Sustainability reporting consulting focuses on helping organizations measure, manage, and communicate their environmental, social, and governance (ESG) performance to meet regulatory requirements and stakeholder expectations. Financial advisory consulting centers on optimizing financial strategies, transactions, and risk management to enhance economic value and business growth. Explore the key differences and benefits of each consulting service to determine the best fit for your company's needs.

Why it is important

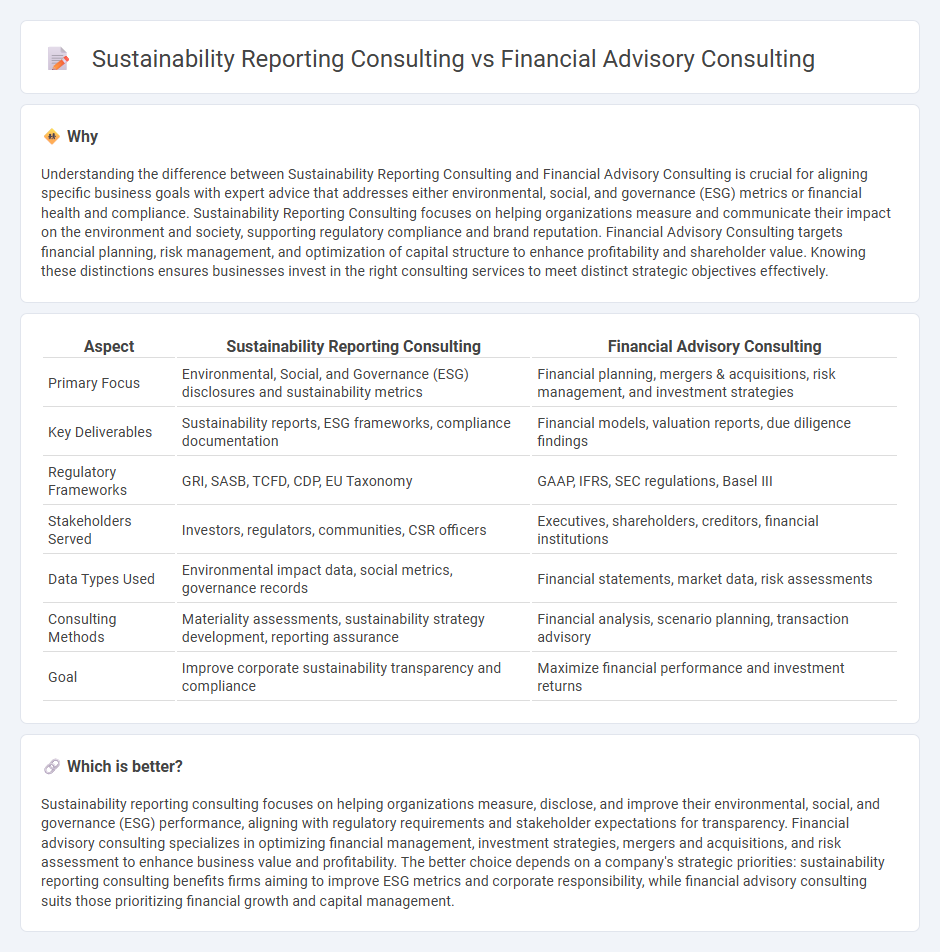

Understanding the difference between Sustainability Reporting Consulting and Financial Advisory Consulting is crucial for aligning specific business goals with expert advice that addresses either environmental, social, and governance (ESG) metrics or financial health and compliance. Sustainability Reporting Consulting focuses on helping organizations measure and communicate their impact on the environment and society, supporting regulatory compliance and brand reputation. Financial Advisory Consulting targets financial planning, risk management, and optimization of capital structure to enhance profitability and shareholder value. Knowing these distinctions ensures businesses invest in the right consulting services to meet distinct strategic objectives effectively.

Comparison Table

| Aspect | Sustainability Reporting Consulting | Financial Advisory Consulting |

|---|---|---|

| Primary Focus | Environmental, Social, and Governance (ESG) disclosures and sustainability metrics | Financial planning, mergers & acquisitions, risk management, and investment strategies |

| Key Deliverables | Sustainability reports, ESG frameworks, compliance documentation | Financial models, valuation reports, due diligence findings |

| Regulatory Frameworks | GRI, SASB, TCFD, CDP, EU Taxonomy | GAAP, IFRS, SEC regulations, Basel III |

| Stakeholders Served | Investors, regulators, communities, CSR officers | Executives, shareholders, creditors, financial institutions |

| Data Types Used | Environmental impact data, social metrics, governance records | Financial statements, market data, risk assessments |

| Consulting Methods | Materiality assessments, sustainability strategy development, reporting assurance | Financial analysis, scenario planning, transaction advisory |

| Goal | Improve corporate sustainability transparency and compliance | Maximize financial performance and investment returns |

Which is better?

Sustainability reporting consulting focuses on helping organizations measure, disclose, and improve their environmental, social, and governance (ESG) performance, aligning with regulatory requirements and stakeholder expectations for transparency. Financial advisory consulting specializes in optimizing financial management, investment strategies, mergers and acquisitions, and risk assessment to enhance business value and profitability. The better choice depends on a company's strategic priorities: sustainability reporting consulting benefits firms aiming to improve ESG metrics and corporate responsibility, while financial advisory consulting suits those prioritizing financial growth and capital management.

Connection

Sustainability reporting consulting and financial advisory consulting intersect through the integration of environmental, social, and governance (ESG) factors into financial decision-making and corporate strategy. Accurate sustainability reporting enhances transparency, enabling financial advisors to assess risks and opportunities related to ESG criteria, which influences investment strategies and capital allocation. This connection drives sustainable growth by aligning financial performance with responsible business practices.

Key Terms

**Financial advisory consulting:**

Financial advisory consulting specializes in providing expert guidance on mergers and acquisitions, capital raising, risk management, and financial restructuring to enhance business value and optimize financial performance. Consultants analyze market trends, financial statements, and investment opportunities to deliver strategic financial solutions tailored to clients' goals. Explore more about how financial advisory consulting can drive your company's growth and stability.

Valuation

Financial advisory consulting emphasizes precise business valuation through in-depth financial analysis, forecasting, and risk assessment to guide investment and strategic decisions. Sustainability reporting consulting integrates environmental, social, and governance (ESG) factors into valuation models, reflecting the long-term impact of sustainable practices on corporate value. Explore how combining both approaches can enhance accurate asset valuation and stakeholder confidence.

Mergers and Acquisitions (M&A)

Financial advisory consulting in Mergers and Acquisitions (M&A) primarily centers on valuation, due diligence, and risk assessment to optimize investment decisions and maximize transaction value. Sustainability reporting consulting in M&A emphasizes integrating Environmental, Social, and Governance (ESG) criteria into the transaction process, ensuring compliance with regulatory standards and enhancing long-term value through transparent ESG disclosures. Explore these distinct consulting approaches to understand their strategic impact on successful mergers and acquisitions.

Source and External Links

What Is a Financial Consultant and What Do They Do? - Financial consultants offer personalized advice to help investors build wealth by creating financial plans and guiding investment strategies.

What Is a Financial Consultant? - A financial consultant conducts an audit of a client's financial situation and strategizes a plan to achieve future goals, often providing specialized services like tax preparation and insurance advice.

Financial Advisory - Financial advisory consulting involves providing expert advice on topics such as corporate finance, risk management, and tax advisory, often working closely with a client's CFO.

dowidth.com

dowidth.com