No code implementation consulting focuses on empowering businesses to rapidly develop and deploy software solutions without traditional coding, leveraging platforms like Bubble and Zapier to accelerate digital transformation. Financial advisory provides expert guidance on investment strategies, risk management, and wealth planning to optimize financial health and growth for individuals and corporations. Explore the distinct benefits and applications of these consulting services to determine the best fit for your business needs.

Why it is important

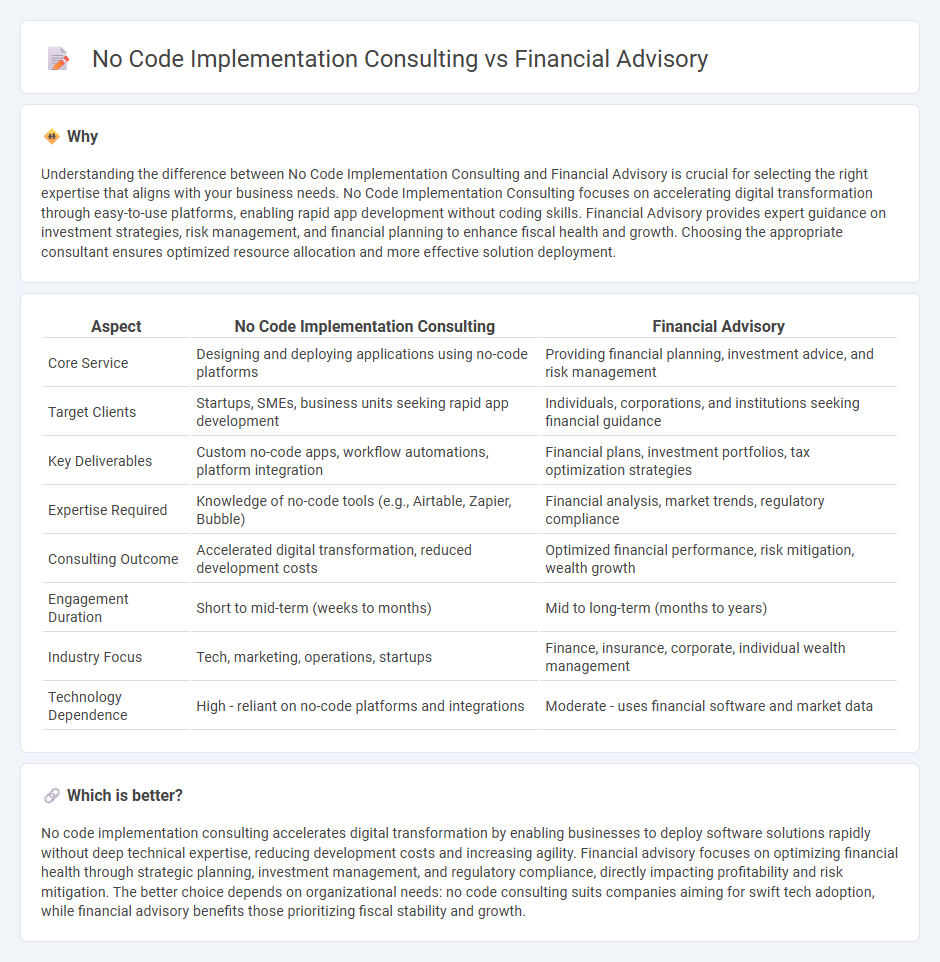

Understanding the difference between No Code Implementation Consulting and Financial Advisory is crucial for selecting the right expertise that aligns with your business needs. No Code Implementation Consulting focuses on accelerating digital transformation through easy-to-use platforms, enabling rapid app development without coding skills. Financial Advisory provides expert guidance on investment strategies, risk management, and financial planning to enhance fiscal health and growth. Choosing the appropriate consultant ensures optimized resource allocation and more effective solution deployment.

Comparison Table

| Aspect | No Code Implementation Consulting | Financial Advisory |

|---|---|---|

| Core Service | Designing and deploying applications using no-code platforms | Providing financial planning, investment advice, and risk management |

| Target Clients | Startups, SMEs, business units seeking rapid app development | Individuals, corporations, and institutions seeking financial guidance |

| Key Deliverables | Custom no-code apps, workflow automations, platform integration | Financial plans, investment portfolios, tax optimization strategies |

| Expertise Required | Knowledge of no-code tools (e.g., Airtable, Zapier, Bubble) | Financial analysis, market trends, regulatory compliance |

| Consulting Outcome | Accelerated digital transformation, reduced development costs | Optimized financial performance, risk mitigation, wealth growth |

| Engagement Duration | Short to mid-term (weeks to months) | Mid to long-term (months to years) |

| Industry Focus | Tech, marketing, operations, startups | Finance, insurance, corporate, individual wealth management |

| Technology Dependence | High - reliant on no-code platforms and integrations | Moderate - uses financial software and market data |

Which is better?

No code implementation consulting accelerates digital transformation by enabling businesses to deploy software solutions rapidly without deep technical expertise, reducing development costs and increasing agility. Financial advisory focuses on optimizing financial health through strategic planning, investment management, and regulatory compliance, directly impacting profitability and risk mitigation. The better choice depends on organizational needs: no code consulting suits companies aiming for swift tech adoption, while financial advisory benefits those prioritizing fiscal stability and growth.

Connection

No code implementation consulting streamlines the deployment of financial advisory solutions by enabling rapid prototyping and customization without extensive coding, reducing time-to-market and operational costs. Financial advisory firms leverage no code platforms to enhance client data analysis, regulatory compliance, and reporting accuracy, facilitating more agile and data-driven decision-making. Integration of no code tools empowers financial consultants to focus on strategic insights rather than technical complexities, improving service delivery and client satisfaction.

Key Terms

**Financial advisory:**

Financial advisory encompasses expert guidance on investment strategies, risk management, and financial planning to optimize asset growth and ensure compliance with regulatory standards. It integrates data-driven insights and market analysis to tailor solutions that align with client goals across diverse sectors. Explore how financial advisory can enhance your fiscal strategy and decision-making processes.

Valuation

Financial advisory specializing in valuation offers expert analysis of company assets, market position, and revenue streams to provide accurate business worth assessments. No code implementation consulting enhances valuation by streamlining operations and accelerating digital transformation, thereby increasing business efficiency and potential market value. Explore how integrating both approaches can maximize your company's valuation potential.

Risk Assessment

Financial advisory emphasizes risk assessment by analyzing market trends, regulatory compliance, and credit risks to safeguard investments and optimize portfolio performance. No code implementation consulting focuses on identifying technical risks, data security vulnerabilities, and integration challenges to ensure seamless deployment of solutions without extensive coding. Explore the distinctive approaches to risk assessment in both fields to gain a comprehensive understanding.

Source and External Links

Best Financial Advisors: Top Firms For 2025 | Bankrate - Offers guidance on choosing financial advisors based on your needs, compensation style, and credentials like CFP or CFA to ensure trusted, personalized advice.

360 Financial - Top Advisors Minnesota - Investment Advisors - A fiduciary financial advisory firm providing comprehensive wealth management and planning services, emphasizing the value of fiduciary advice to preserve multi-generational wealth.

Ameriprise Financial: Financial Planning Advice and Financial - Longstanding leader in personalized financial advice offering retirement planning, secure client access, and consultation to help clients reach their financial goals confidently.

dowidth.com

dowidth.com