Regenerative business consulting focuses on sustainable growth by integrating environmental, social, and economic strategies to revitalize ecosystems and communities, while financial advisory consulting primarily centers on optimizing financial performance, risk management, and investment strategies for corporations. These consulting types differ significantly in approach, goals, and impact, with regenerative consulting promoting long-term resilience and ethical practices beyond profit maximization. Explore the distinct methodologies and benefits of regenerative business consulting versus financial advisory consulting to determine the best fit for your organization's objectives.

Why it is important

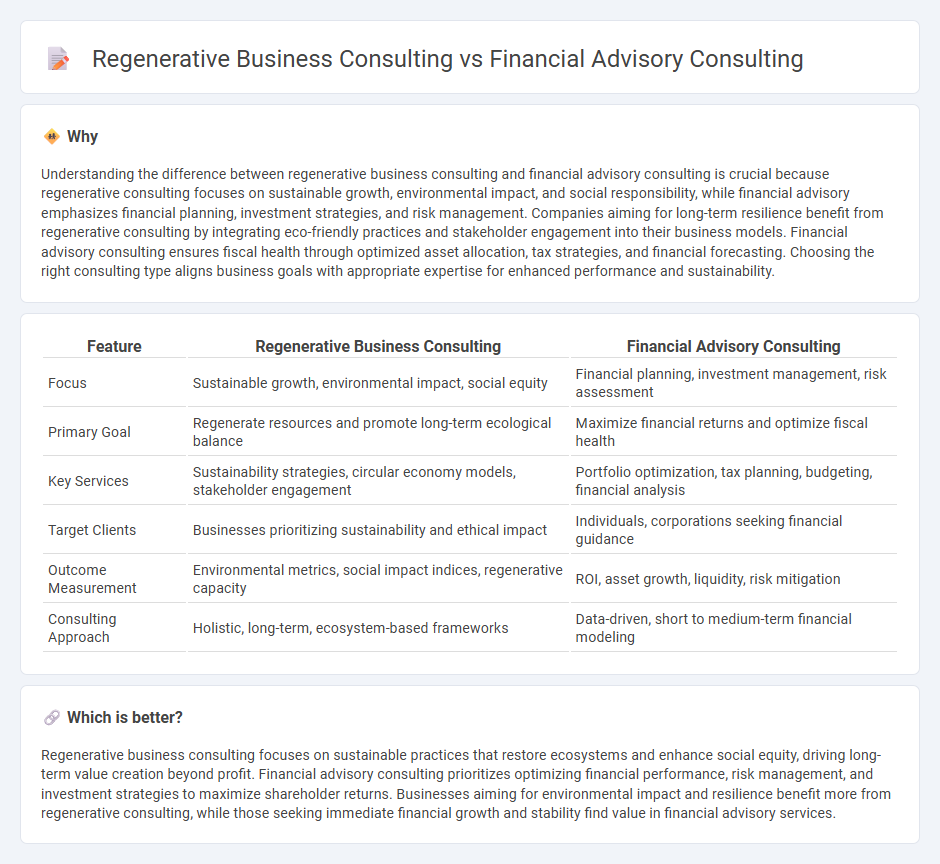

Understanding the difference between regenerative business consulting and financial advisory consulting is crucial because regenerative consulting focuses on sustainable growth, environmental impact, and social responsibility, while financial advisory emphasizes financial planning, investment strategies, and risk management. Companies aiming for long-term resilience benefit from regenerative consulting by integrating eco-friendly practices and stakeholder engagement into their business models. Financial advisory consulting ensures fiscal health through optimized asset allocation, tax strategies, and financial forecasting. Choosing the right consulting type aligns business goals with appropriate expertise for enhanced performance and sustainability.

Comparison Table

| Feature | Regenerative Business Consulting | Financial Advisory Consulting |

|---|---|---|

| Focus | Sustainable growth, environmental impact, social equity | Financial planning, investment management, risk assessment |

| Primary Goal | Regenerate resources and promote long-term ecological balance | Maximize financial returns and optimize fiscal health |

| Key Services | Sustainability strategies, circular economy models, stakeholder engagement | Portfolio optimization, tax planning, budgeting, financial analysis |

| Target Clients | Businesses prioritizing sustainability and ethical impact | Individuals, corporations seeking financial guidance |

| Outcome Measurement | Environmental metrics, social impact indices, regenerative capacity | ROI, asset growth, liquidity, risk mitigation |

| Consulting Approach | Holistic, long-term, ecosystem-based frameworks | Data-driven, short to medium-term financial modeling |

Which is better?

Regenerative business consulting focuses on sustainable practices that restore ecosystems and enhance social equity, driving long-term value creation beyond profit. Financial advisory consulting prioritizes optimizing financial performance, risk management, and investment strategies to maximize shareholder returns. Businesses aiming for environmental impact and resilience benefit more from regenerative consulting, while those seeking immediate financial growth and stability find value in financial advisory services.

Connection

Regenerative business consulting and financial advisory consulting intersect by integrating sustainable practices into financial strategies to enhance long-term profitability and environmental impact. Financial advisors incorporate regenerative principles to identify investment opportunities in green technologies, circular economy models, and social impact projects. This synergy drives resilient business growth while aligning financial goals with ecological and societal well-being.

Key Terms

**Financial advisory consulting:**

Financial advisory consulting centers on providing expert guidance in investment strategies, risk management, and wealth optimization to enhance an organization's financial health. Consultants analyze financial statements, develop budgeting plans, and offer insights on mergers, acquisitions, and capital raising to maximize profitability and ensure regulatory compliance. Explore our comprehensive financial advisory services to unlock your business's full economic potential.

Risk management

Financial advisory consulting prioritizes risk management through detailed financial analysis, portfolio diversification, and regulatory compliance to protect assets and maximize returns. Regenerative business consulting integrates risk management with sustainable practices, addressing environmental, social, and governance (ESG) risks to foster long-term resilience and innovation. Explore how tailored risk management strategies in both consulting types can optimize business stability and growth.

Capital structure

Financial advisory consulting specializes in optimizing capital structure by analyzing debt-to-equity ratios, cost of capital, and financing strategies to enhance shareholder value and liquidity management. Regenerative business consulting, however, integrates sustainable capital frameworks that prioritize long-term ecosystem health, social impact, and circular economy principles alongside financial returns. Explore how each consulting approach uniquely shapes capital strategy for resilient and responsible business growth.

Source and External Links

What Is a Financial Consultant and What Do They Do? - SmartAsset - Financial advisory consulting involves personalized financial planning, investment guidance, and wealth management services tailored to meet clients' goals like retirement, home buying, and education funding, often provided by specialists such as Chartered Financial Consultants (ChFC) or Certified Public Accountants (CPA).

Financial Advisory - Consulting.us - Financial advisory consulting focuses on expert advice related to internal corporate finance functions such as M&A deals, risk management, tax, compliance, and transaction services, primarily serving CFOs and internal finance departments rather than broad market analytics.

Financial Advisory | Consultancy.org - Financial advisory consulting encompasses a range of specialized financial analytical services including corporate finance, tax advisory, real estate advisory, and pension consulting, with providers often originating from large audit and accounting firms but also including strategy, risk, and economic consulting experts.

dowidth.com

dowidth.com