Digital forensics consulting specializes in investigating cybercrimes, analyzing digital evidence, and mitigating security breaches to protect organizations from data loss and legal risks. Mergers and acquisitions consulting focuses on evaluating financial performance, conducting due diligence, and ensuring seamless integration of companies to maximize transaction value. Explore the distinct benefits of these consulting services to determine which aligns best with your organizational needs.

Why it is important

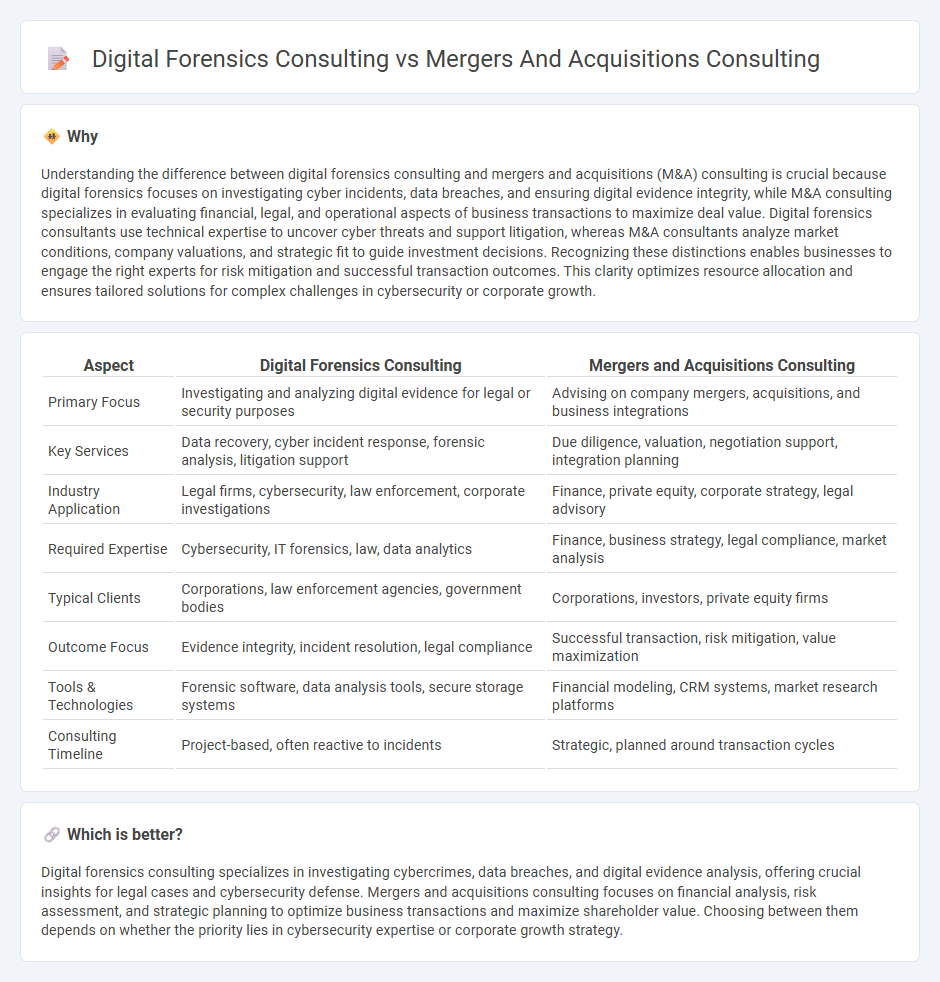

Understanding the difference between digital forensics consulting and mergers and acquisitions (M&A) consulting is crucial because digital forensics focuses on investigating cyber incidents, data breaches, and ensuring digital evidence integrity, while M&A consulting specializes in evaluating financial, legal, and operational aspects of business transactions to maximize deal value. Digital forensics consultants use technical expertise to uncover cyber threats and support litigation, whereas M&A consultants analyze market conditions, company valuations, and strategic fit to guide investment decisions. Recognizing these distinctions enables businesses to engage the right experts for risk mitigation and successful transaction outcomes. This clarity optimizes resource allocation and ensures tailored solutions for complex challenges in cybersecurity or corporate growth.

Comparison Table

| Aspect | Digital Forensics Consulting | Mergers and Acquisitions Consulting |

|---|---|---|

| Primary Focus | Investigating and analyzing digital evidence for legal or security purposes | Advising on company mergers, acquisitions, and business integrations |

| Key Services | Data recovery, cyber incident response, forensic analysis, litigation support | Due diligence, valuation, negotiation support, integration planning |

| Industry Application | Legal firms, cybersecurity, law enforcement, corporate investigations | Finance, private equity, corporate strategy, legal advisory |

| Required Expertise | Cybersecurity, IT forensics, law, data analytics | Finance, business strategy, legal compliance, market analysis |

| Typical Clients | Corporations, law enforcement agencies, government bodies | Corporations, investors, private equity firms |

| Outcome Focus | Evidence integrity, incident resolution, legal compliance | Successful transaction, risk mitigation, value maximization |

| Tools & Technologies | Forensic software, data analysis tools, secure storage systems | Financial modeling, CRM systems, market research platforms |

| Consulting Timeline | Project-based, often reactive to incidents | Strategic, planned around transaction cycles |

Which is better?

Digital forensics consulting specializes in investigating cybercrimes, data breaches, and digital evidence analysis, offering crucial insights for legal cases and cybersecurity defense. Mergers and acquisitions consulting focuses on financial analysis, risk assessment, and strategic planning to optimize business transactions and maximize shareholder value. Choosing between them depends on whether the priority lies in cybersecurity expertise or corporate growth strategy.

Connection

Digital forensics consulting plays a crucial role in mergers and acquisitions consulting by evaluating the cybersecurity posture and uncovering potential digital risks of target companies. Comprehensive forensic assessments identify hidden liabilities such as data breaches, intellectual property theft, or compliance violations that could impact transaction value. Integrating digital forensics insights ensures informed decision-making and safeguards asset integrity during M&A due diligence processes.

Key Terms

**Mergers and Acquisitions Consulting:**

Mergers and acquisitions consulting specializes in advising companies on strategic deals to optimize valuation, due diligence, integration planning, and risk assessment for successful business combinations. Experts analyze financial statements, market conditions, and regulatory compliance to ensure smooth transaction processes and maximize shareholder value. Discover how mergers and acquisitions consulting can drive growth and secure competitive advantage in your next corporate transaction.

Due Diligence

Due diligence in mergers and acquisitions consulting emphasizes financial analysis, risk assessment, and regulatory compliance to ensure smooth transactions that maximize value and minimize liabilities. Digital forensics consulting centers on examining electronic evidence and cybersecurity risks, identifying data breaches, and verifying intellectual property ownership within the due diligence process. Explore deeper insights on how these consulting specialties drive informed decision-making and safeguard investments.

Valuation

Mergers and acquisitions consulting specializes in valuation by analyzing financial statements, market conditions, and synergies to determine the fair value of target companies for informed deal-making. Digital forensics consulting enhances valuation accuracy by investigating data integrity, uncovering hidden liabilities, and validating digital assets that impact overall company worth. Explore how these consulting fields intersect to optimize business valuation strategies.

Source and External Links

M&A (Mergers & Acquisitions) Strategy Consulting | BCG - BCG offers strategic M&A consulting to help clients create replicable merger processes, avoid common pitfalls, assess fit and synergies, and provide end-to-end support from transaction strategy to post-merger integration using proprietary tools and cross-industry insights.

Mergers & Acquisitions Consulting Services - Dryden Group - Dryden Group specializes in M&A consulting focused on procurement, performing due diligence, spend and vendor analyses to optimize resources, reduce costs, and ensure a smooth transition during mergers and acquisitions.

M&A consulting | EY - US - EY provides comprehensive M&A consulting services including growth strategy, portfolio reshaping, due diligence, post-merger integration, and restructuring, leveraging AI-enabled technologies and advanced analytics to maximize deal value and strategic alignment.

dowidth.com

dowidth.com