Operational due diligence assesses a company's internal processes, management efficiency, and operational risks to ensure sustainable performance post-acquisition. Legal due diligence focuses on identifying potential legal liabilities, compliance issues, and contract validity to protect against regulatory and litigation risks. Discover how integrating both approaches enhances informed decision-making in consulting engagements.

Why it is important

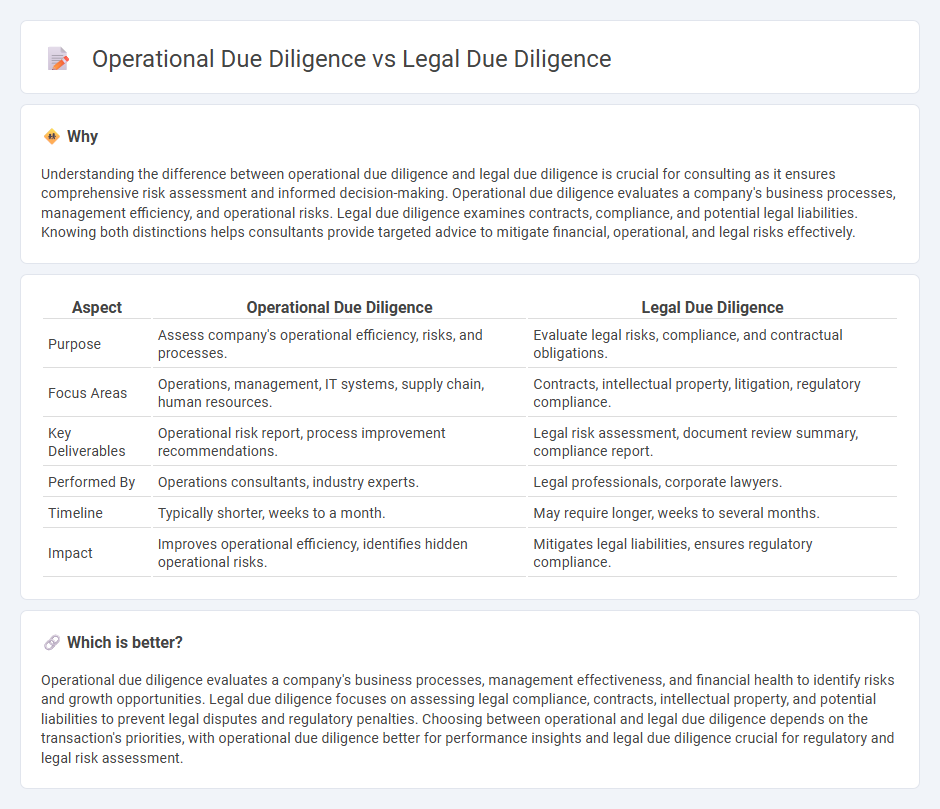

Understanding the difference between operational due diligence and legal due diligence is crucial for consulting as it ensures comprehensive risk assessment and informed decision-making. Operational due diligence evaluates a company's business processes, management efficiency, and operational risks. Legal due diligence examines contracts, compliance, and potential legal liabilities. Knowing both distinctions helps consultants provide targeted advice to mitigate financial, operational, and legal risks effectively.

Comparison Table

| Aspect | Operational Due Diligence | Legal Due Diligence |

|---|---|---|

| Purpose | Assess company's operational efficiency, risks, and processes. | Evaluate legal risks, compliance, and contractual obligations. |

| Focus Areas | Operations, management, IT systems, supply chain, human resources. | Contracts, intellectual property, litigation, regulatory compliance. |

| Key Deliverables | Operational risk report, process improvement recommendations. | Legal risk assessment, document review summary, compliance report. |

| Performed By | Operations consultants, industry experts. | Legal professionals, corporate lawyers. |

| Timeline | Typically shorter, weeks to a month. | May require longer, weeks to several months. |

| Impact | Improves operational efficiency, identifies hidden operational risks. | Mitigates legal liabilities, ensures regulatory compliance. |

Which is better?

Operational due diligence evaluates a company's business processes, management effectiveness, and financial health to identify risks and growth opportunities. Legal due diligence focuses on assessing legal compliance, contracts, intellectual property, and potential liabilities to prevent legal disputes and regulatory penalties. Choosing between operational and legal due diligence depends on the transaction's priorities, with operational due diligence better for performance insights and legal due diligence crucial for regulatory and legal risk assessment.

Connection

Operational due diligence evaluates a company's processes, systems, and organizational efficiency to identify potential risks and areas for improvement. Legal due diligence examines contracts, compliance, and regulatory issues that could affect the business's legal standing and future liabilities. Together, these assessments provide a comprehensive understanding of operational risks intertwined with legal obligations, ensuring informed decision-making during mergers, acquisitions, or investments.

Key Terms

**Legal Due Diligence:**

Legal due diligence involves a thorough examination of a company's legal documents, contracts, compliance status, intellectual property rights, and potential litigation risks to identify any legal liabilities or regulatory issues. This process ensures that all legal aspects of a transaction are transparent and compliant with applicable laws, thus protecting buyers and investors from future legal disputes. Discover more about the critical role of legal due diligence in safeguarding business transactions.

Compliance

Legal due diligence focuses on reviewing an organization's adherence to laws, regulations, contracts, and potential legal risks to ensure compliance and avoid litigation. Operational due diligence evaluates internal processes, controls, and compliance with industry standards to identify operational risks and efficiency improvements. Explore more about how these due diligence types safeguard compliance and mitigate risks across business functions.

Contracts

Legal due diligence emphasizes the thorough review of contracts to identify potential liabilities, compliance issues, and enforceability risks, ensuring that agreements align with regulatory standards and protect stakeholders. Operational due diligence assesses contracts from a practical standpoint, focusing on performance obligations, vendor relationships, and operational risks that could impact business continuity and efficiency. Explore detailed insights to understand how both due diligence types affect contract assessment and decision-making.

Source and External Links

Due Diligence Checklist: What You Need to Know | Axiom Law - Legal due diligence involves a thorough examination of a target company's legal and compliance status, including company structure, contracts, intellectual property, regulatory compliance, litigation, environmental concerns, and data privacy to identify potential legal risks before acquisition or investment.

What Is Legal Due Diligence in M&A & How To Do It - Ansarada - Legal due diligence in mergers and acquisitions is the detailed review and assessment of all legal documents and information like contracts, leases, litigation, intellectual property, regulatory compliance, and corporate documents to uncover risks and liabilities prior to closing a deal.

Legal Due Diligence: How to Do It Properly [+ Checklist] - Legal due diligence is a critical component of M&A, focused on examining licenses, contracts, regulatory issues, and pending legal liabilities to identify deal-breakers and ensure the target company's legal standing is sound before acquisition.

dowidth.com

dowidth.com