Stakeholder capitalism emphasizes the importance of all stakeholders, including employees, customers, suppliers, and communities, in driving long-term value creation for businesses. Impact investing focuses on allocating capital to projects and companies that generate measurable social and environmental benefits alongside financial returns. Discover how consulting services can navigate these approaches to align business strategy with sustainable growth goals.

Why it is important

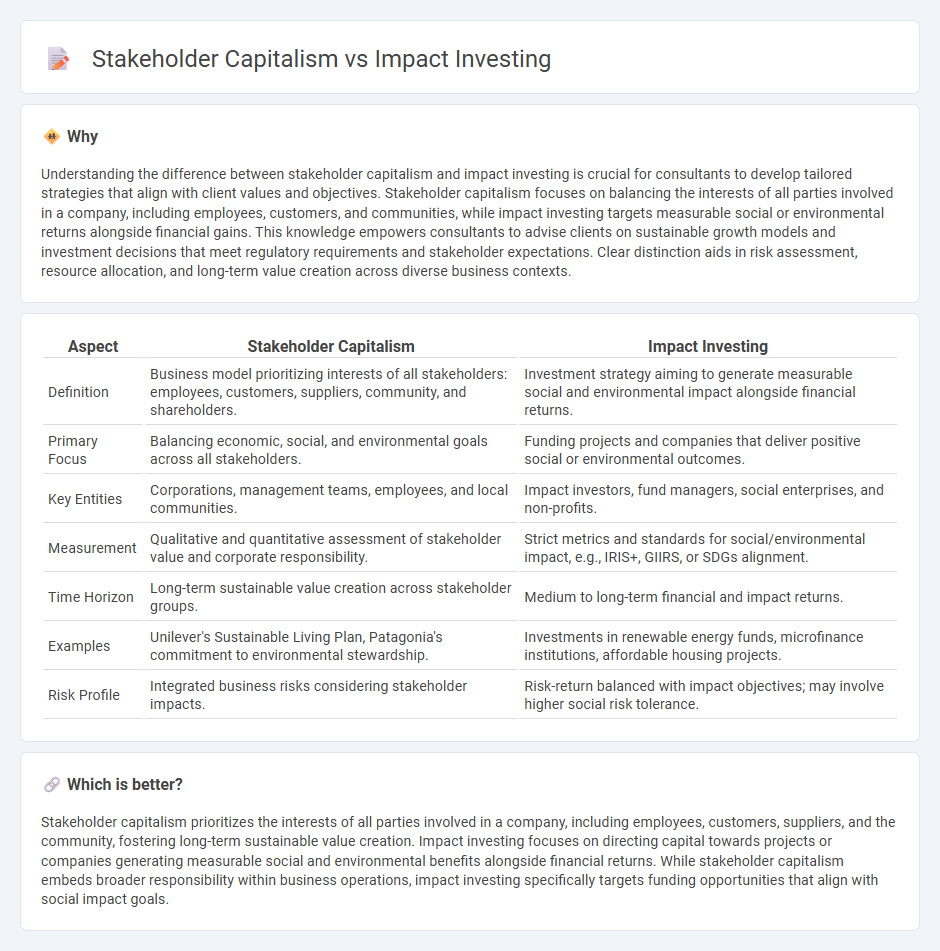

Understanding the difference between stakeholder capitalism and impact investing is crucial for consultants to develop tailored strategies that align with client values and objectives. Stakeholder capitalism focuses on balancing the interests of all parties involved in a company, including employees, customers, and communities, while impact investing targets measurable social or environmental returns alongside financial gains. This knowledge empowers consultants to advise clients on sustainable growth models and investment decisions that meet regulatory requirements and stakeholder expectations. Clear distinction aids in risk assessment, resource allocation, and long-term value creation across diverse business contexts.

Comparison Table

| Aspect | Stakeholder Capitalism | Impact Investing |

|---|---|---|

| Definition | Business model prioritizing interests of all stakeholders: employees, customers, suppliers, community, and shareholders. | Investment strategy aiming to generate measurable social and environmental impact alongside financial returns. |

| Primary Focus | Balancing economic, social, and environmental goals across all stakeholders. | Funding projects and companies that deliver positive social or environmental outcomes. |

| Key Entities | Corporations, management teams, employees, and local communities. | Impact investors, fund managers, social enterprises, and non-profits. |

| Measurement | Qualitative and quantitative assessment of stakeholder value and corporate responsibility. | Strict metrics and standards for social/environmental impact, e.g., IRIS+, GIIRS, or SDGs alignment. |

| Time Horizon | Long-term sustainable value creation across stakeholder groups. | Medium to long-term financial and impact returns. |

| Examples | Unilever's Sustainable Living Plan, Patagonia's commitment to environmental stewardship. | Investments in renewable energy funds, microfinance institutions, affordable housing projects. |

| Risk Profile | Integrated business risks considering stakeholder impacts. | Risk-return balanced with impact objectives; may involve higher social risk tolerance. |

Which is better?

Stakeholder capitalism prioritizes the interests of all parties involved in a company, including employees, customers, suppliers, and the community, fostering long-term sustainable value creation. Impact investing focuses on directing capital towards projects or companies generating measurable social and environmental benefits alongside financial returns. While stakeholder capitalism embeds broader responsibility within business operations, impact investing specifically targets funding opportunities that align with social impact goals.

Connection

Stakeholder capitalism emphasizes the importance of creating value for all stakeholders, including employees, customers, communities, and investors, aligning closely with the principles of impact investing, which seeks measurable social and environmental benefits alongside financial returns. Consulting firms help organizations integrate stakeholder-centric strategies by advising on sustainable business models that attract impact investors focused on long-term value creation. This synergy drives corporate responsibility and resilience, fostering growth that benefits society and diverse stakeholder groups.

Key Terms

Social Return on Investment (SROI)

Impact investing prioritizes generating measurable social and environmental benefits alongside financial returns by leveraging Social Return on Investment (SROI) metrics to evaluate outcomes. Stakeholder capitalism emphasizes balancing the interests of all stakeholders, including employees, customers, and communities, promoting long-term value creation beyond traditional profit measures. Explore deeper insights into how SROI bridges these concepts to create sustainable and equitable business practices.

ESG (Environmental, Social, Governance) Metrics

Impact investing prioritizes generating measurable social and environmental benefits alongside financial returns by targeting specific ESG goals, whereas stakeholder capitalism integrates ESG principles into overall corporate governance to balance the interests of all stakeholders, including employees, customers, and communities. ESG metrics serve as key performance indicators in both approaches to assess sustainability, ethical impact, and long-term value creation within companies. Explore how these frameworks shape responsible business practices and investment strategies in today's market.

Multi-Stakeholder Engagement

Impact investing prioritizes generating measurable social and environmental benefits alongside financial returns, emphasizing targeted outcomes through investments in responsible enterprises. Stakeholder capitalism broadens corporate responsibilities beyond shareholders to include employees, communities, and the environment, promoting long-term value creation through multi-stakeholder engagement. Explore how these approaches integrate strategic collaboration for sustainable impact and inclusive growth.

Source and External Links

What you need to know about impact investing - Impact investments are investments made with the intention to generate positive, measurable social or environmental impact alongside a financial return, addressing sectors like energy, healthcare, and sustainable agriculture.

What Is Impact Investing? | NPTrust - Impact investing is a strategy that leverages capital to achieve positive social or environmental change while also generating financial returns, challenging the traditional separation between philanthropy and market investments.

Impact Investing Institute: Home - Impact investments are made with the intention to generate positive, measurable social and environmental impact alongside a financial return, with over 90% of impact investors meeting or exceeding their financial targets.

dowidth.com

dowidth.com