Revenue operations consulting focuses on streamlining sales, marketing, and customer service processes to maximize income and improve business efficiency. Risk consulting targets identifying, assessing, and mitigating potential threats to safeguard organizational assets and ensure regulatory compliance. Explore how specialized consulting services can drive growth and protect your business.

Why it is important

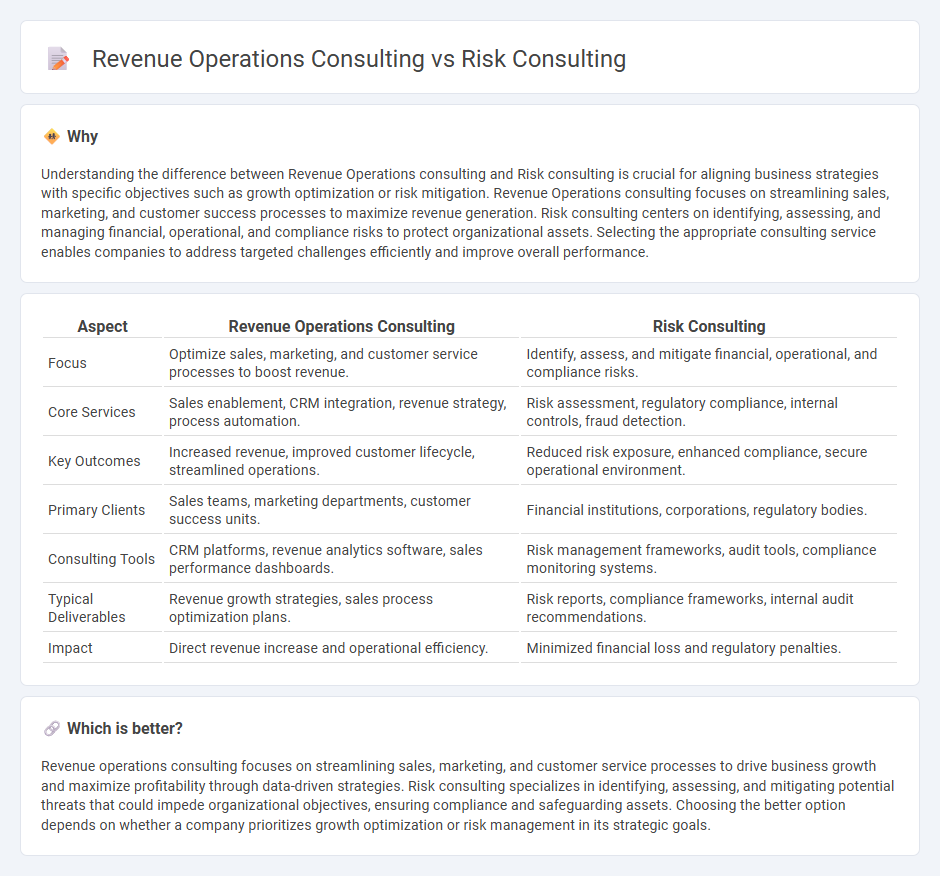

Understanding the difference between Revenue Operations consulting and Risk consulting is crucial for aligning business strategies with specific objectives such as growth optimization or risk mitigation. Revenue Operations consulting focuses on streamlining sales, marketing, and customer success processes to maximize revenue generation. Risk consulting centers on identifying, assessing, and managing financial, operational, and compliance risks to protect organizational assets. Selecting the appropriate consulting service enables companies to address targeted challenges efficiently and improve overall performance.

Comparison Table

| Aspect | Revenue Operations Consulting | Risk Consulting |

|---|---|---|

| Focus | Optimize sales, marketing, and customer service processes to boost revenue. | Identify, assess, and mitigate financial, operational, and compliance risks. |

| Core Services | Sales enablement, CRM integration, revenue strategy, process automation. | Risk assessment, regulatory compliance, internal controls, fraud detection. |

| Key Outcomes | Increased revenue, improved customer lifecycle, streamlined operations. | Reduced risk exposure, enhanced compliance, secure operational environment. |

| Primary Clients | Sales teams, marketing departments, customer success units. | Financial institutions, corporations, regulatory bodies. |

| Consulting Tools | CRM platforms, revenue analytics software, sales performance dashboards. | Risk management frameworks, audit tools, compliance monitoring systems. |

| Typical Deliverables | Revenue growth strategies, sales process optimization plans. | Risk reports, compliance frameworks, internal audit recommendations. |

| Impact | Direct revenue increase and operational efficiency. | Minimized financial loss and regulatory penalties. |

Which is better?

Revenue operations consulting focuses on streamlining sales, marketing, and customer service processes to drive business growth and maximize profitability through data-driven strategies. Risk consulting specializes in identifying, assessing, and mitigating potential threats that could impede organizational objectives, ensuring compliance and safeguarding assets. Choosing the better option depends on whether a company prioritizes growth optimization or risk management in its strategic goals.

Connection

Revenue operations consulting and risk consulting intersect through their shared focus on optimizing business processes and mitigating potential threats to revenue streams. Both disciplines analyze data and operational workflows to identify vulnerabilities that could impact financial performance and implement strategies to enhance resilience. Integrating risk assessments into revenue operations enables organizations to proactively address uncertainties, ensuring sustainable growth and compliance.

Key Terms

**Risk Consulting:**

Risk consulting specializes in identifying, assessing, and mitigating financial, operational, and regulatory risks to ensure organizational resilience and compliance. Experts use data analytics, regulatory frameworks, and internal audits to develop risk management strategies tailored to specific industries and business models. Explore in-depth risk consulting services to protect your company's assets and enhance strategic decision-making.

Compliance

Risk consulting centers on identifying, assessing, and mitigating compliance risks to ensure organizations adhere to legal and regulatory standards, thereby preventing financial penalties and reputational damage. Revenue operations consulting emphasizes aligning marketing, sales, and customer success processes to optimize revenue growth while ensuring compliance with industry regulations related to data handling, reporting, and sales practices. Explore more to understand how specialized consulting approaches can safeguard compliance while driving business performance.

Risk Assessment

Risk consulting centers on identifying, analyzing, and mitigating potential threats, providing organizations with strategies to manage financial, compliance, and operational risks effectively. Revenue operations consulting focuses on optimizing processes across sales, marketing, and customer success to drive predictable revenue growth through data-driven decision-making. Explore detailed comparisons to understand how each consulting type enhances business performance.

Source and External Links

Risk and strategic consulting - Wikipedia - Risk consulting focuses on providing analysis and information about political and economic risks, helping clients understand external environments rather than internal operations, often targeting emerging markets and involving services like corporate investigations and security advice.

Risk Advisory & Consulting Services - RSM US - Risk consulting at RSM involves advising companies on governance, risk management, and compliance to protect against emerging threats and leverage risk as a strategic business driver by tailoring solutions to specific company needs and culture.

Risk consulting | Marsh - Marsh Risk Consulting provides specialized risk management and analytics, particularly for the mining industry, helping companies assess risks like political instability and business interruption with sophisticated modeling and insurance review services.

dowidth.com

dowidth.com