Climate risk advisory focuses on identifying, assessing, and managing risks linked to climate change impacts on business operations, supply chains, and regulatory compliance. ESG consulting encompasses a broader scope, guiding companies on environmental, social, and governance criteria to improve sustainability performance and stakeholder engagement. Explore our detailed insights to understand how specialized advisory services can drive resilient and responsible business strategies.

Why it is important

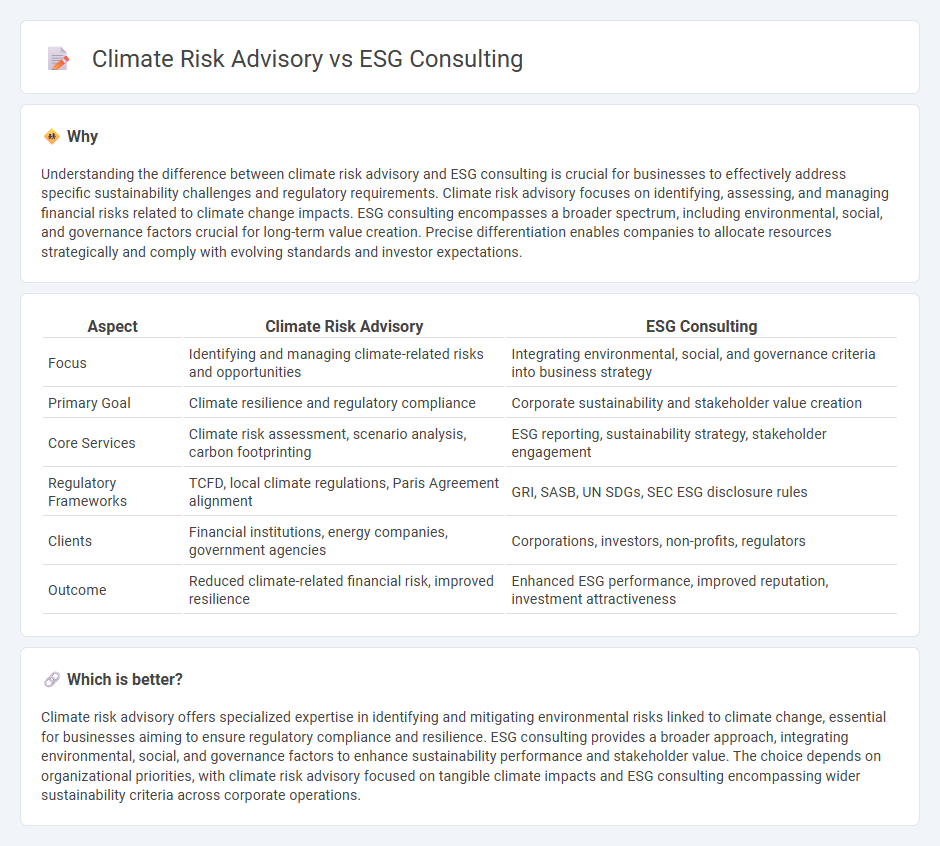

Understanding the difference between climate risk advisory and ESG consulting is crucial for businesses to effectively address specific sustainability challenges and regulatory requirements. Climate risk advisory focuses on identifying, assessing, and managing financial risks related to climate change impacts. ESG consulting encompasses a broader spectrum, including environmental, social, and governance factors crucial for long-term value creation. Precise differentiation enables companies to allocate resources strategically and comply with evolving standards and investor expectations.

Comparison Table

| Aspect | Climate Risk Advisory | ESG Consulting |

|---|---|---|

| Focus | Identifying and managing climate-related risks and opportunities | Integrating environmental, social, and governance criteria into business strategy |

| Primary Goal | Climate resilience and regulatory compliance | Corporate sustainability and stakeholder value creation |

| Core Services | Climate risk assessment, scenario analysis, carbon footprinting | ESG reporting, sustainability strategy, stakeholder engagement |

| Regulatory Frameworks | TCFD, local climate regulations, Paris Agreement alignment | GRI, SASB, UN SDGs, SEC ESG disclosure rules |

| Clients | Financial institutions, energy companies, government agencies | Corporations, investors, non-profits, regulators |

| Outcome | Reduced climate-related financial risk, improved resilience | Enhanced ESG performance, improved reputation, investment attractiveness |

Which is better?

Climate risk advisory offers specialized expertise in identifying and mitigating environmental risks linked to climate change, essential for businesses aiming to ensure regulatory compliance and resilience. ESG consulting provides a broader approach, integrating environmental, social, and governance factors to enhance sustainability performance and stakeholder value. The choice depends on organizational priorities, with climate risk advisory focused on tangible climate impacts and ESG consulting encompassing wider sustainability criteria across corporate operations.

Connection

Climate risk advisory and ESG consulting intersect by evaluating environmental, social, and governance factors to identify potential financial and operational risks posed by climate change. These services help organizations align their sustainability goals with regulatory requirements and investor expectations, enhancing resilience and long-term value creation. Integrating climate risk into ESG strategies enables companies to manage risks proactively while capitalizing on emerging opportunities in the transition to a low-carbon economy.

Key Terms

Materiality Assessment

ESG consulting prioritizes comprehensive sustainability strategies, integrating environmental, social, and governance factors to enhance corporate responsibility and stakeholder value. Climate risk advisory narrows its focus on identifying, assessing, and managing climate-related risks to ensure regulatory compliance and resilience against physical and transitional climate impacts. Explore how leveraging materiality assessments can optimize both ESG initiatives and climate risk management for your organization.

Scenario Analysis

ESG consulting emphasizes integrating environmental, social, and governance factors into corporate strategies for sustainable growth, while climate risk advisory centers on evaluating potential impacts of climate change through scenario analysis to enhance resilience and compliance. Scenario analysis in climate risk advisory enables organizations to model different climate futures, assess financial and operational risks, and develop strategic responses aligned with regulatory frameworks like the TCFD. Explore further to understand how scenario analysis drives informed decision-making in both ESG consulting and climate risk management.

Regulatory Compliance

ESG consulting primarily guides companies to integrate environmental, social, and governance criteria into their corporate strategies, ensuring overall sustainability and stakeholder alignment. Climate risk advisory specializes in assessing and mitigating the financial and operational impacts of climate-related risks, emphasizing adherence to evolving regulatory frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) and the EU Taxonomy. Discover more about how these services drive compliance and strategic resilience in a rapidly changing regulatory landscape.

Source and External Links

Sustainability Consulting Services - Armanino - ESG consulting involves providing clarity on risks and opportunities in sustainability, environmental, social, and governance issues, helping companies develop strategy, implement programs, and improve reporting aligned with business goals and stakeholder values.

What is an ESG Consultant? - ESG consultants assess a company's current ESG practices, develop tailored strategies, assist in implementation, ensure compliance, manage risks, and support sustainability integration across business operations.

Sustainability and ESG Strategy Consulting | EY - US - ESG strategy consulting includes helping organizations with strategy development, M&A, due diligence, capital allocation, and portfolio optimization to drive long-term value in alignment with regulatory, investor, and societal expectations.

dowidth.com

dowidth.com