risks. Explore the detailed mechanisms and impacts of these countercyclical measures to understand their roles in economic stability and policy trade-offs.

Source and External Links

What Are Automatic Stabilizers and How Do They Affect the Federal ... - Automatic stabilizers are government budget mechanisms that automatically increase spending or reduce taxes during economic downturns, thereby widening deficits to support aggregate demand during recessions and often narrowing them during expansions.

What are automatic stabilizers? - Brookings Institution - These are built-in features of government budgets (such as unemployment insurance, food stamps, and progressive taxes) that kick in without new legislation, providing immediate relief to households and stimulating the economy during slowdowns, while phasing down when conditions improve.

Lesson summary: automatic stabilizers (article) - Khan Academy - Automatic stabilizers, like progressive tax systems and transfer payments, automatically adjust to economic cycles by supporting disposable income and consumption when incomes fall, thereby softening the impact of business cycle fluctuations without requiring new policy actions.

dowidth.com

dowidth.com