Innovation outposts serve as strategic hubs for companies to tap into emerging technologies and local talent without full operational commitment, while joint ventures involve formal partnerships combining resources and risks to pursue shared business goals. Both approaches accelerate market entry and innovation, but innovation outposts remain flexible extensions, whereas joint ventures create legally binding entities. Explore the unique advantages of each model to optimize your company's growth strategy.

Why it is important

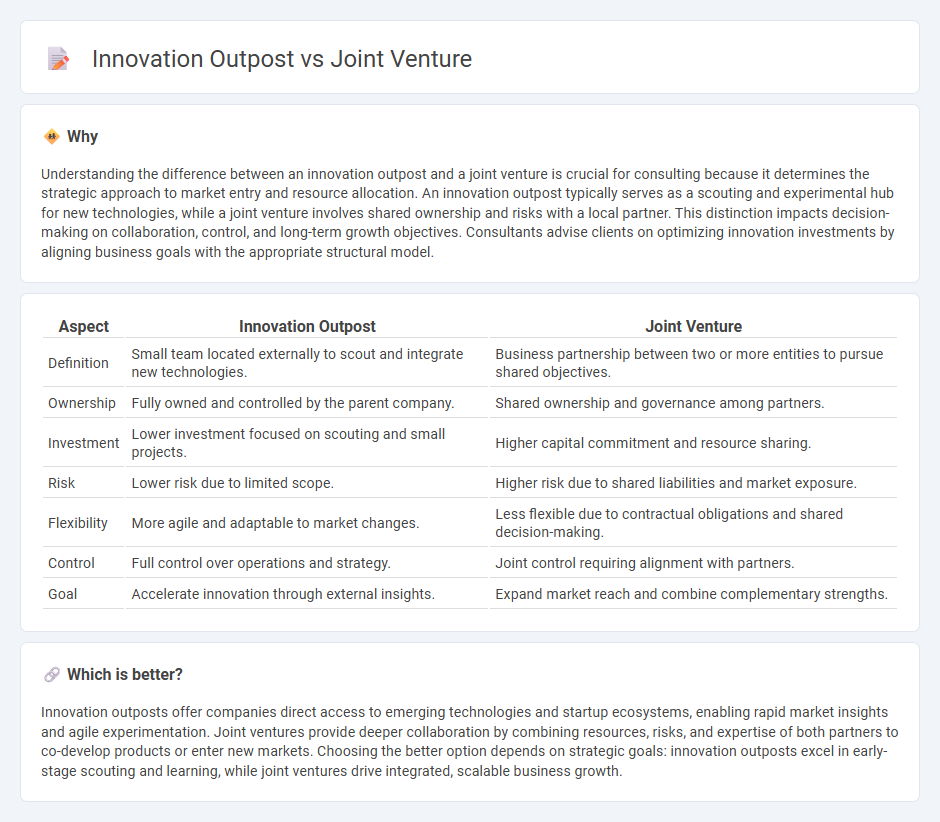

Understanding the difference between an innovation outpost and a joint venture is crucial for consulting because it determines the strategic approach to market entry and resource allocation. An innovation outpost typically serves as a scouting and experimental hub for new technologies, while a joint venture involves shared ownership and risks with a local partner. This distinction impacts decision-making on collaboration, control, and long-term growth objectives. Consultants advise clients on optimizing innovation investments by aligning business goals with the appropriate structural model.

Comparison Table

| Aspect | Innovation Outpost | Joint Venture |

|---|---|---|

| Definition | Small team located externally to scout and integrate new technologies. | Business partnership between two or more entities to pursue shared objectives. |

| Ownership | Fully owned and controlled by the parent company. | Shared ownership and governance among partners. |

| Investment | Lower investment focused on scouting and small projects. | Higher capital commitment and resource sharing. |

| Risk | Lower risk due to limited scope. | Higher risk due to shared liabilities and market exposure. |

| Flexibility | More agile and adaptable to market changes. | Less flexible due to contractual obligations and shared decision-making. |

| Control | Full control over operations and strategy. | Joint control requiring alignment with partners. |

| Goal | Accelerate innovation through external insights. | Expand market reach and combine complementary strengths. |

Which is better?

Innovation outposts offer companies direct access to emerging technologies and startup ecosystems, enabling rapid market insights and agile experimentation. Joint ventures provide deeper collaboration by combining resources, risks, and expertise of both partners to co-develop products or enter new markets. Choosing the better option depends on strategic goals: innovation outposts excel in early-stage scouting and learning, while joint ventures drive integrated, scalable business growth.

Connection

Innovation outposts serve as strategic hubs for companies to explore emerging technologies and market trends, providing valuable insights that can inform the formation of joint ventures. Joint ventures leverage these insights to collaborate with specialized partners, accelerating the development and commercialization of innovative solutions. The synergy between innovation outposts and joint ventures enhances a company's ability to access new capabilities, share risks, and expand market reach effectively.

Key Terms

Equity Sharing (Joint Venture)

Equity sharing in a joint venture involves partnering entities contributing capital, resources, or technology in exchange for ownership stakes, aligning incentives and risks between parties. This equity-based collaboration contrasts with innovation outposts, which typically operate as company-owned entities without shared ownership, focusing on market insights and innovation scouting rather than capital investment. Explore how equity-sharing models in joint ventures drive strategic growth and mutual investment opportunities.

Market Intelligence (Innovation Outpost)

An innovation outpost serves as a specialized hub for market intelligence, enabling companies to gather real-time data on emerging technologies and consumer trends in targeted ecosystems. Unlike joint ventures, which primarily focus on collaboration and shared ownership, innovation outposts provide agile access to startups, research institutions, and innovation clusters without the constraints of equity partnerships. Explore how innovation outposts can enhance your strategic market insights and drive forward-thinking decisions.

Strategic Partnerships

Strategic partnerships through joint ventures enable companies to share resources, risks, and market access while fostering long-term collaboration and co-creation of value. Innovation outposts serve as localized hubs for capturing emerging technologies and trends, providing direct insights and rapid experimentation in new markets. Explore further to understand how these strategic models drive competitive advantage and growth.

Source and External Links

What Is a Joint Venture and How Does It Work? - NerdWallet - A joint venture is an agreement between two or more businesses or people to accomplish a specific business goal together, often to access new markets or combine resources, and typically involves finding partners, negotiating terms, and protecting confidential information.

Joint Venture (JV) - Corporate Finance Institute - A joint venture is a commercial enterprise where two or more organizations pool resources for tactical and strategic advantages, sharing profits, losses, and often expertise, to grow faster, lower costs, or enter new markets.

joint venture | Wex | US Law | LII / Legal Information Institute - A joint venture is a collaboration of two or more parties who share resources, risks, control, and profits to develop a specific project or enterprise, distinct from a partnership or corporation and often used to enter foreign markets.

dowidth.com

dowidth.com