Locavesting focuses on investing in local businesses to stimulate regional economic growth, often emphasizing community impact and sustainability. Angel investing involves affluent individuals providing capital to startups and early-stage companies in exchange for equity, targeting high-growth potential ventures. Explore the advantages and considerations of locavesting versus angel investing to determine which aligns best with your financial goals.

Why it is important

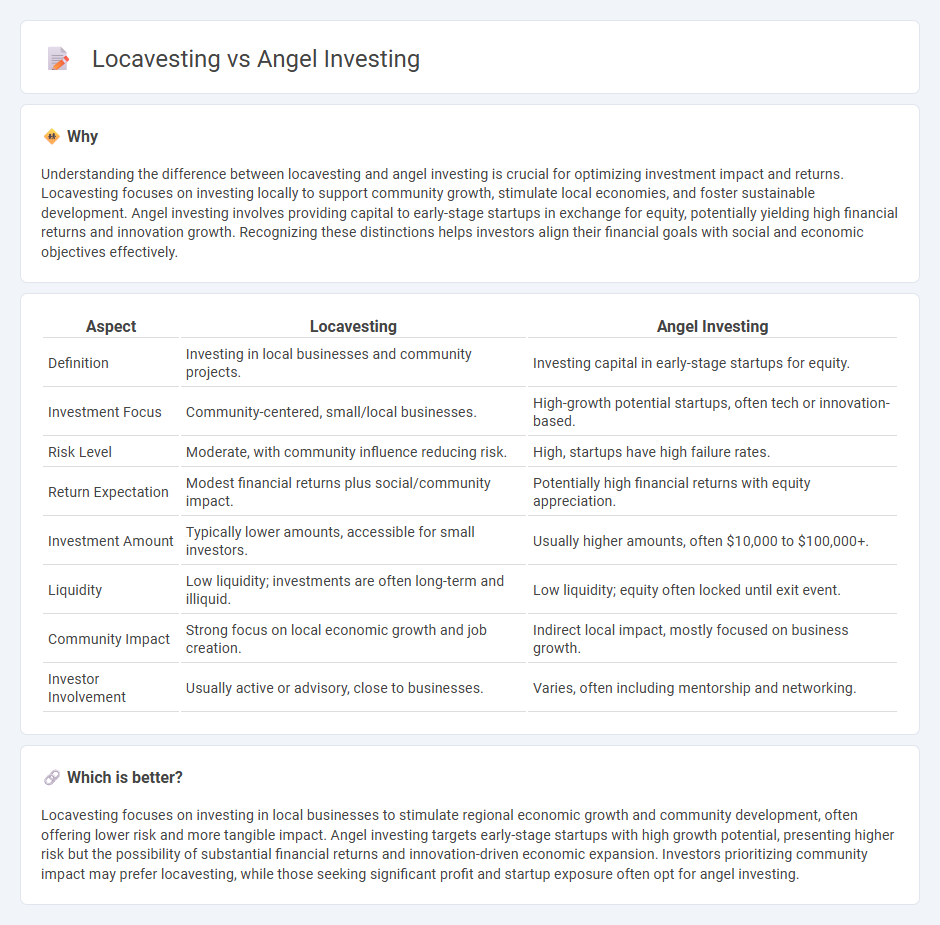

Understanding the difference between locavesting and angel investing is crucial for optimizing investment impact and returns. Locavesting focuses on investing locally to support community growth, stimulate local economies, and foster sustainable development. Angel investing involves providing capital to early-stage startups in exchange for equity, potentially yielding high financial returns and innovation growth. Recognizing these distinctions helps investors align their financial goals with social and economic objectives effectively.

Comparison Table

| Aspect | Locavesting | Angel Investing |

|---|---|---|

| Definition | Investing in local businesses and community projects. | Investing capital in early-stage startups for equity. |

| Investment Focus | Community-centered, small/local businesses. | High-growth potential startups, often tech or innovation-based. |

| Risk Level | Moderate, with community influence reducing risk. | High, startups have high failure rates. |

| Return Expectation | Modest financial returns plus social/community impact. | Potentially high financial returns with equity appreciation. |

| Investment Amount | Typically lower amounts, accessible for small investors. | Usually higher amounts, often $10,000 to $100,000+. |

| Liquidity | Low liquidity; investments are often long-term and illiquid. | Low liquidity; equity often locked until exit event. |

| Community Impact | Strong focus on local economic growth and job creation. | Indirect local impact, mostly focused on business growth. |

| Investor Involvement | Usually active or advisory, close to businesses. | Varies, often including mentorship and networking. |

Which is better?

Locavesting focuses on investing in local businesses to stimulate regional economic growth and community development, often offering lower risk and more tangible impact. Angel investing targets early-stage startups with high growth potential, presenting higher risk but the possibility of substantial financial returns and innovation-driven economic expansion. Investors prioritizing community impact may prefer locavesting, while those seeking significant profit and startup exposure often opt for angel investing.

Connection

Locavesting and angel investing both focus on channeling capital into local ventures, strengthening regional economies by supporting early-stage businesses. Angel investors often participate in locavesting by funding startups and small enterprises within their communities, fostering job creation and innovation locally. This synergy enhances economic resilience, as financial resources circulate within a defined geographic area, promoting sustainable growth.

Key Terms

Early-stage Capital

Angel investing involves individuals providing early-stage capital to startups, often gaining equity and advisory roles, thereby fueling innovation and business growth. Locavesting emphasizes investing in local businesses and startups, aiming to boost regional economies and create community wealth through early-stage funding. Explore the nuances and benefits of both strategies to optimize your early-stage capital deployment.

Community Investment

Angel investing involves providing capital to early-stage startups, typically seeking high returns and business growth, whereas locavesting emphasizes investing in local businesses to boost community development and economic resilience. Locavesting prioritizes social impact and sustainable growth within a specific geographic area, fostering stronger local connections and shared prosperity. Explore how aligning your investments with community values can drive meaningful change and long-term benefits.

Local Enterprises

Angel investing channels capital into startups typically seeking high growth and scalable business models, fostering innovation but often outside immediate local contexts. Locavesting concentrates financial resources within local enterprises to stimulate regional economic development and community wealth, emphasizing social impact alongside returns. Explore how local-focused investing strategies can diversify portfolios while empowering community resilience.

Source and External Links

Understanding angel financing and investing - J.P. Morgan - Angel investors are individuals who invest their own money in startups in exchange for equity or convertible debt, often providing both capital and mentorship to help founders develop prototypes, conduct market research, and reach early milestones before institutional funding rounds.

Angel Investors - The Hartford Insurance - Angel investors are wealthy private individuals who finance startups for equity, are usually more patient and willing to invest smaller amounts than venture capitalists, and expect a return on investment through an eventual exit like a sale or public offering, often aiming for around a 30% ROI.

Angel investor - Wikipedia - Angel investors (also called business angels or seed investors) provide early-stage funding, sometimes acquiring around 8% equity per investment, and in the UK, have shown average returns of about 2.2 times their investment over about 3.6 years, with a growing role in technology startups and impact investing.

dowidth.com

dowidth.com