Due diligence deep dive involves a comprehensive evaluation of a company's financial, legal, and operational aspects to mitigate risks during mergers and acquisitions. Market entry analysis focuses on assessing market conditions, competitive landscape, and consumer behavior to formulate effective entry strategies. Explore how these consulting services empower strategic decision-making and business growth.

Why it is important

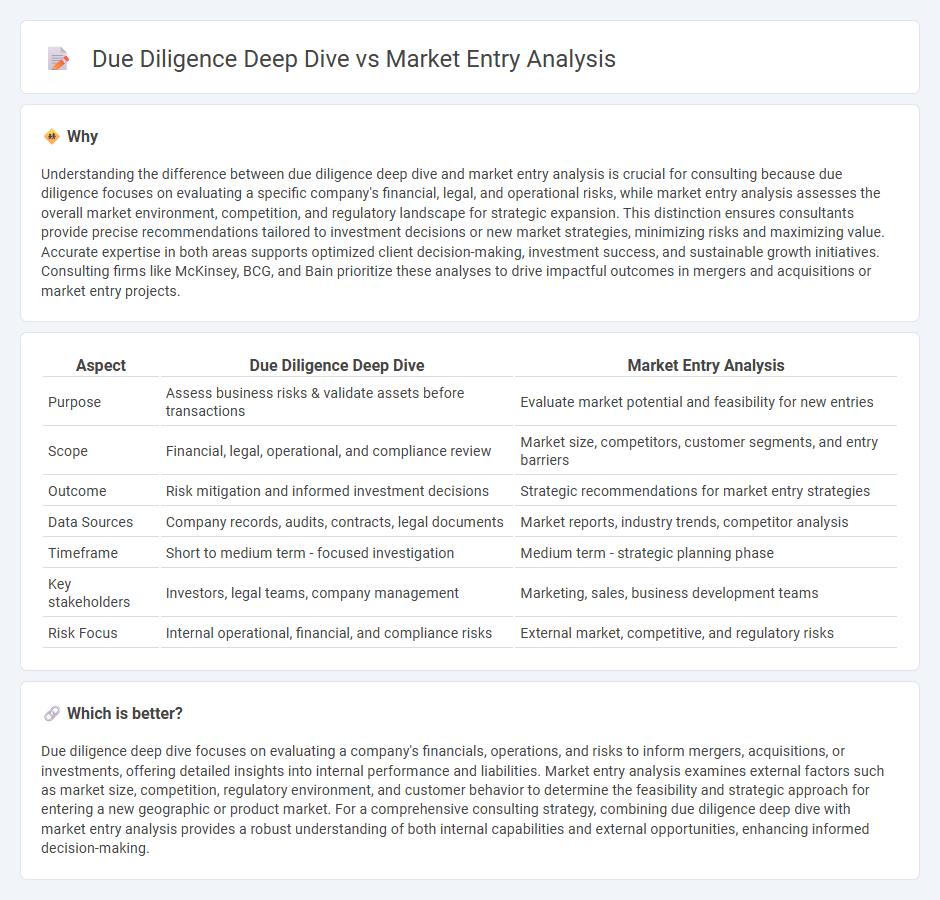

Understanding the difference between due diligence deep dive and market entry analysis is crucial for consulting because due diligence focuses on evaluating a specific company's financial, legal, and operational risks, while market entry analysis assesses the overall market environment, competition, and regulatory landscape for strategic expansion. This distinction ensures consultants provide precise recommendations tailored to investment decisions or new market strategies, minimizing risks and maximizing value. Accurate expertise in both areas supports optimized client decision-making, investment success, and sustainable growth initiatives. Consulting firms like McKinsey, BCG, and Bain prioritize these analyses to drive impactful outcomes in mergers and acquisitions or market entry projects.

Comparison Table

| Aspect | Due Diligence Deep Dive | Market Entry Analysis |

|---|---|---|

| Purpose | Assess business risks & validate assets before transactions | Evaluate market potential and feasibility for new entries |

| Scope | Financial, legal, operational, and compliance review | Market size, competitors, customer segments, and entry barriers |

| Outcome | Risk mitigation and informed investment decisions | Strategic recommendations for market entry strategies |

| Data Sources | Company records, audits, contracts, legal documents | Market reports, industry trends, competitor analysis |

| Timeframe | Short to medium term - focused investigation | Medium term - strategic planning phase |

| Key stakeholders | Investors, legal teams, company management | Marketing, sales, business development teams |

| Risk Focus | Internal operational, financial, and compliance risks | External market, competitive, and regulatory risks |

Which is better?

Due diligence deep dive focuses on evaluating a company's financials, operations, and risks to inform mergers, acquisitions, or investments, offering detailed insights into internal performance and liabilities. Market entry analysis examines external factors such as market size, competition, regulatory environment, and customer behavior to determine the feasibility and strategic approach for entering a new geographic or product market. For a comprehensive consulting strategy, combining due diligence deep dive with market entry analysis provides a robust understanding of both internal capabilities and external opportunities, enhancing informed decision-making.

Connection

Due diligence deep dive evaluates a company's financial health, operations, and risks, providing critical insights essential for informed market entry decisions. Market entry analysis leverages these findings to assess competitive dynamics, customer needs, and regulatory conditions in the target market. Together, they enable consultants to develop strategic recommendations that minimize risks and maximize opportunities for successful market expansion.

Key Terms

**Market Entry Analysis:**

Market Entry Analysis involves evaluating target market size, competitive landscape, regulatory environment, and consumer behavior to identify optimal entry strategies and potential barriers. This process includes assessing distribution channels, pricing models, and local partnerships to maximize market penetration and growth potential. Explore detailed methodologies and industry-specific examples to enhance your market entry success.

Market Potential

Market entry analysis evaluates a target market's potential by assessing factors such as customer demand, competitive landscape, and regulatory environment to determine the feasibility and strategic fit for expansion. Due diligence deep dive goes beyond surface-level assessment, thoroughly examining financials, legal risks, operational capabilities, and compliance to identify potential pitfalls that could impact market entry success. Explore detailed insights to optimize your market entry strategy with a comprehensive understanding of market potential and risk.

Competitive Landscape

Market entry analysis evaluates the competitive landscape by identifying key players, market share, and potential barriers to entry, helping businesses position themselves effectively in a new market. Due diligence deep dive goes beyond by assessing competitor strategies, strengths, weaknesses, and potential risks to inform investment or partnership decisions. Explore our comprehensive insights to master competitive strategies and ensure informed market entry.

Source and External Links

A Comprehensive Guide to the Market Entry Framework - Bob Stanke - A market entry framework is a strategic blueprint that includes market research, entry strategy development, product adaptation, regulatory compliance, marketing, distribution, and ongoing performance monitoring for successfully launching in a new market.

Market Entry Framework: The Expert Guide - Leland - The framework involves assessing market attractiveness through factors like size, growth, profit margins, and political stability, and evaluating a company's internal capabilities such as technical skills, cost structure, and market understanding for effective entry.

The Market Entry Framework: A Step-by-Step Guide - My Consulting Offer - The market entry process can be broken down into four steps: assessing the target market's profitability and size, evaluating client capabilities and resources, understanding investment needs and ROI expectations, and analyzing regulatory and competitive barriers.

dowidth.com

dowidth.com